Few things make us as emotional as the prospect of losing money. Wouldn’t investing be easier if you were a robot? Imagine the market crashes and yet, there you are, cool as a cucumber. But unfortunately that’s not how it works.

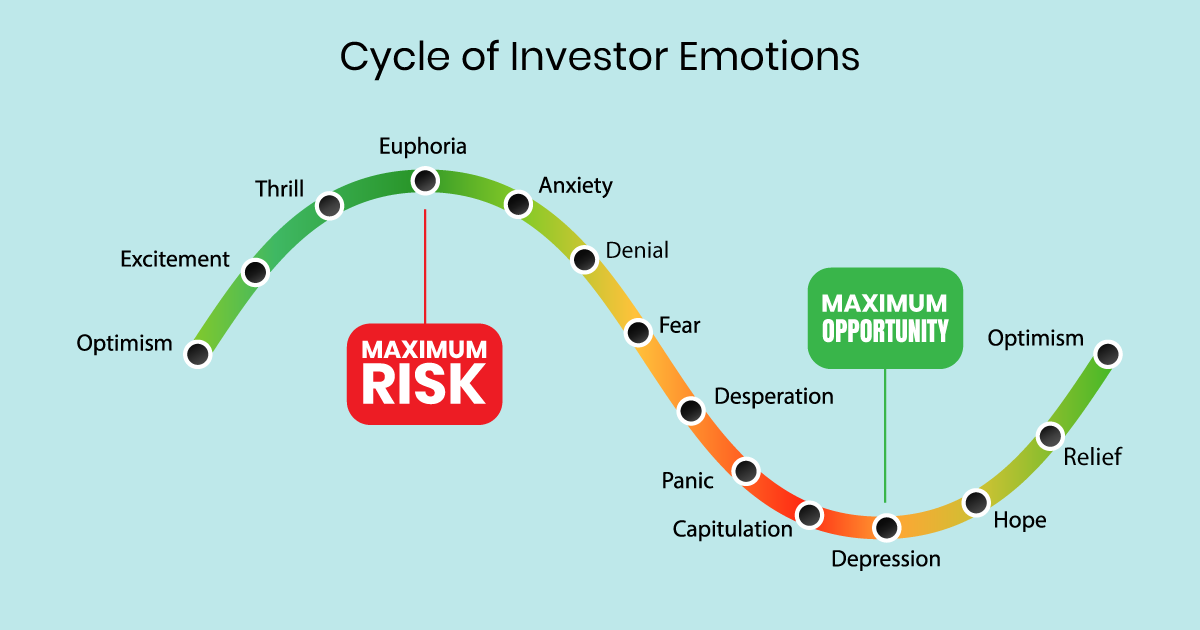

As humans, we are hardwired to avoid pain and pursue pleasure. Our primal instinct is to avoid predators and react to warning signals. While our innate behavior may have helped keep our ancestors alive, too often it makes it almost impossible for us to make good investment decisions. The Cycle of Investor Emotions illustrates this:

As the image depicts, when the market begins an upswing, you feel optimistic. As it rises, so do your emotions. Finally as the market hits its high, you enter into a state of total euphoria. Then, prices drop, just a little, and you begin to feel a little anxious, thinking this couldn’t possibly be happening again. Before you know it, your fear has grown into total despondency and depression. Right before you decide you just can’t take it any longer, what happens? The market moves up and alas, your optimism returns.

It’s normal to feel good when the market is up. And of course, your natural inclination in this state is to buy. You convince yourself you’d be a fool not to get into the market. But you have to remember that the more expensive an asset is, the riskier it is. If you got into the market now, you would be buying at the point of maximum risk. On the flip side, when the market declines, you become an emotional wreck. But in reality, market lows represent the point of maximum opportunity.

