Markets might move up and down but the need for income remains constant. Maintaining a steady income often requires predicting stock prices or interest rate decisions – a nearly impossible task even for professional investors. But what if you could generate consistent income regardless of which way the market moves?

Calendar spreads offer a rare opportunity to profit primarily from the passage of time rather than market direction. They capitalize on the mathematical certainty that all options lose value as they approach expiration. And this predictable decay creates income opportunities regardless of the overall market direction.

The good news is that you don’t need to be an options expert to implement this strategy. If you’re familiar with covered calls, you already understand the concept of selling options for income. Calendar spreads simply take this approach to the next level.

In this article, you’ll learn how calendar spreads work, when you might want to consider them, and how they can help you level up your portfolio’s income.

Understanding Calendar Spreads

A calendar spread is much simpler than it sounds. You sell one option that expires soon and buy another that expires later with the same strike price. The result is a position where you profit from time itself rather than market direction – as time passes, the short-term option you sold loses value faster than the long-term option you bought.

The rate at which an option loses value due to the passage of time is known as “theta” in the options world. For instance, a theta value of -0.05 means the option will lose about $5 per day due to time decay alone. Since theta increases as the expiration date nears, calendar spreads make it possible to profit from short- and long-term arbitrage.

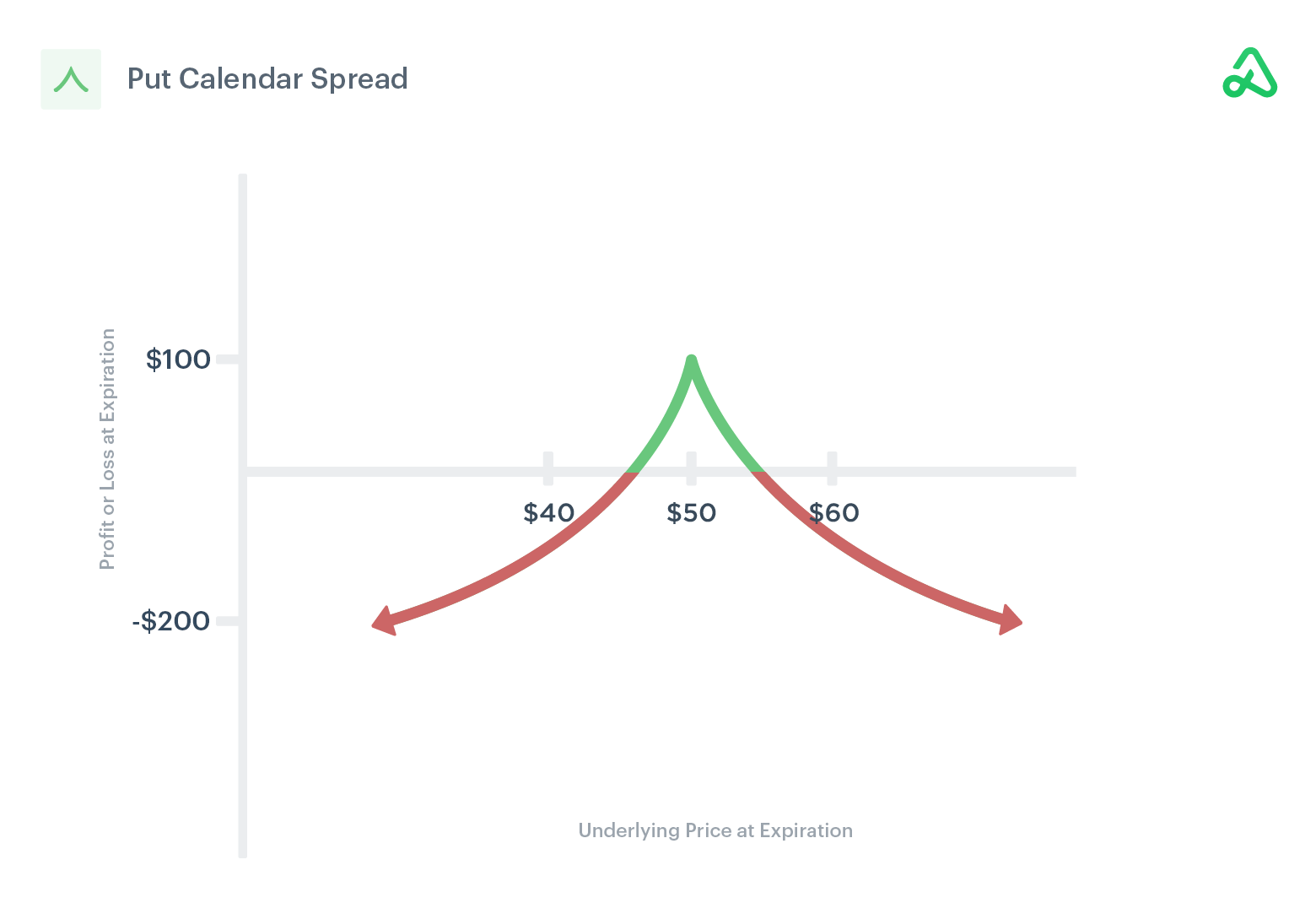

A put calendar spread (shown above) consists of one short put and a long put at the same strike price. Source: Option Alpha

