Option trading may sound like a risky endeavor, but like most investments, it’s only as risky as you make it. After all, stock investing can be incredibly risky if you’re investing in penny stocks, but few financial advisors would argue against a diversified blue-chip stock portfolio. The key to building income for retirement is using strategies that generate stable, predictable, and low-risk income over time rather than taking on large risks to ‘get rich quick’. Using option trading for income can help boost your portfolio paycheck in retirement.

In this post, we will look at option strategies that may be appropriate for retirement income, how risky these strategies really are, and why investors should be open to using options.

Why Use Options at All?

Many conventional investment strategies rely on bonds or dividend stocks to generate a steady income during retirement. For example, 20-year Treasury bonds currently yield approximately 4.95 percent, which means that a $1,000,000 portfolio might generate $49,500 per year in income. Similarly, the S&P 500 offers a 1.27 percent dividend yield, which would generate $12,700 per year in income, with a larger opportunity for inflation protection throughout retirement.

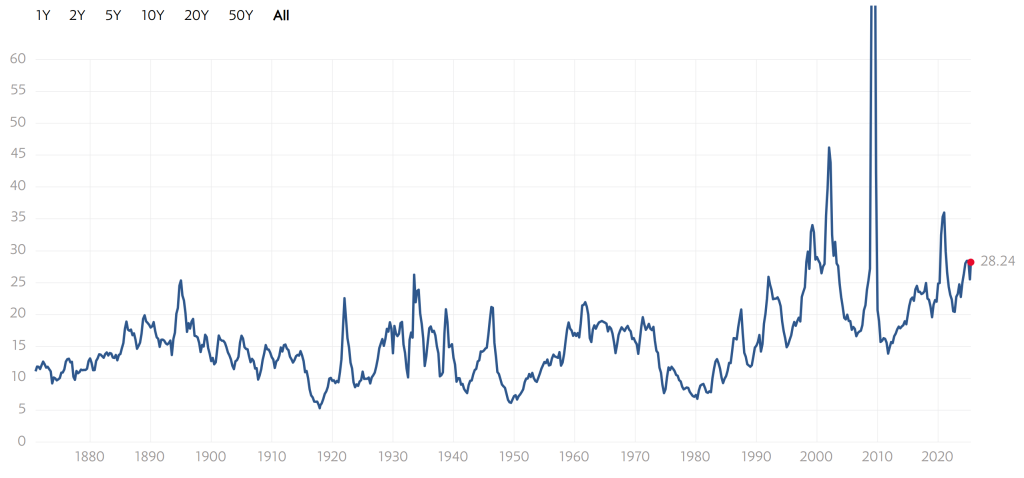

For the past several years, we have experienced average interest rates, but low interest rate environments, like the period following the 2008 financial crisis, can make these types of investments increasingly risky. As interest rates rise, bond prices tend to fall, potentially reducing the value of a bond portfolio over time. Currently, the S&P 500 index’s price-earnings ratio—a measure of valuation—stands at about 28.24, which is significantly higher than the historical average of around 16, suggesting that equities may be overvalued.

S&P 500 PRICE-EARNINGS RATIO OVER TIME – SOURCE: MULTPL.COM

Options trading provides a way to generate income from stock holdings without taking on additional downside risk. In fact, the biggest risk associated with the most conservative strategies is being forced to sell early if the stock moves higher than expected. Other option strategies provide ways to hedge a portfolio against decline by setting a price floor – a strategy that could be attractive for retirement investors looking to reduce risk.

How Options Generate Income

There are many different ways to generate an income using stock options, but they all take advantage of a feature known as time decay. The basic idea is that an investor sells or writes an out-of-the-money option with no intrinsic value – only time value – and generates an income as that time value decays throughout the life of the option. These positions are usually hedged using long stock positions or other options to limit their downside potential.

The two most popular option income strategies are:

- Covered Calls: An investor that owns a long stock position can sell an out-of-the-money call option and receive the premium as income. If the strike price is never reached, the investor would simply keep the premium as income. If the strike price is met, the investor could sell their shares for a profit or pay the difference.

