Stock options may be risky and unfamiliar for many traditional investors. For example, they may be uncomfortable with the idea of losing their entire investment or be unsure of how to find opportunities in the options market. Both of these concerns are valid for many option traders, but some strategies are far less risky and complex than others. Let’s take a look at selling call options, popular strategies for investors, and alternatives to consider.

What Are Call Options?

Call options give buyers the right, but not obligation, to purchase an asset at a specified price (strike price) and time (expiration date) in exchange for an upfront premium payment. Sellers collect the premium from the sale of the option in exchange for the obligation to deliver the asset, if requested by the buyer, at the specified price and time.

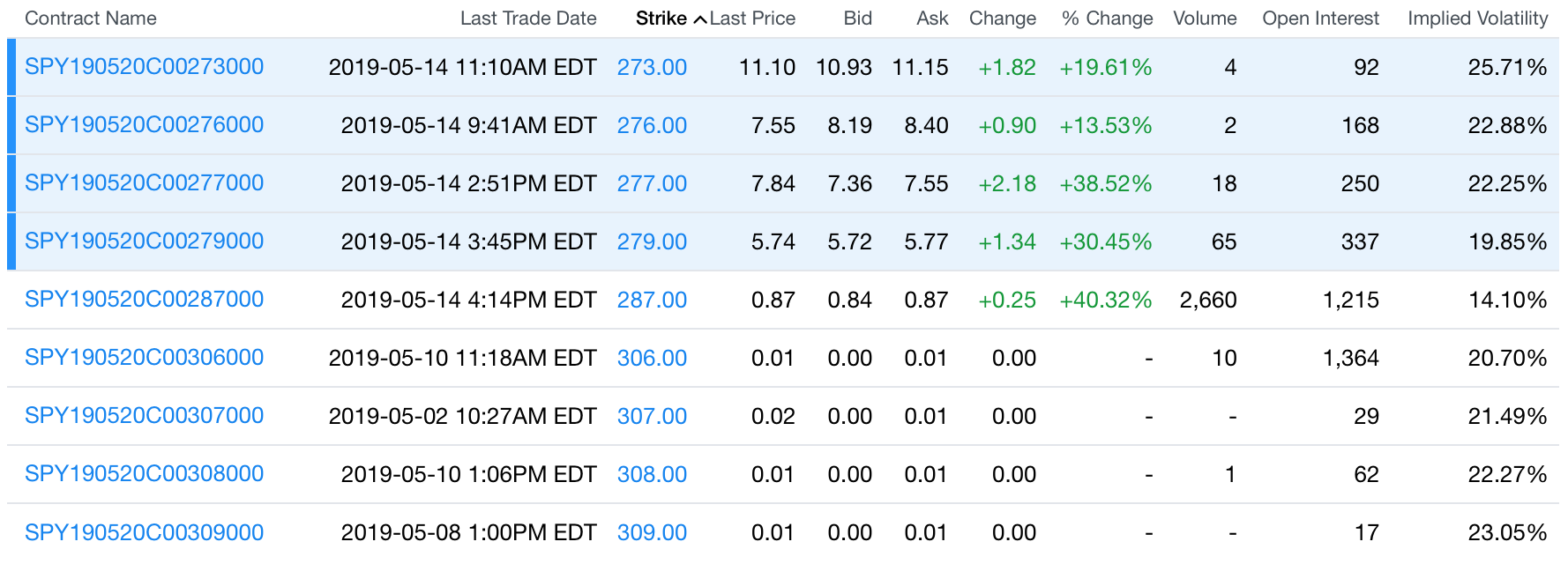

Let’s take a look at an example of call options on the S&P 500 SPDR ETF (NYSE: SPY), which traded at $283.40 at this point in time with five days until expiration.

Call Option Chart – Source: Yahoo! Finance

Suppose that you believe that the S&P 500 was going to rise to $290.00 over the coming days. Rather than purchasing 100 shares of the ETF for $28,340.00, you could purchase a call option for just $87.00 that gives you the right to purchase the ETF for $287.00 per share on or before the expiration date. You have an opportunity to potentially earn more with less money at risk.

