Covered calls are a popular way to generate extra income by trading upside potential for option premiums—but you can also use them to rebalance and diversify your portfolio. Rather than selling stocks, covered calls provide a unique mechanism to balance the odds of a stock being called away with extra premium income.

In this article, we’ll explore how you can leverage covered calls to rebalance your portfolio while generating an optimal income in the process.

Why Rebalance Your Portfolio?

Suppose you have a $100,000 portfolio that includes a 10% ($10,000) to Apple and another 10% ($10,000) to Exxon. Over the next year, Apple surges 80% while Exxon falls 20%. If you don’t do anything, your Apple position will grow to 16% of your portfolio ($18,000) and your Exxon one will shrink to just 7% ($8,000) of your portfolio.

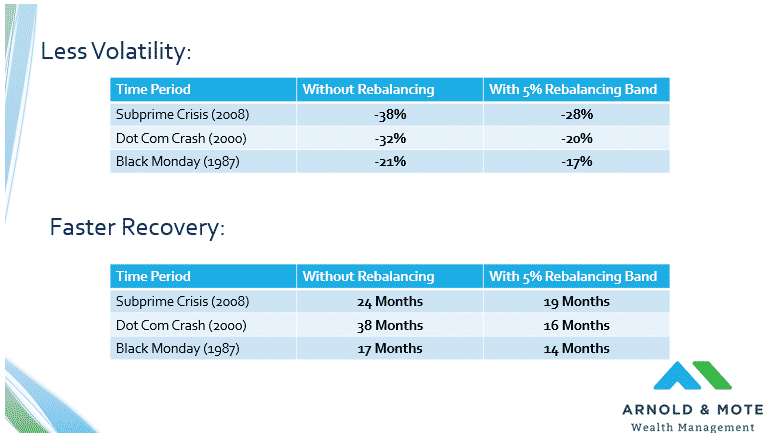

Rebalancing can help mitigate risk (translating to less volatility) while also boosting returns (translating to a faster recovery from a market decline). Source: Arnold & Mote

Regular rebalancing of your portfolio enforces a systematic “buy low, sell high” discipline. By trimming positions that have grown large and reinforcing those that have underperformed, you capture gains from winners while reaping the benefits of diversification. Research has shown that this helps enhance risk-adjusted returns over time.

Of course, rebalancing also ensures your portfolio remains aligned with your own risk tolerance and investment goals. As you approach retirement, your willingness to take on the risk of a high-growth tech stock may decline, making rebalancing essential to avoid a single stock or sector from dominating a portfolio.

Accelerate Exits with High Delta Calls

Conventional wisdom says to sell stocks that grow too large in your portfolio and reallocate the capital to maintain diversification. While you could simply sell the stock, writing high delta covered calls—typically with deltas above 0.7—offers a more nuanced approach, particularly if you have significant embedded capital gains.

High delta calls have a strong probability of being exercised because they’re already deep in-the-money. By writing these calls against an oversized position, you’re essentially pre-arranging a sale at a specific price point while collecting additional premium income in the process. The higher the delta, the greater the likelihood your shares will be called away.

For example, suppose a stock appreciates from $50 to $100 and now represents 15% of your portfolio instead of your target 5%. You might write a $90 strike covered call, which has a high probability of exercise since it’s deep in-the-money. While you might give up some upside beyond $90, you’ll collect a substantial premium that increases your exit price.

The main trade off is that you’re committing to sell at the strike price, even if the stock surges higher, and you may need to wait. But when your primary goal is to rebalance, this controlled exit strategy can help you systematically reduce oversized positions. And if you’re sitting on taxable gains, waiting with income isn’t always a bad idea.

Build Income with Low Delta Calls

When you have a strong conviction in a stock or sector’s long-term potential, low delta covered calls—typically with deltas between 0.2 and 0.35—can help you maintain your position while generating steady income. These out-of-the-money calls have a lower probability of being exercised, allowing you to capture more upside.

The premium income, while smaller than high delta covered calls, can be strategically reinvested to actually increase your position over time. This creates a powerful compounding effect: You’re using the options market to generate cash flow that builds your stake in a promising investment. It’s not unlike dividend reinvestment!

This “premium recycling” strategy is particularly effective in sideways or slowly rising markets. For example, value investors may find the strategy helpful for boosting income while they wait for the market to attain an appropriate valuation. The biggest challenge is selecting strike prices that minimize the odds of the stock being called away.

The important caveat to this strategy is that you generate less income and must be very consistent over time. In addition, the strategy can be painful when there’s a sharp market downturn and you’re stuck with losses while still having covered call obligations. It’s critical to ensure that you do this during optimal market conditions.

Take Advantage of Implied Volatility

High implied volatility creates lucrative opportunities for covered call writers because option premiums expand when the market anticipates larger price swings. During periods of elevated IV, you can collect substantially higher premiums for the same strike prices and expiration dates, effectively getting paid more for the same level of risk.

This premium inflation is particularly noticeable in trendy or newsworthy stocks where market excitement can push implied volatility to unsustainable levels. While these heightened premiums reflect genuine uncertainty, the market often overprices the magnitude of potential moves.

By writing covered calls when IV is elevated, you benefit from both the time decay of the option and the eventual normalization of volatility levels. As IV reverts to more typical levels—known as volatility crush—the option premium deflates, allowing you to either buy back the calls at a profit or maintain the position to expiration.

The catch is that many novice investors underestimate the risks in these scenarios. While experienced traders may know if high IV is justified, it requires a lot of research to understand what factors are truly driving the price.

What About Cash-Secured Puts?

While covered calls help manage existing positions, cash-secured puts offer a mirror-image strategy for establishing new ones. Instead of selling potential upside, you’re getting paid to commit to buying shares at a lower price—essentially naming your own entry point while collecting premium income.

This strategy works well in tandem with covered calls as part of a portfolio rebalancing approach. While you’re using covered calls to gradually reduce oversized positions, you can simultaneously write cash-secured puts to establish new positions or add to underweight ones. And you’ll generate two incomes in the process!

These strategies are especially popular amongst value investors as a way to get paid while waiting for stocks to hit their target entry points. While there’s a risk if a stock drops for a good reason and they catch a falling knife, many value investors are more interested in the long-term intrinsic value than a temporary deviation.

The Bottom Line

Covered calls and cash-secured puts offer sophisticated tools for portfolio management that go well beyond simple income generation. Using the strategies, you can use options strategies to rebalance your portfolio and ensure optimal diversification while supercharging your income and offsetting some losses.

Ultimately, these strategies are best for larger portfolios where investors are comfortable with option mechanics and risks. They can also be helpful when tax efficiency is a major concern. However, notice investors may want to steer clear until they have a better understanding or time to commit to actively monitor the market.

If you’re just getting started with options, Snider Advisors offers a series of e-courses to help you learn how to invest in covered calls for income. We go beyond the basics to explore how to choose the right stocks, strike prices, and expiration dates to maximize income, as well as handle unexpected events, like when a stock suddenly soars higher.

Leave a Reply