2021: A Plan for Financial Success in the New Year

5 Steps to Get in Financial Shape for 2021

1. Know Where You Stand

First things first, you must evaluate exactly where you are now. I have long believed that you only move what you measure. And the easiest way to measure where you are now is to create personal financial statements, specifically, an income statement and a balance sheet.

-

-

-

- Income Statement

-

-

The income statement reflects all your various sources of income and where you spend that income. We recommend that you divide expenses up into two categories: non-discretionary and discretionary. Non-discretionary expenses are the items you must pay each month – mortgage, groceries, insurance. Discretionary is everything else.

-

-

-

- Balance Sheet

-

-

The balance sheet is a tally of your assets and liabilities. Assets are things you own. Liabilities are things you owe. Assets include things like equity in your home, savings accounts and 401(k) balances. Liabilities include mortgages, student loans and credit card balances. The difference between your assets and your liabilities is your net worth.

You should also track your day-to-day inflows and outflows. This is a lot easier to do if you do it on an ongoing basis rather than going back and trying to organize a year’s worth of statements and receipts.

When your personal financial statements are complete, then you can really get into the nitty-gritty of planning. Without them, you are just throwing darts.

2. Create a Budget and Stick to It

Once you complete your financial statements, you should create a monthly budget. Budgeting gets back to basics of tracking your spending and expenses. It allows you to restrict spending, maximize saving and investing. Budgeting will also help you avoid any new debt and come up with a plan to pay off your existing debt.

You Need a Budget (YNAB) and Mint are two popular online budgeting tools. One of the biggest differences is that Mint is free, while YNAB has a monthly fee. However, many people prefer the singular focus that YNAB has on budgeting, while Mint offers a broader scope.

3. Pay Off Debt

If you have accumulated debt, you should create a plan for paying it off. While there are many ways to approach paying off debt, we recommend that you start by prioritizing high-interest debt. Debt with higher interest rates cost you the most money each month.

Ten percent of $1,000 is the same as one percent of $10,000. In other words, debts with high interest rates cost you more. That’s why it’s important to prioritize repayment based on interest rates before trying to pay off debts based on their size or other factors.

Start by paying the minimum on all balances, and then use extra funds to pay off the highest interest debt. If there’s not a big difference in interest rates, you can pay off the smaller debts first to quickly eliminate them.

It’s usually a good idea to use cash to pay down debt before selling retirement assets. When you sell stocks or bonds, you will trigger capital gains taxes that could impact your tax rates and benefits. That also applies to retirement investment accounts. Raiding these accounts to pay down debt will have a long-term impact on your wealth.

4. Build Up Emergency Cash Reserves

The beginning of the year is a perfect time to evaluate your emergency fund and create a plan for replenishment if necessary. Your emergency fund is a key component of the foundation of your financial plan.

Although the rule of thumb is that you should have 3-6 months of living expenses saved, at Snider Advisors, we typically take a more conservative approach and recommend 6 -12 months. Certainly, you could save more, but there is a point where you are better off investing instead saving.

Make sure to keep your emergency fund someplace liquid like a money market fund or savings account and of course, shop around online for a good interest rate.

Your emergency fund is sacrosanct and should only be used in the event of an actual emergency. The most important purpose of your emergency fund is to be used in the event of paycheck disruption or variances in portfolio income. When you are employed, this means that you should not draw your emergency funds unless you have suffered a job loss or any other circumstance that gravely affects your income.

Once you retire and begin living off your investments, it’s different. Your income will not be affected by something like losing your job. However, it could be affected by a dramatic downturn in the market. In this case, cash reserves can help supplement your portfolio income in a market swing. Cash is your most effective tool for smoothing out the effect of market volatility on your retirement income.