- Credit Spreads: An investor sells a short-term option and receives the premium as income and then buys a longer-term option for less than the premium amount. If the strike price of the short option is never reached, the investor keeps the premium as income. If the strike price is met, the investor could cover both positions or exercise the long option and deliver the shares to the short option.

Retirement investors often use covered calls to generate an additional income from existing long stock positions. For example, an investor that holds 100 shares of a company stock may write one covered call contract against that position and generate extra income. This lets them, for example, generate a ‘virtual dividend’ on stocks that don’t pay a dividend. By writing calls month-after-month, you can create a monthly paycheck from your portfolio.

How Risky Are Options?

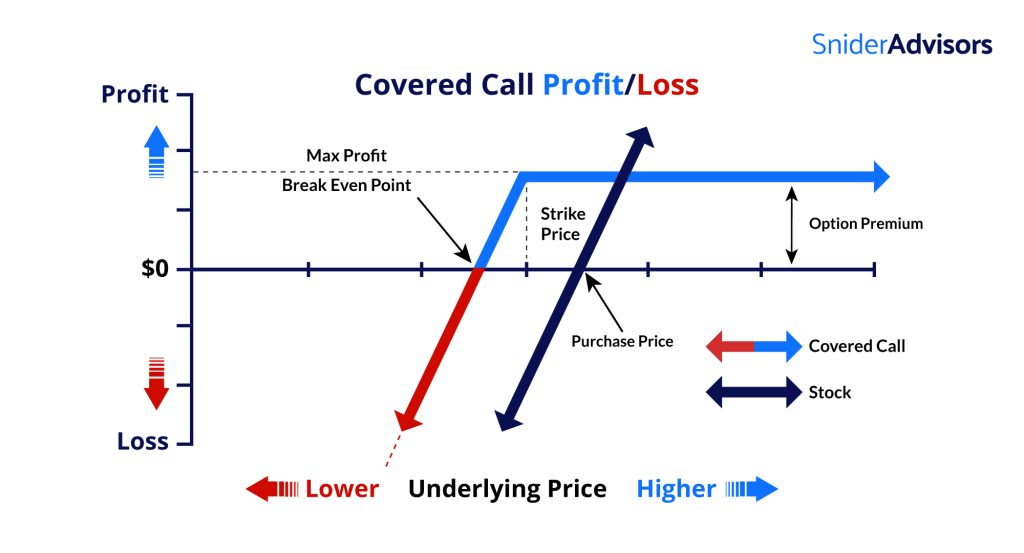

A key feature of stock options is that they have very predictable levels of risk and reward, while stocks and bond prices can experience significant losses or even theoretically fall to zero. For example, a covered call strategy will never lose more money than the underlying stock movement. The only cost associated with the strategy is giving up potential upside if the stock moves higher than expected and the investor needs to prematurely sell or pay the difference.

COVERED CALL PAYOFF DIAGRAM – SOURCE: SNIDER ADVISORS

In addition, stock options enable investors to profit from a decline in stock prices without the risk of short-selling. A bear credit spread, for example, involves two call options with the same expiration but different strike prices. The strike price of the short call is below the strike of the long call, which means that the strategy generates a net cash inflow. The investor keeps all premium income if the stock price remains below the short call’s strike price.

The key risk associated with options strategies is that they require an investor to understand short-term price movements. For instance, investors in covered calls may predict how high a stock price will rise over just a month. The key to success is selecting the right underlying stocks and understanding their historical volatility to ensure that any call options written expire worthless rather than being exercised or offer enough upside to make a difference.

The Bottom Line

Options trading may seem like a risky endeavor, but there are many low-risk strategies that retirement investors may want to consider. Covered calls offer attractive income potential in a low/rising interest rate environment that has made some stocks and bonds riskier. Investors may want to consider this strategy as part of their overall retirement portfolio to increase yield and provide a steady income over time.

Snider Advisors specializes in helping retirement investors meet two goals: generate consistent monthly cash flow as close to 1% of total investment as possible with no permanent loss of capital. Clients can choose a do-it-yourself approach with our training and tools or a professionally managed account. Download the Snider Investment Method Owner’s Manual to learn more.