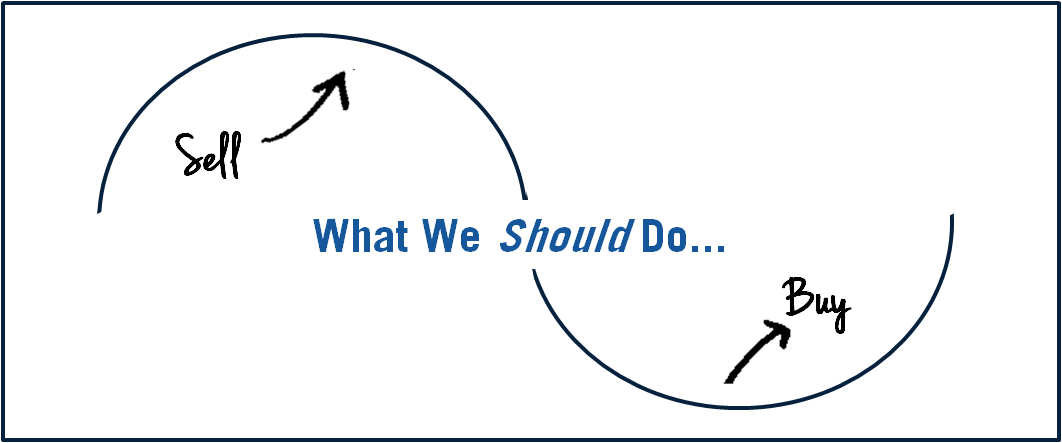

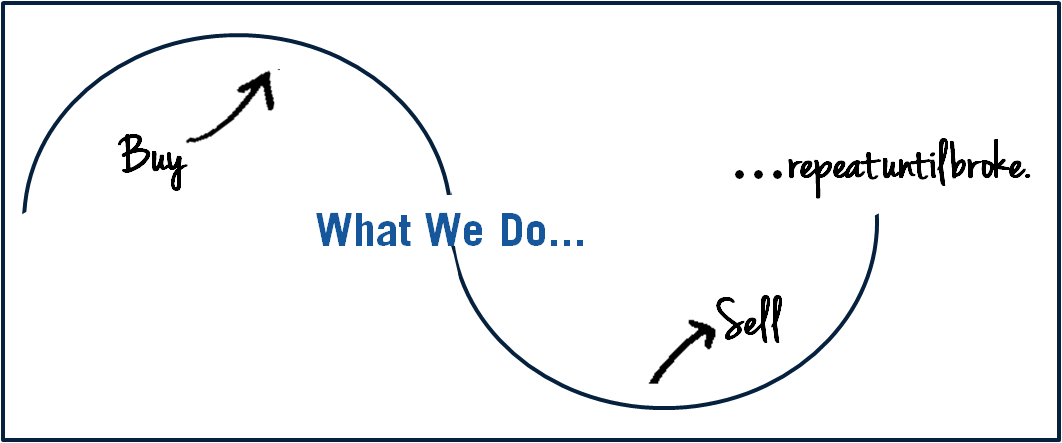

Yet your primal urge to avoid loss and pursue gain keeps you so mixed up that you can’t always see this. Instead of buying low and selling high, what do most investors do? The exact opposite of what they should be doing! They buy high and sell low – and if they’re not careful, they repeat this cycle over and over again.

Nothing quantifies the impact of investor behavior better than DALBAR’s study, the Quantitative Analysis of Investor Behavior (QAIB), which compares investor’s returns to relevant benchmarks over a rolling 20 year period.

In the 20 year period ending in 2016, the S&P 500 had a return of 7.68%. However, the average investor only got 4.79%. In other words, they under-performed their investment by a margin of almost 3%. It’s not just equity investors that fall behind. As you can see, fixed income investors trailed Barclay’s by an even greater distance.

When you make investment moves based on emotions, you’re simply acting on what you wished would have happened. Sure, everyone wishes they could have reaped the gains of a participating in a market upswing. But by the time most investors actually get the courage to buy, it’s too late. Making investment moves based on what you wished would have happened is akin to driving while looking in the rearview mirror. It’s dangerous. And if you do it too long, you’re bound to get hurt.

You cannot, nor will you ever be able to control the stock market. Market chaos and media frenzy will always exist and the primal part of your brain will always want to react. But the lesson is that you can’t. If you have a history of repeatedly buying and selling at the wrong time – STOP! If you’re continually chasing better performance, stop and do something different.