Covered Calls Reimagined

Elevate Your Portfolio: Strategic Income through Options

Designed for Forward Thinking Investors Seeking Enhanced Retirement Income

Where Technology Meets Expertise in Covered Calls

Snider Investment Method

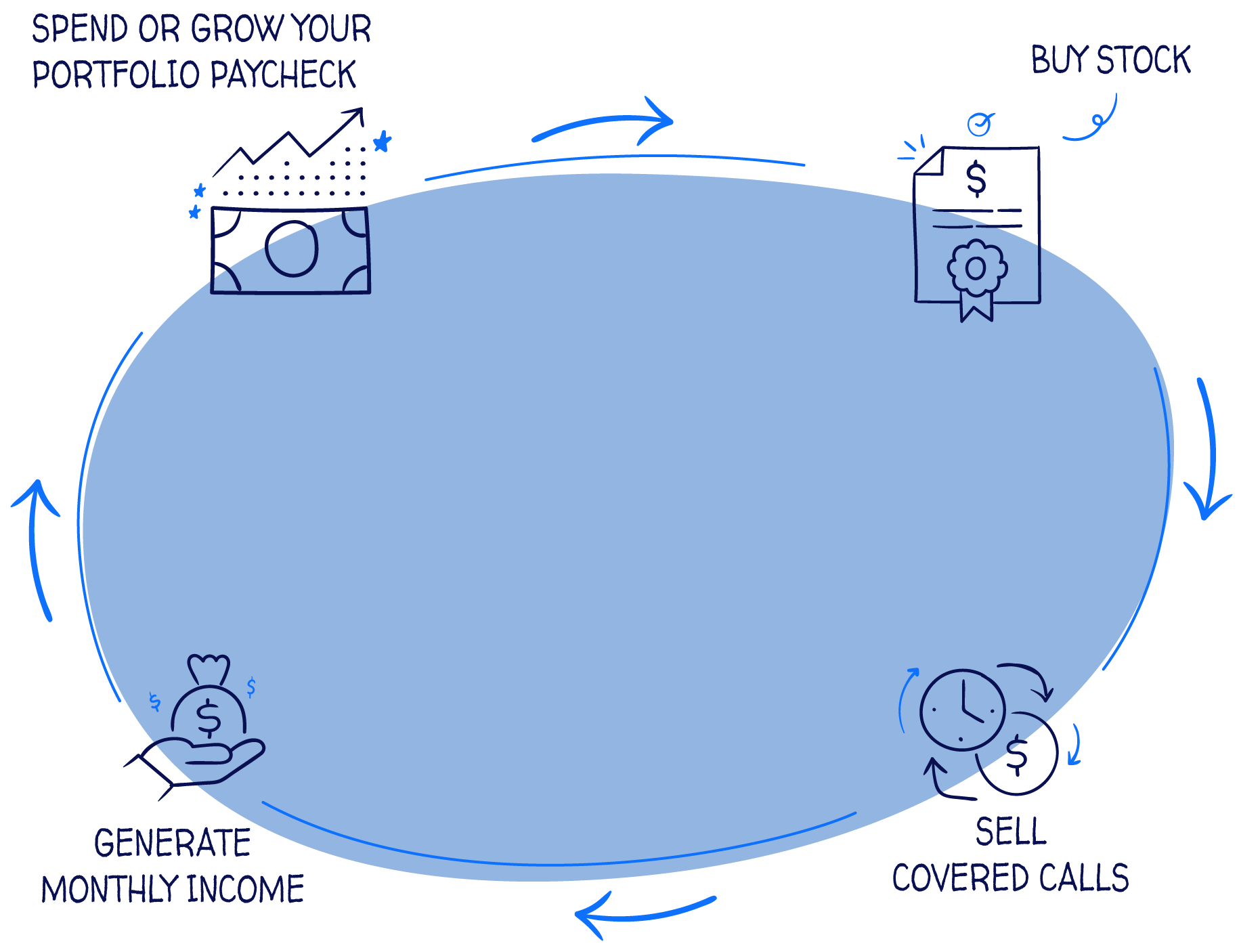

A long-term investment strategy designed to create income from your portfolio. The Snider Method uses a combination of buying stocks, selling options, and cash management in a specific sequence to maximize your portfolio’s income. It starts with a strict stock screening process to restrict our investments to financially healthy companies. Next, we generate option premium using covered calls and cash-secured puts, boosting income from your stock portfolio. And finally, by managing our cash and stock market exposure, we reduce risks while creating a reliable portfolio income.