5. Evaluate Retirement Accounts

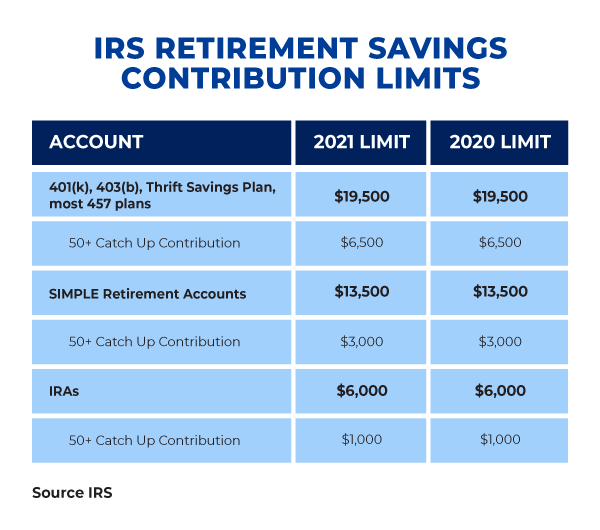

If you’re still working, you will need to spend some time evaluating your retirement accounts. First, you should determine how much you’re going to contribute. Here are the 2021 contribution limits, which are the same as 2020:

Conventional wisdom holds that unless you are paying off debt, you should max out your contributions. At a minimum, you should contribute at least enough to get the company match, otherwise you’re just leaving money on the table.

Now is also a good time to focus on maximizing the efficiency of your old retirement accounts. If you left a 401(k) with a previous employer, it probably makes sense roll it over to an IRA. By doing so, you will most likely reduce any management and investment fees, and have greater flexibility and control over what you invest in.

Enroll in the Snider Investment Method: Fast Track Online Course

5 Ways to Protect Yourself in 2021

Consistently Monitor Your Credit Score

Monitoring your credit score may be the easiest thing you can do to protect yourself. Regularly monitoring your credit will quickly identify any credit inaccuracies and limit the potential damage done by cybercriminals.

To receive your free credit report on a regular basis, simply sign up at annualcreditreport.com. You are eligible to receive a free report from each from the three major credit reporting agencies (Equifax, Transunion, and Experian) every 12-month period. We recommend that you pull one report from a different agency every 4 months. This approach allows you to keep close tabs on your information without paying any fees.

You may also want to consider placing a credit freeze. Doing this will make it harder for someone to open a new account in your name, but the freeze will not affect your credit score in any way. It also won’t affect your ability to open new accounts; you would simply need to lift the freeze temporarily, for a specific time period or for a specific party.

To freeze your credit, you should contact each of the credit reporting agencies websites or phone numbers listed below: (Keep in mind, it needs to be done at each agency.)

-

-

- Equifax: 1-800-349-9960 or https://www.equifax.com/personal/education/identity-theft/fraud-alert-security-freeze-credit-lock/

- Experian: 1-888-397-3742 or https://www.experian.com/freeze/center.html

- TransUnion: 1-888-909-8872 or https://www.transunion.com/credit-freeze

- Innovis: 1-800-540-2505 or https://www.innovis.com/personal/securityFreeze

-

File Your Tax Return Early

You may wonder how filing your taxes early helps you to be safe. Certainly, if you’re getting a refund, it’s nice to get it quickly, but as it turns out, the primary benefit of filing your taxes early is that it can help prevent tax return identity theft.

If a criminal has your Social Security number, they have everything they need to file a tax return in your name. The purpose of a fraudulent tax return is, obviously, not to pay your back taxes, but to get their hands on your tax refund. The earlier you file, the less likely you are to be a victim of a fraudulent tax return.

Furthermore, if you do have to pay, especially if it’s a substantial amount, filing your taxes early can give you more time to plan. Even if you file early, you do not have to pay taxes you owe until the deadline in mid-April. This extra time allows you to see exactly how much you may owe and gives you time to arrange your payment.

Also, filing early allows you to get access important documents. If you’re purchasing a house or have a college student, getting your tax return done early gives you a head start on the paperwork you will need for these processes.

Update Your Cybersecurity

You’ve heard it many times before – you should use a unique password for every site. Along with that, you should change them regularly. If you haven’t already done so, using an online password manager like LastPass, Dashlane or 1Password will make the process manageable.

Additionally, enable 2-step or multi-factor authentication on existing accounts. This extra layer of security requires a user to have more than just a username and password. After entering the standard information, the site will send a code to your email or phone for verification.

Cybercrime, including identity theft and online fraud, will only become more common in the future. A few wise decisions now can save you from some much larger headaches in the future. 50 years ago, you may not have locked your front door or car at night. Our habits need to evolve in order to protect ourselves from bad people. Security will also improve, but you should make these changes today to lead a more secure “online” life.

