Humans are hardwired for survival, but this innate motivation to stay safe can be fundamentally at odds with investment success. Emotional responses to market volatility—especially fear and greed—can trigger impulsive decisions that derail even the most well-thought-out investment plans. But these reactions are deeply ingrained, and for most investors, they represent the greatest obstacle to achieving consistent, long-term results.

Understanding the Emotional Cycle of Investing

Investor behavior often follows a predictable emotional cycle. The Cycle of Investor Emotions illustrates that when the market begins an upswing, you feel optimistic and as it rises, so do your emotions. Finally as the market hits its high, you enter into a state of total euphoria. Of course, your natural inclination in this state is to buy.

Then, prices drop, just a little, and you begin to feel a little anxious, thinking this couldn’t possibly be happening again. Before you know it, your fear has grown into total despondency and depression and you convince yourself you’d be a fool not to sell.

This behavior leads to a dangerous pattern: buying at elevated valuations and selling at depressed ones. It’s important to remember that market peaks typically represent the greatest risk, while market lows often offer the most opportunity—yet emotions push most investors in the opposite direction.

The Evidence: Performance Gaps Driven by Behavior

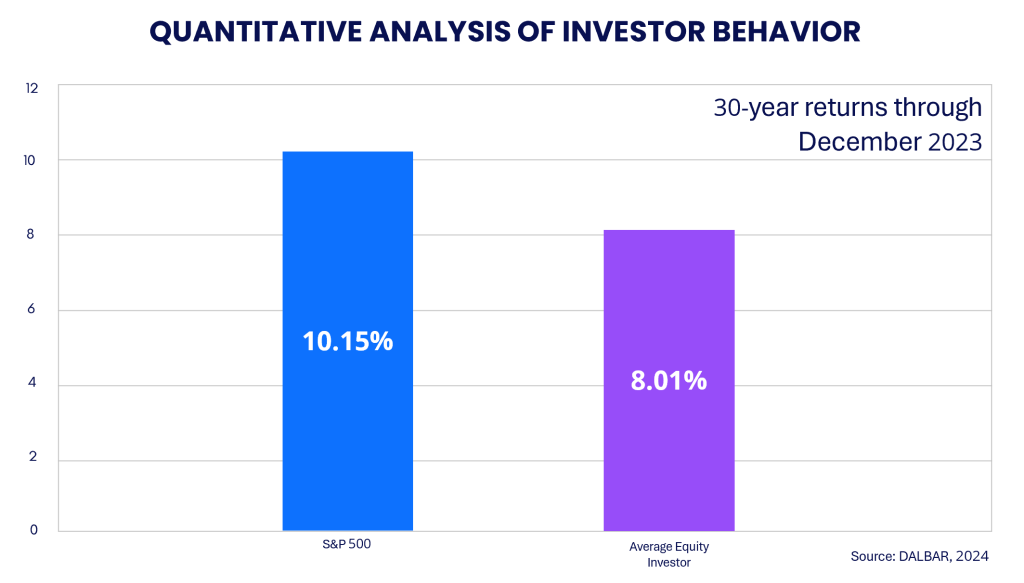

The financial impact of buying high and selling low is best quantified by DALBAR’s study, the Quantitative Analysis of Investor Behavior (QAIB), which compares investor’s returns to relevant benchmarks.

As you see depicted below, in the 30 year period ending in 2023, the S&P 500 had a return of 10.15%. However, the average investor only got 8.01%, under-performing their investment by a margin of more than 2 percent.

As are so many things rooted in the human condition, the causality of the performance gap is simple. It is human nature to want what we can’t have. In this case, we want high returns with minimal risk.

The desire for a higher performing yet less painful investment leads you to make crucial investment errors. But your primal urge to avoid loss and pursue gain keeps you so mixed up that you can’t always see this.

Emotional Investing is Backward-Looking

Emotional investing is often driven by regret and hindsight. You make decisions based on what you wished would have happened. Sure, everyone wishes they could have reaped the gains of participating in a market upswing. But by the time most investors actually buy, all they’ve actually accomplished is paying more for an asset than they should have.

Making investment decisions based on past outcomes is similar to driving while staring into the rearview mirror. It’s dangerous. And if you do it too long, you’re bound to get hurt.

But you’re only human, so what do you?

What Investors Can Control

You must acknowledge that your investment results depend on your behavior as much as your investment’s performance.

You must also control what you can and ignore the rest. You cannot, nor will you ever be able to control the stock market. Market chaos and media frenzy will always exist and you will always want to react. But the lesson is that you can’t. If you have a history of repeatedly buying and selling at the wrong time – STOP!

The Value of a Systematic, Rule-Based Approach

Discipline is essential for long-term investment success. Rule-based investment strategies are designed to minimize the impact of emotional decision-making by providing a clear, consistent framework for action.

The Snider Investment Method never relies on emotions or gut feelings to determine when to buy or sell. It works because it is a set of firm rules and steps, repeated deliberately and systematically month-to-month.

Rather than relying on hunches, hope, or headlines, a good strategy uses a powerful combination of logic, reason, and probabilities, making it a good fit for both the novice and experienced investors.