Live Webinar

Covered Calls with the Snider Method: Strategy not Speculation

Discover how the Snider Method goes well beyond your typical covered call strategy. In this free 1-hour webinar, you’ll learn the trading techniques we use to generate a monthly “portfolio paycheck,” the philosophy behind the Snider Method, and see a real-world example of how to apply it in your own portfolio. Whether you’re new to options or seeking a reliable retirement income approach, this session will show you how to turn your investments into consistent cash flow.

Do Not Hesitate!

Join our next LIVE webinar series to learn:

- The specific trading techniques and option strategies we use to generate a monthly “portfolio paycheck”

- The philosophy that guides the Snider Method

- A real-world example of how you can apply the Snider Method in your own portfolio

Thursday, February 19, 2026

12:00 PM CST

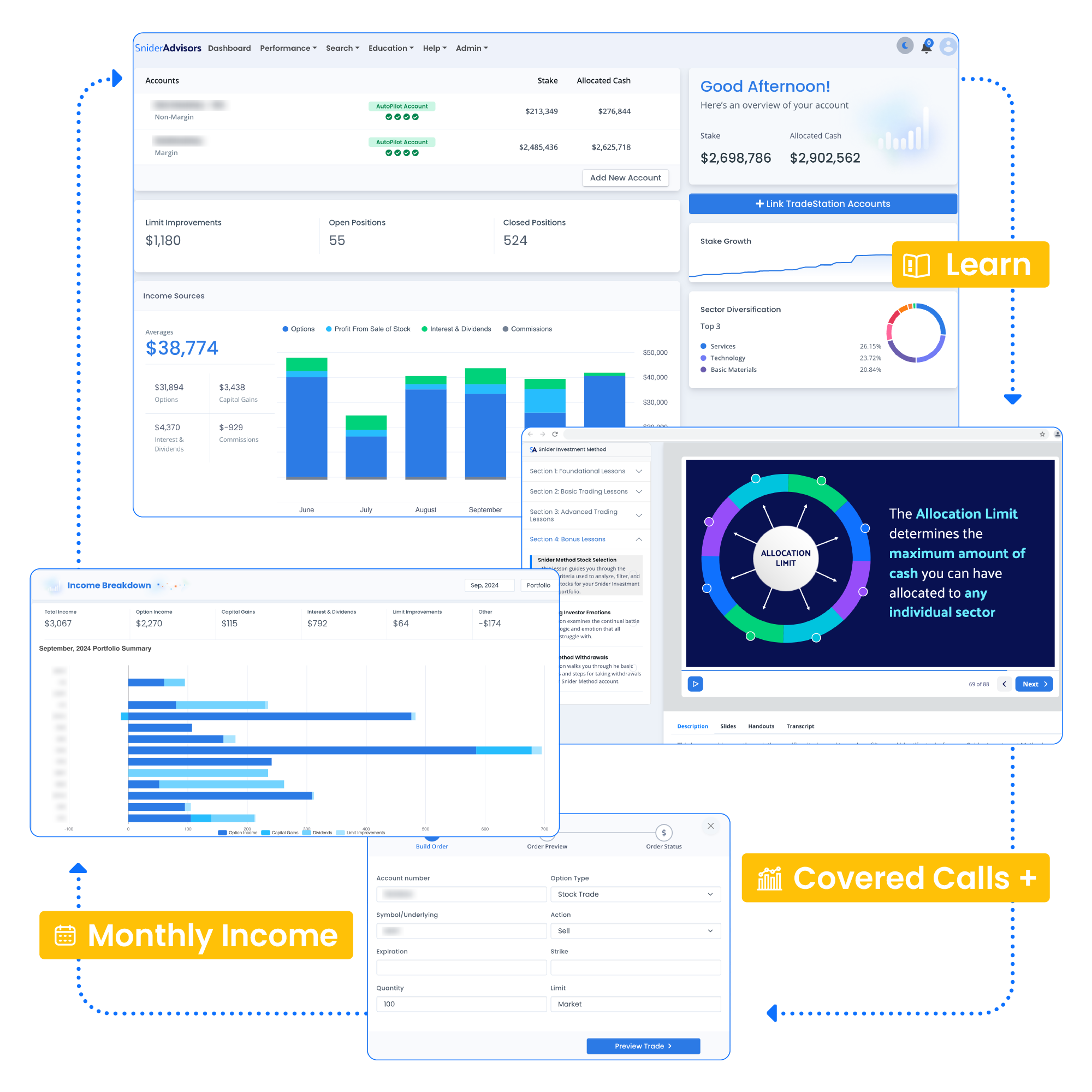

Powerful Portfolio Management & Trading Software

We Believe Technology Should Empower Investors

Systems, processes, and automation will increase the chances of success for an investor. This makes building the technology to support our investors easy. Although you have the tools in place to guide your funds each step of the way, our support team is still here to guide you through learning and implementing the Snider Investment Method.