Let’s take a look at an example to see how they work:

Suppose you sell a $215 call option expiring in three weeks for $6.50 while simultaneously purchasing a $215 call option expiring in three months for $12.70, costing a net of $6.20. If the stock trades near $215 when the short-term option expires, the short-term option might expire at $0.20 while the long-term one is still worth $9.40. In this case, the initial $6.20 investment would yield a $3.00 profit ($9.40 – $0.20 = $9.20 – $6.20 = $3.00), which translates to a nearly 50% return in just three weeks!

The biggest risk of calendar spreads is a reduction in sensitivity to time decay. For instance, in our previous example, if the stock surged to $241 rather than expiring at $215, our position would look a lot different. The short-term $215 call would be deep in-the-money and worth closer to $26.50, while the long-term call only increased to about $30.20. The spread would have collapsed to just $3.70, which is a 40% loss from the $6.20 investment.

While calendar spreads carry risk, they have less risk than standalone options. The long-term option you purchase will always retain more value than the short-term option you sell, which means you won’t lose your entire investment. As a result, calendar spreads may be a more conservative choice than buying call or put options.

Implementing Calendar Spreads

Not all stocks are good candidates for calendar spreads. As we’ve seen in the previous section, wild price swings or completely flat stocks aren’t ideal for calendar spreads. The best opportunities are typically established companies that tend to trade within predictable ranges between major earnings announcements.

You can control a lot of these risks with market timing. While you can implement the strategy any time, staying away from volatility-driving events – such as earnings announcements or new product launches – can reduce the possibility of any unwelcome surprises. But, of course, the profitability depends on the magnitude and timing of the move.

Money management matters even more than picking ideal stocks. By limiting each calendar spread position to less than 5% of your portfolio, you’re protected from the occasional trade that moves against you. In other words, one bad outcome won’t undo months of disciplined income investing with calendar spreads.

It’s also a good idea to stagger calendar spreads across different stocks and expiration cycles to even out income. When one spread reaches its short-term expiration, another might be midway through its cycle and a third is just beginning. This creates a consistent monthly income machine without as many ups and downs.

You can also fine-tune calendar spreads by making adjustments. For instance, you might use a slightly different strike price on one of the options to express a slight directional bias while still capitalizing on time decay (known as a diagonal spread). Or, you can add a second calendar spread to widen the price range for profitable outcomes.

Other Strategies for Option Income

Calendar spreads are an excellent option for sideways markets, but they’re not the only income-focused option strategy. If you have a directional bias, other strategies often work better. Trying to adapt your approach to match market conditions is the surest way to maintain consistent income, optimized for any market conditions.

Covered calls remain the workhorse of options income strategies for good reason. By selling call options against stocks you already own, you generate immediate premium income while maintaining your long-term market exposure up to the strike price. This strategy is best for steadily rising markets, allowing you to collect dividends, option premiums, and gains.

Cash-secured puts offer the mirror image approach for investors with a bullish bias who are patient about entry points. Rather than waiting for a stock to drop before buying, you can sell put options with cash set aside and earn a premium while you wait. It’s a great way to lower the cost basis for stocks you want to own anyways.

More aggressive investors might consider credit spreads. For instance, bull put spreads generate income when you expect stocks to rise or stay flat, while bear calls spreads do the same when you expect flat or falling prices. Unlike calendar spreads, you can directly benefit from market movements in your predicted direction.

The Bottom Line

Generating a steady income from your portfolio doesn’t always have to involve predicting market direction. Calendar spreads offer an opportunity to profit from time decay rather than price direction. While no strategies work in all conditions, they’re an essential part of an income investors repertoire to adapt to changing market conditions.

If you’re just getting started with options, Snider Advisors can help introduce you to covered calls and cash secured puts – the workhorses for any income investor. Our free e-courses can teach you everything you need to know to get started. And the Snider Investment Method can help fill in the blanks with a comprehensive strategy.

Get started with our free e-courses today or inquire about our asset management services if you prefer a more hands-off approach.

Leave a Reply