Most people are familiar with asset allocation even if they don’t recognize the term. For example, the SEC’s Beginners’ Guide to Asset Allocation uses the example of a street vendor selling both sunglasses and umbrellas. The street vendor would never sell both items at the same time but having both in stock helps even out their revenue regardless of whether it is raining or sunny outside on a given day.

Free Worksheet: What’s Your Ideal Asset Allocation?

In this article, we will look at what asset allocation is, why it’s probably the most important investment decision that you’ll make, and how covered call options can play a role.

What Is Asset Allocation?

Asset allocation is the practice of dividing an investment portfolio into different types – or classes – of assets, such as stocks, bonds, and cash. Whenever you see a pie chart on your account statements, you’re probably looking at your portfolio’s asset allocation. These asset allocations change over time depending on a variety of different factors, including the investor’s time horizon and risk tolerance.

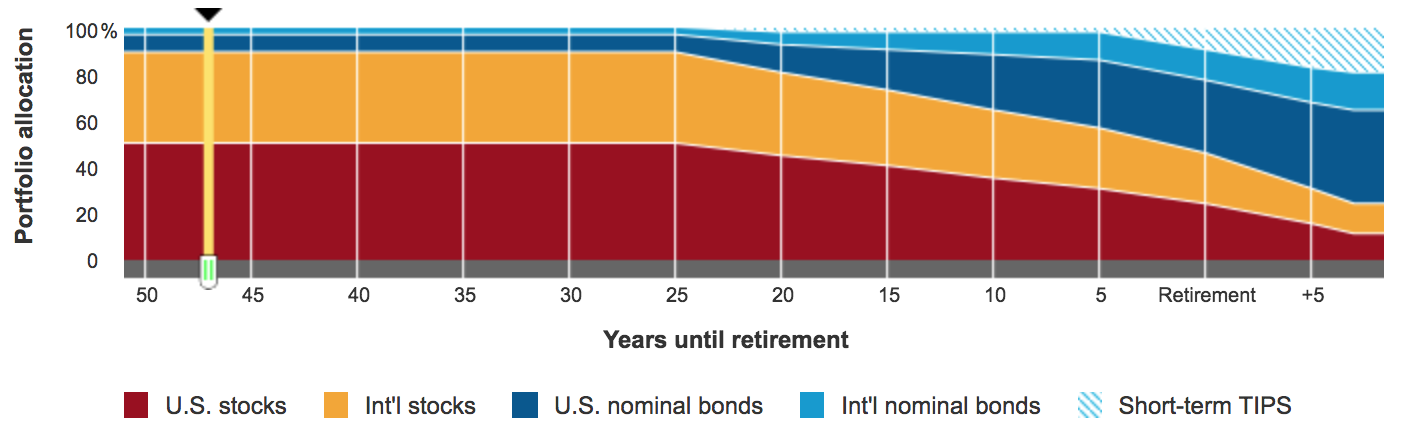

MULTI-COLORED COLORED CHART DESCRIBED IN THE TEXT BELOW THE IMAGE.

Figure 1 shows the asset allocations that Vanguard uses for their target date retirement funds. As you can see, the portfolio’s allocation to U.S. stocks, international stocks, U.S. bonds, international bonds, and TIPS (inflation-hedged cash equivalents) changes as the investor draws closer to retirement. Self-directed investors often take a similar approach when managing their own portfolio asset allocations over time.

There are several different asset classes:

- Stocks/Equities – Stocks, or equities, have historically offered the highest risk and highest returns. But, not all stocks are the same. Large-cap stocks are less risky and small-cap stocks have more risk. Investors willing to put up with the volatility of stocks have realized the best positive returns over time.

- Bonds & Fixed Income – Bonds have historically had less volatility than stocks, but the tradeoff is that they offer more modest returns. But, there are some types of bonds that are riskier, such as junk bonds and high-yield bonds. Investors with a short time horizon often keep their investments in bonds since they offer stability and income.

- Cash & Cash Equivalents – Cash and equivalents are the least risky asset class since there’s very little risk of losing capital. In addition to cash, these investments might include certificates of deposit, Treasury bonds, or other cash-like securities.

Selecting the right asset allocation depends on several factors, including:

- Time Horizon – The number of months or years until your financial goal is the primary factor driving asset allocation. Investors saving up for retirement often invest in riskier assets since they have a long time horizon, while a parent saving up for a teenager’s college education may stick to less risky investments since they have a shorter time horizon.

- Risk Tolerance – The second major factor influencing asset allocation is an investor’s risk tolerance. In other words, their ability and willingness to lose some or all of their original investment in exchange for greater returns. Aggressive investors may be willing to take on higher risk to get better returns, while conservative investors may stick with low-risk investments aimed more at capital preservation.

The Importance of Asset Allocation

Asset allocation helps investors reduce risk through diversification. Historically, the returns of stocks, bonds, and cash haven’t moved in unison. Market conditions that lead to one asset class outperforming during a given timeframe might cause another to underperform. The result is less volatility for investors on a portfolio level since these movements offset each other.

In addition to diversification, asset allocation is essential to ensure that you reach your financial goals. An investor that isn’t taking on enough risk might not generate high enough returns to reach their goal, while an investor that’s taking on excessive risk may not have enough money when they need to access it. Selecting the right asset allocation helps avoid these issues by ensuring that a portfolio is ideally positioned to reach a goal.

Asset allocation accounts for a whopping 88 percent of volatility and returns, according to Vanguard, which means that your experience will be very consistent with any other diversified investor with the same asset allocation regardless of the specific investments you choose. In other words, asset allocation matters a lot more than stock picking when it comes to reaching your financial goals!

How Covered Calls Fit In

Covered Calls are a great way to realize the best attributes of both equities and fixed income asset classes. By selling the right to purchase a stock that you already own, covered calls can help generate additional income on an equity position. You can effectively realize some of the upside of equities and still receive the income of a bond. This win-win approach may be appropriate for some investors that would otherwise have all of their money tied up in bonds.

Free Worksheet: What’s Your Ideal Asset Allocation?

Bond allocations may be risky depending on market conditions. For example, rising interest rate environments tend to hurt bond prices and increase bond yields. Covered calls provide an alternative source of income that side steps these concerns and keep investors in equities that may perform better than bonds in rising rate environments. The only major risk is that the equity rallies to a price where you are forced to sell or buy back your call option.

If you’re interested in learning more about covered calls, take our free introductory course designed to show you how to get started trading options. The Snider Method is designed to help any investor generate income from their equity portfolio using strategically chosen covered call options. We offer a six-month course designed to teach you our method or offer asset management for those looking to take a hands-off approach.

The Bottom Line

Asset allocation is one of the most important decisions that an investor will make for their financial future. By choosing the right mix of stocks, bonds, cash, and other asset classes, you can ensure that you’re setup to reach your financial goals. Covered calls can also be used to blend some of these assets to better reach certain financial goals.

For more information take our free introductory courses and learn more about the Snider Method and how it works.