Covered calls may be the most popular options strategy, but it’s best employed under certain market conditions and with specific stocks and options. If you’re blindly writing call options against just any stock, you could be missing out on income at best or taking on excessive risk at worst. Understanding the nuances is essential to long-term success.

In this guide, we’ll delve into the specific stock and option characteristics you should look for when writing covered calls to maximize your income and minimize your risk.

A (Really) Brief Primer

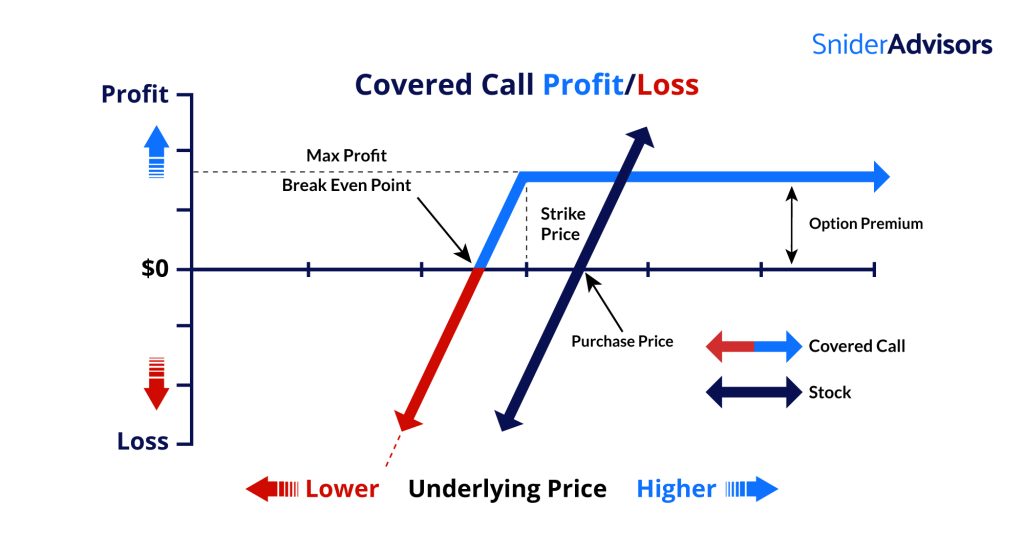

A covered call gives someone else the right to buy a stock you already own at a specific price (strike price) at any time on or before a specific date (expiration date). In exchange, you receive an upfront premium that serves as income above and beyond any dividend. The only downsides are any decline in the stock price and any opportunity cost above the strike price.

You can create a covered call by purchasing a long stock position (or using a stock you already own) and then writing (or selling) a call option. When you sell an option, the buyer pays you a premium that you receive as cash in your account. Then, you either keep the premium and stock or deliver the stock if the buyer exercises the option (or you can buy back the option).

Most investors sell covered calls to boost their portfolio income. In an ideal outcome, you can receive the option premium, collect a dividend, and realize a small capital gain at the same time! However, others use covered calls as a way to exit a long position since you can generate extra income when you’re already planning to sell the stock.

How to Pick the Right Stock

A high-flying AI stock may have a place in a long stock portfolio, but that kind of volatility (in either direction) can be bad news for covered calls. Instead, the best candidates are stocks with a stable to slightly bullish outlook and no short-term catalysts that could blow up your position. You don’t want an earnings announcement or FDA decision to suddenly result in big losses or a huge jump in the stock’s price.

At the same time, you own the underlying stock – and potentially for a long time. So, you should look for quality and value when picking the underlying stocks for a covered call. A blue-chip stock trading with a low price-earnings ratio has a much greater margin of safety than a tech stock with a lofty valuation – and therefore may be less risky to hold long-term.

Finally, if you’re seeking to maximize income, dividend stocks provide a bonus by providing you with dividend and premium income. But, of course, you need to pick a strike price that minimizes the risk of the option buyer exercising the option to collect the dividend. If you have an at-the-money option, a buyer will want to exercise it to capture the dividend!