Review Your Insurance Policies

The beginning of the year is a good time to review your policy to ensure you have the proper coverage. With insurance, it is easy to have a “set it and forget it” mentality. But it is important to give your policies some attention from time-to-time. This is particularly true if you experienced a major life change in 2020.

The easiest way to review your policies is to create a policy overview page for each one. You should be able to find most of the information you need on the insurance policy’s declaration or summary page. The goal is to make sure you truly understand your policy.

Although each type of policy requires a slightly different evaluation here are some of the basic things to consider:

-

-

- Type of policy and insurance carrier

- Policy number and date issued

- Premium amount and frequency

- Who or what is insured?

- What is the benefit or the coverage limits?

- What event triggers coverage?

- Are there any restrictions?

- Beneficiary, cash value, and expiration (for life insurance)

- Deductible and co-pays (for health insurance)

-

It may also be wise for you to contact the agent of your policy for a full policy review, particularly if you have questions or are unclear about your coverage.

Research Potential Investments, Brokers, and Advisors

If you are considering making changes in your investments over the next year, it is always in your best interest to work with reputable companies and qualified people.

Finra’s BrokerCheck is a wonderful online tool that allows you to research the background and experience of financial brokers, advisors, and firms. The SEC also offers the Investment Adviser Public Disclosure website, which is another great research tool to learn more about financial advisors.

A third online tool that can be exceptionally useful to you is FINRA’s Scam Meter. This tool will help you to identify high-risk or fraudulent investments.

Enroll in the Snider Investment Method: Fast Track Online Course

Will 2021 be the Year You Become a Resilient Investor?

Let’s talk about how you can avoid making the costly mistake of letting your emotions dictate your investment outcomes. This may seem easy, but quite frankly, the fact that you are human makes it considerably more challenging.

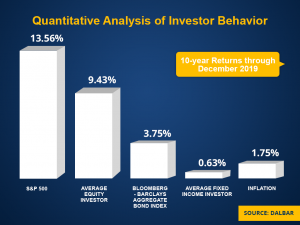

You are hard-wired to flee from things that cause you stress and pain. While this is great for your survival, it is terrible for your investing! Nothing quantifies this better than DALBAR’s study, the Quantitative Analysis of Investor Behavior (QAIB).

The QAIB evaluates actual investor returns, as well as the behaviors that produce those returns. In the chart below, you see how the average investor stacks up against relevant benchmarks.

In the 10-year period ending in December 2019, the S&P 500 had an average return of 13.56 percent. However, the average equity investor only made 9.43 percent. In other words, the person invested in the S&P 500 under-performed it by over 4 percent on an annualized basis.

So, why does a gap exist between what the market gets and what you get?

To be fair, some of it is due to fees, but most of it is caused by you and your behavior. DALBAR calls it, “investor irrationality.” To have long-term success as an investor, you must understand the gap between the returns of the average investor and those of the indices has nothing to do with the market and everything to do with you. To be very clear, the problem isn’t that you choose the wrong investments – it’s that you can’t stick with them.

How many times have you bought an asset thinking that it was a sure thing? But, after you buy it, the price declines? So, what do you do? If you’re like most people, you sell at a loss and move to something else that you feel better about. And when that asset goes down in price? You sell again! Before you know it, you’ve fallen into the costly cycle of buying high and selling low.

How do you change the cycle?

The first step is to choose your investments wisely. You should choose investments based on your time horizon, risk tolerance, and long-term financial objectives.

The second step is to stay the course. Never sell an investment solely because it is down in price. Assuming you chose your investments appropriately in the first place, the only reason to sell is if you can do so at a profit, or your time horizon, risk tolerance, or financial objective has changed. The chance of having a significant shift in any of those is slim and furthermore, should have nothing to do with economic, geopolitical, or market events.

You must learn to control what you can and ignore the rest. If you have a history of allowing your emotions to take over and repeatedly buying and selling at the wrong time – STOP! As an investor, there are a lot of things you can’t control, including the business cycle, stock prices, and inflation, just to name of a few. But at the top of the list of the things that you can and should control is your own behavior.

Discipline is the best strategy for avoiding the high cost of following your emotions. We believe you increase your chance of success when you follow a rule-based system that is designed to address the human condition.