Consider these three scenarios:

- The ETF rises to $290.00: You could exercise the option, receive the stock for $287.00, and immediately resell it for $290.00. This would result in a profit of $300.00 on your $87.00 investment, or over a 200% return on investment.

- The ETF falls to $280.00: You would lose your original $87.00 investment, which is less than the $340.00 unrealized loss that you would have experienced if you bought the stock at $283.00 and held it to $280.00.

- The ETF remains at $283.40: You would lose your original $87.00 investment, which is more than the $0.00 loss that you would have experienced holding the stock. At any price at or below the strike price of the call, the call buyer will lose 100% of their investment.

Of course, the ETF is most likely to remain near $283.40 with just five days until expiration, which is why there’s such a high premium paid for buyers of the call option. This is why buying call options tends to be a riskier strategy, albeit with a well-defined max potential loss. Many long-term investors aren’t willing to take these kinds of risks.

Why Sell Call Options?

Selling call options is a conservative strategy that’s better suited for long-term investors looking to generate some extra portfolio income. Selling call options against an existing long stock position is known as a covered call strategy and it’s one of the most popular option strategies for long-term investors for a variety of different reasons.

Download our free Option Income Strategies Worksheet to find the right trade for your portfolio.

Retirement investors may use covered call strategies to maximize their portfolio income. Rather than writing covered calls against their existing portfolio, they might build a portfolio specifically designed for maximizing income from covered calls. We use this strategy with the goal of generating as close to one percent per month as possible for our clients.

Other investors may simply be interested in maximizing their total return from their existing portfolio. They may own many different blue chip stocks and write covered calls against them to generate an extra income that’s above and beyond what’s possible with dividends. The key is ensuring that their long stock positions aren’t called away and sold.

The biggest risk with selling call options is the opportunity cost. If the stock rises above the strike price, you still have to sell the stock for the agreed upon price. The good news is that this price may still leave you with a profit on the trade — it’s just not as much profit as it could have been!

Strategies for Selling Call Options

The most common strategy for selling call options is covered calls, which we discussed in the last section. The key to success in writing covered calls is identifying opportunities that maximize income and minimize the odds of the stock being called away and sold. This can be accomplished through an effective screening process and smart portfolio construction.

Diagonal spreads are a slightly more complex version of a covered call. Rather than owning the actual stock, you can purchase a longer term stock option with a lower strike price that guarantees that you could own the stock. You can then sell a call option with a higher strike price against that position. The idea is that the lower cost basis creates greater income potential in terms of a yield on the trade.

Selling naked calls is the riskiest way to sell call options. Since you don’t own the underlying stock (or rights to it), you will be required to buy the stock at the market price if it rises above the strike price. This creates the potential for unlimited losses in exchange for a fixed (and relatively small) income from the premium payment.

Strategies like buying call options and selling naked calls are where options get their ‘risky’ label. New option investors can take our Options Investing 101 course to see how to use options to reduce risk, boost income in their portfolio, and avoid risky strategies.

Alternatives to Consider

The best alternative to selling call options depends on your investment objectives and market sentiment.

If you’re seeking greater income, you may want to consider adding other asset classes, such as bonds or real estate, that yield more than conventional stocks. You may also consider stocks with a higher dividend yield, such as utilities.

Chasing after higher returns will often result in disappointment. Higher returns mean higher risk and most investors don’t have the stomach to withstand wild fluctuations on their money. Using options as a speculative investment or to add leverage to your portfolio can quickly end in disaster. These types of strategies should only be used by experienced traders.

The Bottom Line

Call options can be used for speculation or income generation depending on your investment objectives. We recommend investors avoid speculative investments to focus on stable, consistent results. For many long-term investors, covered calls are a great way to generate some extra portfolio income without taking on much risk.

Sign up for our free courses to learn more about our approach to writing covered calls for income generation or check out our managed services to learn how we can help you.