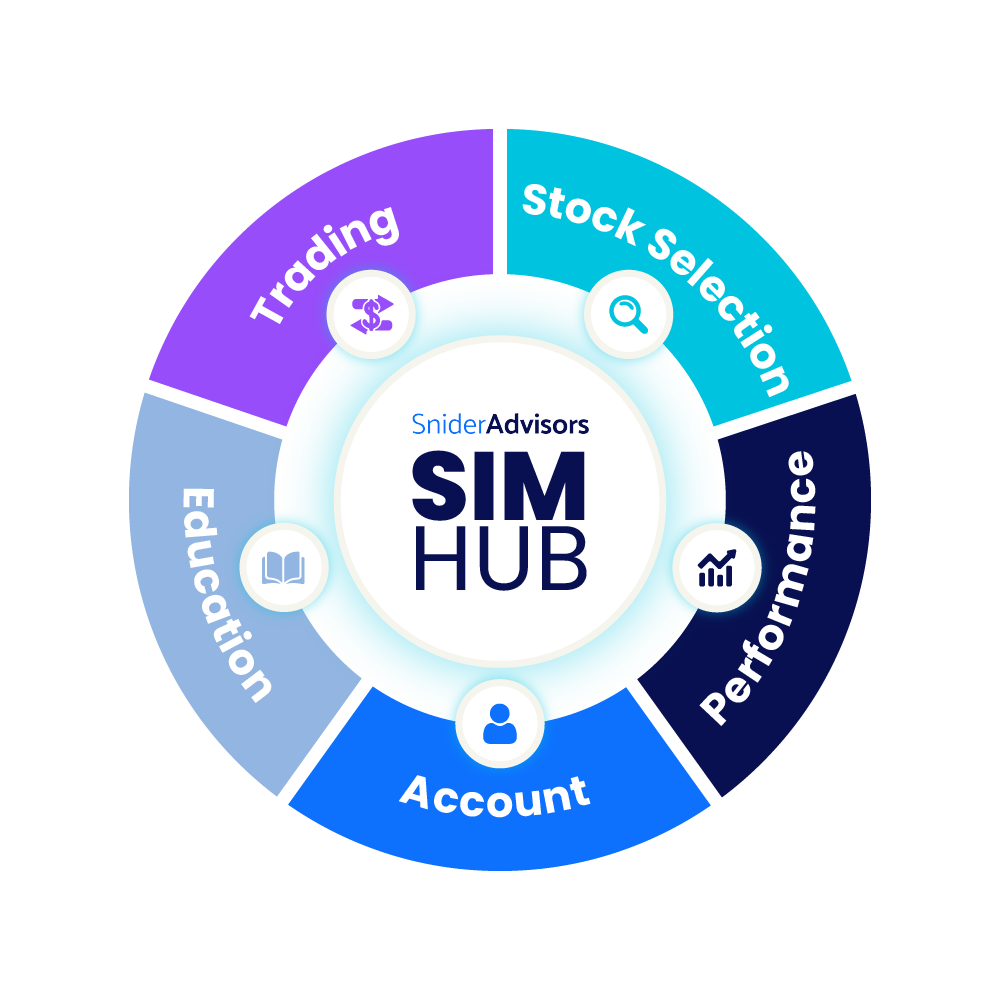

SIM Hub

Experience the impact of our advanced stock screening tool, meticulously tailored for the Snider Investment Method. This intuitive software streamlines your trading journey, combining user-friendly features with expert guidance to give you confidence in every trade. Simplify your strategy and trade smarter with the SIM Hub AutoPilot by your side.

Covered Call Screener

Our trusted partner, optionDash, offers a completely free covered call screener featuring a unique, proprietary stock scoring system. This powerful tool is designed specifically for covered call traders looking to customize and optimize their trading experience fully. Unlock new opportunities and take your trading strategy to the next level with optionDash.

