Most retirees turn to bonds to generate a steady retirement income. But if you only invested in bonds over the past five years, you would have seen your portfolio decline by as much as 9% in value and missed out on an 88% gain in the S&P 500 index.

Dividend stocks offer both income and upside potential, but yields are typically less than three percent. For example, the popular Schwab U.S. Dividend Equity ETF (SCHD) yields just 3.64%. And that means you need a lot more money to generate the same income.

Fortunately, there’s another lesser-known option that provides you with higher yields and equity exposure: Covered calls.

In this short guide to using covered calls to boost retirement income, we’ll take an in-depth look at how covered calls work, why they’re ideal for retirement portfolios, and how you can get started today in your taxable or retirement accounts.

Let’s dive in.

What Are Covered Calls?

Stock options may sound a little too high-risk for a retirement portfolio—but that’s just because nobody talks about the “boring” options.

Buying an ultra-high-risk option that might turn $50,000 into $1 million is much more exciting than covered calls generating an extra 1% monthly cash income. But, if you’re a risk-averse retiree living on a fixed income, that monthly cash income is very appealing.

Covered calls involve selling call options rather than buying them—and that’s much less risky. You’re essentially selling someone the right to buy the stock you own, and in exchange, they pay you a cash premium that you keep no matter what.

The only catch is that you might have to sell the stock you already own for a profit if the stock reaches the agreed-upon “strike price.” In other words, you could miss out on some upside potential if the stock soars above the strike price.

These “opportunity costs” can add up for young investors with a long time horizon. But if you’re a retiree living on a fixed income, missing out on some potential capital gains may be well worth it if you can earn a significant additional income.

How to Invest in Covered Calls

Most covered call strategies involve selling call options each month against your existing stock portfolio. So, for example, if you own 100 shares of Apple, you might sell one call option each month against those 100 shares to earn a premium.

Before getting started, you may have to request permission to trade options from your broker. This usually involves filling out a simple form and questionnaire regarding your investment experience—but don’t worry, covered calls are a “Level 1” strategy.

If you already manage your portfolio, you can begin selling call options against those stocks for extra income. But, if you want to generate more income, you may need to build a portfolio around income generation rather than capital gains potential.

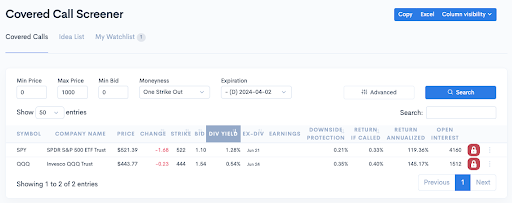

You can find covered call opportunities using tools like optionDash—a covered call screener that sorts opportunities by potential income. Source: optionDash

You may also need to manage your stock and option positions over time. For instance, you might need to buy back a call option if the stock price rises and you don’t want to sell the stock (for example, to avoid triggering capital gains taxes).

We offer a series of free e-courses for those interested in taking a do-it-yourself approach with covered calls for retirement income. In these courses, you’ll learn everything from choosing the right strike prices and expiration dates for options to knowing how to act if the stock moves higher or lower than you expect.

Covered Call ETFs

Exchange-traded funds, or ETFs, are another way to invest in covered calls.

Most covered call ETFs (also known as buy-write ETFs) own a popular index like the S&P 500 and sell options against that index. By investing in an index rather than individual stocks, they have a lower expense ratio due to less trading activity in their portfolio.

For example, the JPMorgan Equity Premium Income ETF (JEPI) writes out-of-the-money S&P 500 index call options against a long stock portfolio to generate a 8.36% dividend yield. That’s more than four times more than the S&P 500’s long-term average yield.

Some ETFs also write call options against bonds. The iShares 20+ Year Treasury Bond BuyWrite Strategy ETF (TLTW) now offers a 16.3% distribution yield, but of course you’re holding bonds—not stocks—and long-term Treasuries are down about 1% year‑to‑date.

The drawback of covered call ETFs is that you don’t control the underlying stocks and they involve an extra expense ratio. So, you cannot easily invest in “conservative” stocks or build international exposure into your portfolio while still selling call options.

How Much Income to Expect

Asking how much income you can expect from covered calls is a bit like asking how much a stock portfolio will increase—it’s unpredictable and depends on many factors.

Many covered call ETFs offer yields of between five and ten percent. But in the earlier example, you can see that TLTW’s higher yields came with a significant price drop. You should consider both income potential and capital gains.

The best way to fine-tune your risk-adjusted income is by building your portfolio. That way, you can ensure the stocks you own match your risk tolerance while choosing companies that offer the most income potential from options.

A good target for a self-managed portfolio is about 1% income per month holding a diversified stock portfolio that matches (or nearly matches) the market. Of course, this assumes that one stock or sector isn’t driving all benchmark returns.

Using Covered Calls in IRAs

Covered calls are so safe that you can use them in many Individual Retirement Accounts, including Traditional and Roth IRAs. And these accounts are ideal for a few reasons.

First, you don’t have to worry as much about selling and replacing stock in your portfolio. If you sell a call option and the option buyer ends up purchasing your stock, you won’t incur capital gains when selling the stock. You can simply replace it in your portfolio without worrying about an extra tax burden or tax loss harvesting rules.

Second, Roth IRAs won’t owe any taxes on capital gains realized from reinvesting covered call income. In other words, you can keep the income in the portfolio and reinvest it in more stock, growing your overall portfolio.

Before setting up an IRA, you should consult your financial advisor to learn more about the benefits and drawbacks. For example, retirement investors may prefer traditional over Roth IRAs to lower their taxable income for benefits purposes. Roth IRAs also have strict income limitations for contributions.

The Bottom Line

Covered calls are an underappreciated strategy for boosting retirement income. Unlike bonds, you hold assets that typically appreciate over the long term. And, unlike dividend stocks, you can earn a higher level of income.

If you’re interested in learning more, sign up for our free e-courses to learn the basics, and check out our covered call screener to find opportunities in today’s market. Or, if you’re interested in a hands-off approach, contact us to learn more about our asset management services that can help you generate more income without any extra effort.