And, in case you’re wondering, the Snider Investment Method never relies on emotions or gut feelings to determine when to buy or sell. It works because it is a set of firm rules and steps, repeated deliberately and systematically month-to-month. A successful investment strategy must never ignore the fact that you are human.

What if you decide 2021 is the year you become a resilient investor, who has enough of an emotional disconnect to stop self-sabotaging your investment results and have true success?

Enroll in the Snider Investment Method: Fast Track Online Course

If You Retire in 2021, How Will Pay Your Bills?

It Starts with a Question

If you retire this year, do you have a plan for how you will pay your bills and maintain your desired lifestyle?

The single biggest issue you will face as you enter retirement is figuring out how you will convert your portfolio into spendable income that you can use to pay your bills, put food on the table, and do the things that bring you joy. Today, I want to help you understand how investing for cash flow (at any stage of life) can get you on track for a more stable and satisfying retirement.

To truly understand why income investing is so powerful, it’s best to start with Capital Appreciation. When you invest for capital appreciation, you buy an asset, such as a stock, with the hope of selling it in the future for a profit. Chances are, that’s how you’re currently invested.

Buy and Hold is Broken

This approach is the old, “Buy and Hold.” But we believe “Buy and Hope,” is a more appropriate name. Buy now and hope like crazy you can sell at a profit when you need the money.

The problem with investing for capital appreciation is that you have no control over what happens in the future. Yes, the stock market increases over the long run. However, the market is also cyclical. We will experience both bull and bear markets.

What happens if you need to sell your assets to live on and we’re in the middle of a devastating recession or bear market? You may be forced to sell your assets at a loss. When you depend on capital appreciation for retirement income, you’re ignoring the reality of the volatility of the stock market and everything that affects it. One event could change your seemingly effective investment plan.

Investing for Cash Flow Is Different

The primary difference between investing for cash flow and investing for capital appreciation is how you make your money. With capital appreciation investing, you make money because you sell an asset. But with cash flow investing, you make money because you own an asset.

In other words, you don’t buy an asset, cross your fingers, and hope that you’ll be able to sell it for a profit in the future. You buy an asset to bring in income.

Think of it as earning a portfolio paycheck. You see, what matters most in retirement is having a sustainable, monthly paycheck that covers your total cost of living for as long as you live. And if you’re not ready to retire, there is no rule saying you have to withdraw the income. But think of the flexibility investing for cash flow gives you; you can use it now or you can reinvest it for compounding growth – and simply ‘turn on the paycheck’ when you need it.

The Snider Investment Method

At Snider Advisors, our strategy for generating cash flow is the Snider Investment Method. The Snider Investment Method is a long-term strategy designed to create income off your portfolio. It uses a combination of stock, options, and cash, along with specific techniques applied in a specific sequence, to maximize your portfolio’s income potential.

The Snider Method has two primary objectives:

-

- Consistent monthly cash flow. Our goal is to generate a monthly cash flow as close to 1% of our total investment as possible.

- No permanent loss of capital. The Snider Method has you buy fundamentally sound companies you would be willing to own for long periods of time, even if the price declines. Stocks are not selected because we think we know the future direction of their price, but rather to use them to generate income.

How does the Snider Method invest for cash flow?

The Snider Method uses options to create a stream of portfolio income and reduce risk. At its core, the Snider Investment Method is built around the popular strategy of selling covered calls. Using covered calls is one of the most widely used options strategies and touted as one of the most conservative. But covered calls work best within the context of a comprehensive plan, like the Snider Investment Method.

There are many ways to trade options. Using them to speculate on future direction price is a risky strategy. In the Snider Method, we never “place bets” with options; we simply use them to generate income from the stocks you own.

The Snider Method requires no previous investment experience. In fact, most of our clients come to us with minimal experience trading stocks and options. We teach you everything you need. We also offer automated trading technology to help you trade without error.

Following a rule-based approach to invest helps you to stay the course and avoid following your emotions. The Snider Investment Method does not rely on your gut feeling to pick which stocks to buy or investment technique to use. It works because it is a set of firm rules and steps, repeated deliberately and systematically month-to-month. Rather than relying on hunches or hypotheses, the Snider Method uses a powerful combination of logic, reason, and probabilities.