Snider Method

Getting started is easy. Learn with expert guidance, execute trades through seamless software integration, and enjoy streamlined, once-a-month trading that supports your long-term goals. The Snider Method is a comprehensive, rules-based system used to boost income from a retirement portfolio. Start earning more from your investment portfolio.

Top Benefits of the Snider Investment Method

Income Focused.

Make money by owning an asset, not selling it. Generate income in up and down markets.

Higher Withdrawal Rate

Generate monthly income on the assets in your portfolio, allowing you to make distributions without selling off your principal.

No Day Trading

Trade just once a month, on the Monday following the third Friday.

No Market Timing

It is impossible to time the market over long periods with any consistency.

Rules-Based System

No guesswork, step-by-step instructions for each trade. A systematic approach to investing.

All Levels of Investors

Complete beginners and novice traders have learned and implemented our strategy with success.

You are in Control

No one cares more about your money than you. You have the knowledge, confidence, and expertise to trade.

Minimize Fees

Manage your own investments to eliminate costly ongoing management fees.

Long-Term Success

Snider Advisors and the Snider Investment Method have a proven track record of 20+ years of success. We can handle all types of market conditions.

First-Class Support.

Our advisors, software tools, and asset management can solve all your service needs.

Pick Your Plan

What Level of Support is Best for Your Needs?

CoPilot

Snider Investment Method Workshop $499.99

Ongoing Cost:

$49.99 / Month

🔥 Most Popular!

AutoPilot

Snider Investment Method Workshop $99.99

Ongoing Cost:

0.50% to 0.75% Annually

Charter

Snider Method Workshop Recommended but Not Required.

Ongoing Cost:

1% to 2% Annually

Built on Experience

Decades of Innovation as Covered Call Advisors

Snider Advisors is a boutique, SEC-registered investment advisor. As professional covered call advisors, we have a fiduciary responsibility to our clients and a verifiable track record since 2002.

We have an extraordinary focus on training and empowering both novice and experienced investors to generate a portfolio paycheck using income option strategies. Our strategies and philosophies are the result of solving real-world problems for our families and ourselves, as well as our clients.

FAQ’s

Answers to your most pressing questions:

Q. What is the Snider Investment Method?

The Snider Investment Method is a unique, income-focused strategy designed to help investors generate consistent cash flow from their portfolios. It combines stock ownership with options trading, allowing you to earn income through covered calls while managing risk and reducing the impact of market volatility. Learn More

Q. Is the Snider Investment Method right for me if I’m new to investing?

The Snider Investment Method is designed to be accessible to investors at all experience levels. Our training, support, and resources make it easy for beginners to understand and implement the strategy. Plus, our team is here to guide you every step of the way, providing the tools and education needed to succeed, regardless of your investing experience. Trading Software

Q. How much time does it take to manage my portfolio using the Snider Investment Method?

Managing your portfolio with the Snider Investment Method typically requires just a few hours each month. Our approach is designed to be effective and time-efficient so you can enjoy the benefits of a powerful investment strategy without constantly watching the market.

Q. Can you manage my portfolio?

Yes! With our Charter Asset Management service, we do all your trading for you. We realize that not everyone is cut out to manage their own assets. If you can’t trust yourself to follow the rules, fear making a mistake, or lack the confidence to place your trades, we are here to implement the Snider Investment Method for you. Asset Management

Q. What kind of support and resources will I receive after joining?

When you start using the Snider Investment Method, you’re not alone. We provide comprehensive support to ensure your success, including access to our expert team for personalized guidance, in-depth training materials, regular webinars, and ongoing updates on market conditions and strategies. Our commitment to your financial success doesn’t end after your initial learning—it’s a lifetime partnership. Service Levels

Q. Do I need to know how to trade options?

No, prior experience in options trading is not required to use the Snider Method. Our system is designed to cater to both beginners and experienced investors. We provide comprehensive educational resources and tools, including our stock selection tool and trading software. More about options.

Q. What are covered calls?

Covered calls are a strategy where investors sell call options on stocks they already own. This approach allows investors to generate income from the option premiums they receive. It is a conservative strategy used to enhance returns on a stock portfolio, providing potential income while still holding the underlying stocks. Learn more with a free course!

Investment Education, Advanced Trading Technology, and First-Class Support.

Thousands of Investors Educated

$120+ Million in AutoPilot & $75+ Million in Managed Assets