Higher interest rates have provided strong income opportunities for retirees in recent years, but that environment is starting to shift. With inflation cooling and economic growth slowing, the Federal Reserve began cutting rates in 2025. In response, yields have continued to fall—most notably, the 10-year Treasury yield, which peaked near 5% in late 2023, has declined to below 4% by mid-2025.

The positive news is that retirees have a variety of tools available to help maintain or enhance income in a lower-rate environment—from dividend-focused equity portfolios to more advanced strategies such as structured products or options overlays. The key lies in aligning your approach with both your income goals and your risk tolerance.

With that in mind, let’s explore several income-generating strategies beyond traditional bond allocations that can help offset declining yields in retirement.

#1. Covered Calls

Covered calls are an options strategy in which investors sell (or “write”) call options against a long stock position. In exchange for capping some of the stock’s upside potential, investors receive a cash premium—essentially generating additional income on top of any dividends received. This approach can be thought of as enhancing the yield of a stock or fund by adding an extra “dividend” stream through option premiums.

The success of this strategy largely depends on selecting the right underlying stock and call options. For example, it’s generally wise to avoid writing calls just before key events like earnings announcements, which can lead to significant price swings. Equally important is having a clear plan for managing positions if the stock price moves unexpectedly and you prefer not to sell the shares. Most importantly, owning high-quality stocks with stable fundamentals is critical—reliable companies are better suited for covered calls, as they are more likely to maintain long-term value while still providing opportunities for premium income. (We cover these issues and more in our free e-courses!)

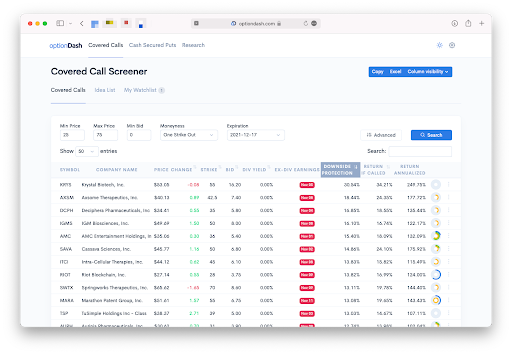

Option screeners can help you find opportunities that meet your requirements without having to manually sort through hundreds of tickers.

optionDash makes it easy to find covered call opportunities for your portfolio, matching your income requirements with risk tolerance. Source: optionDash

If you prefer not to manage covered calls yourself, there are several covered call ETFs that implement the strategy for you. One of the most well-known is the JP Morgan Equity Premium Income ETF (JEPI), which continues to attract investors with its consistent income focus.

As of mid-2025, JEPI offers an SEC yield of approximately 7.5%, though this can vary with market conditions. While these funds offer convenience and broad diversification, they typically come with less flexibility than a DIY approach and may carry higher expense ratios.

#2. Dividend Stocks

Dividend-paying stocks remain a traditional and reliable way to generate investment income. Although average dividend yields have trended lower over the past decade, many high-quality companies continue to offer attractive payouts—with a track record of increasing those dividends over time. Unlike bonds, equities also provide the potential for capital appreciation, allowing investors to grow both income and portfolio value over the long term.

Many retirees turn to the Dividend Aristocrats or other well-established dividend-growth stocks. These companies have consistently raised their dividends for 25 years or more, providing a stable and growing income stream. That said, it’s important to carefully manage your equity exposure, as stock market volatility can still impact your portfolio’s overall risk profile.

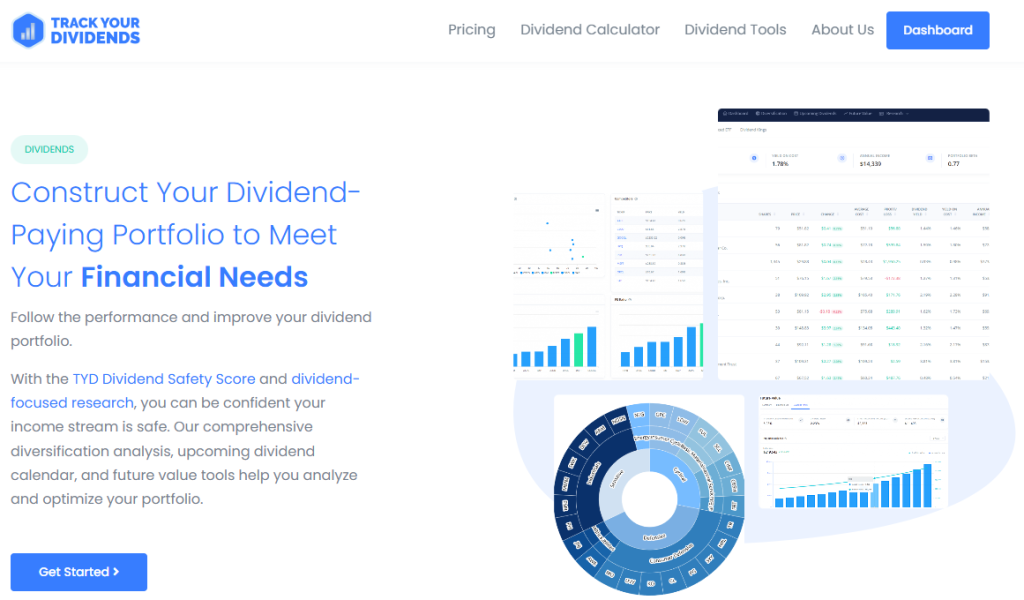

TrackYourDividends.com makes it easy to screen for dividend opportunities and determine your income levels at a glance. Source: TrackYourDividends.com