Snider Method investors only trade one day each month. There are numerous studies that show the more frequently you trade the more likely you are to lose money. We place trades not to take advantage of small movements in price, but rather to meet our long-term objective of generating cash flow in retirement.

Enroll in the Snider Investment Method: Fast Track Online Course

Will 2021 Be the Year You Take Control Your Investments?

Let’s discuss two things Snider Advisor’s is quite passionate about, financial education and the Snider Investment Method online course.

Perhaps the easiest thing you can do to become a better investor is to get an education. In my opinion, the most beneficial aspect of financial education is that it is the best way to avoid being taken advantage of and it puts you in control.

One of our favorite ways to get a general base of knowledge is to attend webinars. We regularly teach free webinars on a variety of financial and investment topics for Snider Advisors and our recommended brokerage firm, Ally Invest. You can also find useful resources on blogs, and Amazon has approximately a million books on finance and investing at reasonable prices.

However, education has the potential to be a little tricky. There are so many programs available and many of them can be quite expensive. It is important to know exactly what you’re getting. So today, we would like to share with you exactly what you get when you participate in the Snider Investment Method: Fast Track Online Course.

We have two different packages to fit your needs.

For only $499, you will receive:

-

- 20+ on-demand, self-paced lessons designed to help you become a Snider Method expert

- 30-days access to Lattco, our proprietary stock selection and portfolio management and trading software

- Snider Method training manual, checklists, and worksheets

- 1-on-1 Instruction. One of our advisors will assist you in setting up Lattco, opening a brokerage account, and placing your first trades.

For only $799, you will receive:

-

- 20+ on-demand, self-paced lessons designed to help you become a Snider Method expert

- 6-months access to Lattco, our proprietary stock selection and portfolio management and trading software

- Snider Method training manual, checklists, and worksheets

- 1-on-1 Instruction. One of our advisors will assist you in setting up Lattco, opening a brokerage account, and placing your first trades.

The Snider Investment Method: Fast Track Online Course is the most comprehensive package of education and technology we offer. It is designed so that you can begin using the Snider Investment Method as quickly as possible.

Now that you have an idea about what you get when you sign up, let’s answer some of the most common questions we get about the course.

What trading experience do I need?

None! The Snider Investment Method is designed to be used by novice and first-time investors, as well as those with a larger amount of investment experience.

How long is the course?

The course is broken into 4 main sections with over 20 lessons. If you sat down and took all the material at once, it will take approximately 6 hours. All the lessons are on-demand so you can start, stop, and replay any lesson.

How much money does it take to get started?

The minimum investment for an account trading the Snider Investment Method is $25,000. This is the lowest amount that we have determined is appropriate for a client to be able to make repeated purchases of a stock position, as may be necessary when trading the Snider Method.

Can I hire you to manage my money?

Our fee-based, asset management services can be a perfect solution for those who want to use the Snider Method, but don’t want to place the trades themselves. When Snider Advisors manages your account, you can enjoy the ease and assurance of professional asset management with fiduciary responsibility and complete transparency.

I’ve heard options are risky. Is that true?

There is always a certain level of risk that comes with any stock market investment. The Snider Investment Method utilizes covered call options and cash secured put options, which are used to reduce the risk of stock market investments. Using options to speculate or for leverage can be risky. The Method does not use options for these purposes.

Can my spouse take the course? If so, how much?

Your spouse can view the course alongside of you at no additional cost. Attending a live event or separate login information may incur additional charges.

What is your refund policy?

We offer a 30-day money back guarantee for the full cost of the course. If at any point in the 30 days after you purchase the course you decide that it is not right for you, simply contact us, and we will refund you the payment for the course in full.

What happens if the market goes down?

Guess what? It will! It’s not a matter of “if” the market will decline, it’s a matter of “when.” The snider Method does not focus on the fluctuations of the stock market on a day to day basis. In the event of a market downturn, we will continue to trade the Method as usual. The Method utilizes dollar cost averaging when purchasing shares for a position, allowing us the opportunity to continue to sell options against our shares and generate income, even in times of a declining stock market.

There really is nothing comparable to what is offered in our online course. We have yet to find another package of investment education as comprehensive as ours. You could spend much, much more for an ambiguous education based on speculative strategies and big promises. But the single best thing about what we offer is that you get to learn a strategy that has a proven, 17-year track record of generating income.