Goals of the Snider Investment Method:

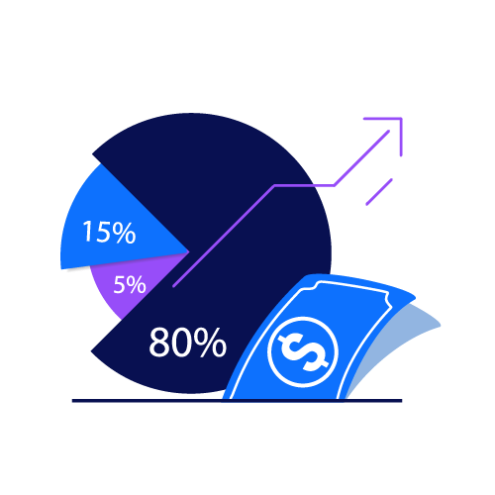

Consistent Monthly Cash Flow

Our primary goal is to generate monthly income as close to 1% of our total investment as possible. We don’t select stocks because we think we know the future direction of their price, but rather to use them to generate income.

No Permanent Loss of Capital

We buy fundamentally sound companies that we are willing to own for long periods of time, even if the price declines.

We define our portfolio performance by the Monthly Net Current Yield. Yield is all realized income – option premiums, gains on sold positions, interest and dividends, net of brokerage commissions, margin interest, and management fees. It does not include unrealized gains or losses.

The yield calculation is different from the total return calculation typically shown by most in the investment industry. The yield is approximately equal to the total return if and when a position closes. While the position is open, there is typically some amount of unrealized loss. The total return measurement would include these losses and would be lower than the yield.

Investment Strategies

Key Components of the Snider Investment Method.

Common investment concepts woven together in a unique way to achieve our investment objectives.

Selling Options for Income

In the Snider Investment Method, we only sell options. Covered calls and cash-secured puts generate option premiums boosting income from a stock portfolio. Whether the options are exercised or not, you get to keep the premium.

Stock Ownership

A strict stock screening process restricts our investments to financially healthy companies we are willing to own for long periods of time. With our focus on income, we buy stocks for their ability to generate income not the hope that they go up in price.

Cash Management

Dollar-cost averaging and laddering covered calls help create a consistent income in both up and down markets. Our risk management techniques help you create the reliable income needed in retirement.

Top Benefits of the Snider Investment Method

Income Focused.

Make money by owning an asset, not selling it. Generate income in up and down markets

Higher Withdrawal Rate

Generate monthly income on the assets in your portfolio, allowing you to make distributions without selling off your principal.

No Day Trading

Trade just once a month, on the Monday following the third Friday.

No Market Timing

It is impossible to time the market over long periods with any consistency.

Rules-Based System

No guesswork, step-by-step instructions for each trade. A systematic approach to investing.

All Levels of Investors

Complete beginners and novice traders have learned and implemented our strategy with success.

You are in control

No one cares more about your money than you. You have the knowledge, confidence, and expertise to trade.

Minimize Fees

Manage your own investments to eliminate costly ongoing management fees.

Long-Term Success

Snider Advisors and the Snider Investment Method have a proven track record of 20+ years of success. We can handle all types of market conditions.

First-Class Support.

Our advisors, software tools, and asset management can solve all your service needs.

The Snider Investment Method is Perfect for You

You are solely responsible for your finances. No one values your money more than you. That’s why investment education is crucial for your success.

Our Ideal Clients

A Retiree ready to turn your hard-earned savings into a portfolio paycheck. Spend more without harming your portfolio.

A DIY Money Manager who enjoys trading and controlling your investments but needs the structure or plan to make you successful.

An Income Investor, familiar with cash flow investments, searching for a way to turn the stock market into a higher income-producing asset.

More Covered Call and Option Trading Education

We pride ourselves on empowering both beginner and experienced investors. As covered call advisors, we use our extensive knowledge to train our clients to write covered calls and boost the income from their portfolios.