When most people think about investing, they think about trading stocks, but that’s not necessarily the only (or best) choice for those looking to generate income from an investment portfolio.

The trouble with regular stock trading is that you need a significant amount of money upfront to get started, and, in addition to choosing the right stocks (which can be hard to do) you have to pay close attention to the fluctuating market to ensure you’re buying and selling them at the right time. You will only make money when – and perhaps more importantly, if – your stock goes up in price.

Option trading is another method of generating portfolio income. Options allow you to make money in various market conditions, and, as the name suggests, options give you the choice to buy or sell various securities, such as stocks, ETFs, indices, or commodities.

Trading options alongside owning stocks offers several advantages over stock trading alone. For investors seeking to enhance their portfolio strategy, this

What Is Option Trading?

Options are a derivative, which means their value is intrinsically linked to the price of another security. Options are traded as contracts that grant the right, but not the obligation, to buy or sell an underlying asset at a set price (strike price), on or before a certain date (expiration).

There are only two types of options: calls and puts. And – there are two sides to every option transaction: the party buying and the party selling (also called writing).

Calls give their buyer (owner) the right to buy the underlying asset. Puts give their owner the right to sell. It is crucial to understand that while option buyers have rights, option sellers have obligations.

The seller of the call is obligated to sell shares to the call buyer if they exercise their right to buy. The seller of the put is obligated to buy.

How Do You Make Money With Options?

A call buyer wants the price of the underlying shares to rise. The call price will rise as the shares do, and the option becomes profitable for the buyer because they purchased the option with less capital than outright stock ownership. They can choose to exercise their right to buy the stock when its shares are high or sell the option to profit on the transaction.

However, if an option isn’t exercised before the expiration date, the entire investment is lost for the buyer. Meanwhile, the seller keeps the premium they received for selling the option contract. If the underlying stock increases above the strike price, the call option will likely be exercised. Depending on the strike price, the call seller may earn additional profit from their shares being “called away.”

As an example, if you had $1,000 to invest in Company X’s stock, currently trading at $20, which you expected to rise in value, you could buy call options instead of purchasing the stock outright (this gives you the right to purchase the stock later if you desire, but not the obligation).

If call options on the stock were trading at $2.00 each (at a strike price of $20), you could buy 500 options (5 option contracts), which would give you the right to buy 500 shares if the stock did go up. If the stock rose to $25, for instance, you could exercise your option to buy 500 shares, and then sell them immediately for a profit of $2,500.

After taking away your original investment of $1,000 to buy the options, you would be left with $1,500 profit and a return on your money of 150%.

On the other side, if the share price fell to $15, the call buyer has lost his entire investment. But the option seller still keeps the $1,000 option premium and retains stock ownership.

The put buyer profits when the underlying stock price falls. A put increases in value as the underlying stock decreases in value. Conversely, put writers typically prefer for the option to expire with the stock price above the strike price, or at least for the stock to decline an amount less than what they have been paid to sell the put.

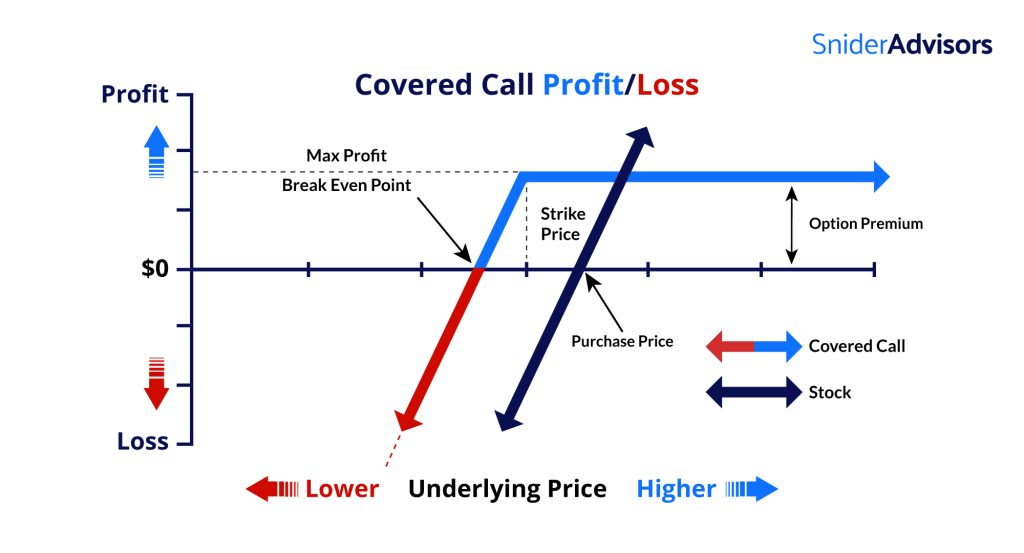

Covered Call Diagram – Source: Snider Advisors

Why Trade Options?

One of the reasons that option trading is a popular choice for speculative investors is that it’s possible to make significant profits without a lot of money upfront. Investors with little starting capital can make proportionately larger returns from their investments. However, we never recommend this type of leverage, speculative option trading.

When done correctly, option trading can reduce your risks and offer a much better risk versus reward ratio. Covered Calls are one options strategy you can use to reduce the risks of individual stock ownership.

Calls and puts, alone, or combined with each other, or even with positions in the underlying stock, can provide various levels of leverage or protection to a portfolio. They can be used in bull, bear or flat markets, and can act as insurance to protect gains in questionable stocks.

Investors that choose to invest in high-quality stocks can also generate income from selling options in addition to receiving dividends, making it a strategy we recommend for retirees who want to create livable income off of their investments.

(If you want to learn more about calls and puts, or want to know how to choose better stocks for option trading, check out our free courses.)

Final Thoughts

One nice thing about option trading is that investors have more options, as the name implies. If you already own securities that you’re unsure about, you could sell options to increase your monthly income. .

As you can likely see, options trading is a little bit more complex than just buying and selling stocks. Before placing any trades, you should be sure to receive the proper guidance and education. We have many great free courses to help you learn more.

When it comes to investing, nothing really gives you the amount of freedom that you have with option trading, which is why it’s a great choice for investors that want to generate income as well as those who want the opportunity to create larger returns from their portfolio.