Dividend screeners, like TrackYourDividends, can help you identify the right dividend stocks for your portfolio. For example, you can look at quality, value, and trend metrics to decide on companies that fit your risk tolerance levels. Meanwhile, filtering by yield helps ensure that you’re generating enough income to support retirement.

#3. High Yield Bonds

Another way to enhance income is by investing in higher-yielding, lower-rated bonds. Known as high-yield bonds or junk bonds, these are typically issued by companies with credit ratings below BB. While these issuers may carry more debt or face greater business risk than investment-grade companies, that doesn’t necessarily mean they’re at imminent risk of default. In many cases, high-yield bonds come from companies with manageable but elevated leverage.

One of the most effective ways to gain exposure to this market is through exchange-traded funds (ETFs), which offer broad diversification. For instance, the iShares Broad USD High Yield Corporate Bond ETF (USHY) holds nearly 2,000 bonds and, as of mid-2025, offers an SEC yield of around 6.2%—though yields fluctuate with market conditions.

When considering high-yield bond funds, it’s important to align the fund’s duration with your investment time horizon. For retirees with shorter-term income needs, short-duration high-yield bond ETFs may be more appropriate, as they offer attractive yields while reducing sensitivity to interest rate changes.

#4. REITs and MLPs

Partnerships and trusts remain attractive options for investors seeking higher income. Two of the most popular structures are Real Estate Investment Trusts (REITs) and Master Limited Partnerships (MLPs). These vehicles typically invest in income-generating assets such as commercial real estate or energy infrastructure like oil and gas pipelines.

REITs have historically delivered competitive total returns through a combination of consistent dividend income and long-term capital appreciation. They also tend to exhibit low correlation with traditional stock and bond markets, making them useful for diversification. However, investors should carefully evaluate each REIT’s leverage, property mix, and sector exposure. Publicly traded REITs are generally preferred for their liquidity and transparency. In contrast, non-traded REITs, despite offering higher yields, often come with significant liquidity constraints and limited pricing visibility—risks that often outweigh the potential rewards.

MLPs, on the other hand, offer unique tax advantages. Distributions are typically classified as a return of capital, which means they are not taxed when received but instead reduce your cost basis. Once your cost basis reaches zero, future distributions are taxed as capital gains. This structure can be tax-efficient for long-term investors but requires diligent record-keeping.

It’s also important to note that both REITs and MLPs may complicate tax reporting. Many MLPs issue Schedule K-1 tax forms, which are more complex than the standard 1099s provided by traditional stocks and ETFs. For some investors, the added administrative burden and potential for delayed filings may outweigh the income benefits.

#5. Exotic Options

Stock options offer a wide range of uses—including speculation, hedging, and income generation. While we’ve already covered covered calls, there are several other income-oriented options strategies that may be worth exploring—particularly if you’re comfortable with a more hands-on approach.

Some popular strategies include:

- Collars – A collar involves holding a stock while selling a covered call and simultaneously buying a protective put. If the premium received from the call offsets the cost of the put, you can earn a small net income while also limiting downside risk. This strategy provides more protection than a standard covered call, making it useful in uncertain markets.

- Spreads – Option spreads involve buying and selling options with different strike prices, expirations, or both. A common example is a call credit spread, where you sell a call option and buy another with a higher strike price. This creates a defined-risk position that generates premium income in flat to moderately bearish markets.

- Cash-Secured Puts – This strategy involves selling put options on a stock you’re willing to own, while setting aside enough cash to buy the stock if assigned. The premium collected represents your income, and the yield is calculated as premium received divided by the cash reserved. This complements covered calls well and can be especially effective in range-bound or slightly bullish markets.

Of course, options trading carries greater complexity and risk than traditional stock or bond investing. When misused, certain strategies—particularly uncovered or “naked” options—can result in substantial losses. Many retirement accounts also restrict more aggressive strategies. For that reason, retirees often prefer to stick with more conservative approaches like covered calls or cash-secured puts.

The Bottom Line

Fortunately, a range of income-generating strategies is available. If you’re looking to generate more income from your portfolio, consider enrolling in our optionsfree e-course on the Snider Investment Method. You’ll learn how to use covered calls to generate consistent income while maintaining a long-term stock portfolio. Or, if you’d prefer a more hands-off solution, reach out to learn more about our asset management services.

If you’re interested in generating extra income from your portfolio, take our free e-course covering the components of the Snider Investment Method. We’ll show you how you can use covered calls to generate extra income while maintaining a long stock portfolio. Or, if you’d prefer a hands-off approach, contact us to learn more about our asset management services.