Choosing the Best Options

Price-earnings ratios and dividends are easy to understand, but options can be much more difficult to understand. Still, choosing the right call option to write (e.g., the strike price and expiration date) is arguably more important than selecting the right stock! So, it’s worth spending the time to understand options and get comfortable with their dynamics.

If-Called Returns

Income potential is a natural starting point. You want to find options that deliver the yield you need for the strategy to make sense in your portfolio. Usually, this means looking at the if-called return to see the estimated annualized net profit of a covered call assuming the stock is above the strike price at expiration and that the stock was sold at assignment.

The calculation looks like this:

If-Called Return = (Income + Gain) / Investment x Time Factor

If-Called Return = (Call Premium + Dividend) + (Strike Price – Stock Price) / Stock Price x (360 Days per Year / X Days to Expiration)

Option Deltas

Aside from income, you usually want to minimize the chances the option buyer will exercise the option (for tax or other reasons). Fortunately, delta – an option’s Greek – can help approximate the probability of an option ending up in-the-money. For example, a 0.3 delta suggests a 30% chance of being in-the-money at expiration and is a good general upper limit.

Call options have a positive delta ranging from 0.00 to 1.00, and at-the-money options trade with a delta near 0.50. As you go deeper in-the-money, the delta increases and approaches 1.00 – a 100% likelihood of exercise. Meanwhile, out-of-the-money options get closer to 0.00 as expiration approaches since the odds of exercise diminish.

Margin of Safety

A final consideration is the margin of safety. In some cases, you might be more concerned about minimizing losses than maximizing income, which means you might look at how much volatility risk the premium income helps offset. This is especially true for long-term investors who are writing covered calls against their long-term holdings for extra income.

You can quantify the margin of safety with this equation:

Downside Protection = (Premium Received / Purchase Price) x 100

The result shows you the percentage decline that the stock price can suffer before you start losing money net of the option premium you receive.

Tools & Other Considerations

We have covered some of the most important conditions for writing covered calls, but it’s not an exhaustive list by any means. If you want to dive even deeper, the Snider Investment Method provides an entire framework for selecting the right stocks and options for covered call strategies, as well as managing those positions over time.

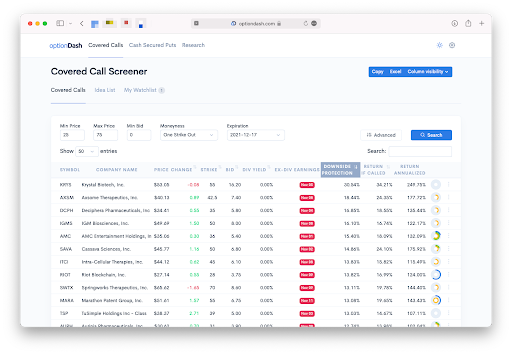

Meanwhile, option screeners like optionDash can help you streamline the research process. You can quickly generate a list of options by if-called return or downside protection while checking the quality and value scores of the underlying stocks. Moreover, you can see upcoming earnings dates to avoid one of the most common catalysts for price movements!

And finally, it’s worth covering the underappreciated impact of taxes.

If you fall into a high marginal tax bracket, you could improve your returns by trading in an individual retirement account (IRA) or other tax-advantaged account. That’s because option income is taxed as ordinary income at your marginal tax rate.

On a related note, it’s generally a good idea to avoid assignment where possible to avoid triggering short-term capital gains taxes on stock sales. If you roll-up or roll-out a covered call (or simply buy it back), you may be able to avoid paying taxes on a short-term gain and instead turn it into a long-term gain later, which is usually taxed at the 15% tax bracket.

The Bottom Line

Covered calls are a nuanced strategy that involves more legwork than a simple long stock position. By understanding stock fundamentals, option deltas, and other concepts we’ve covered, you can better understand the ideal conditions for a covered call and maximize your odds of success.

If you’re interested in learning more, sign up for our free e-course to learn more about picking the right stocks and options (and discover how to manage these positions after you’ve bought them). And, when you’re ready to search for opportunities, optionDash can help you quickly filter through opportunities by income, risk, quality, and other metrics.