Imagine that you’re a 75-year-old homeowner with medical bills eating into your disposable income. You see an advertisement for a reverse mortgage that promises to not only eliminate your existing mortgage payment, but provides you with an extra $700 per month to help cover your living expenses. Better yet, you’ll never owe more than the home is worth!

Critics of reverse mortgages tell you a different story: What the advertisement fails to tell you is that you’ll pay upwards of $14,000 in upfront costs and tens of thousands of dollars in interest costs over time — essentially making it a high-cost home equity loan in disguise. However, it can be very helpful to seniors meeting certain criteria.

Many retirees find their biggest asset to be their home. Unfortunately, even a house that is fully paid for can still be a drain on the pocketbook with taxes and maintenance. Reverse mortgages give the homeowner the opportunity to turn their largest asset into a cash flow investment rather than a large expense. We believe cash flow is the one thing that should be most important to a retiree.

So, are reverse mortgages ever a good idea or should they be avoided at all costs? Let’s start from the beginning and take a look at how reverse mortgages work before moving on to the pros and cons and expert opinions on the matter.

What Are Reverse Mortgages?

Reverse mortgages are home equity loans designed for homeowners aged 62 or older that either own their own home or significant equity in it. Rather than making a monthly mortgage payment, the borrower receives regular payments and the loan is repaid when the borrower passes away or sells the house. These attributes make it an appealing option for elderly individuals needing additional income and want to remain in their home.

The loan amount depends on the age of the homeowner, value of the home, interest rate, principal limit factor (set by the HUD), and maxes out at the Federal Housing Administration’s HECM mortgage limit of $636,150. This amount can be distributed as a lump sum, or in monthly term or tenure payments. Term payments occur over a set period of time while tenure payments last as long as the borrower remains eligible for the loan.

There are several costs associated with a reverse mortgage, including:

- Interest Rates – The interest rate that you pay on the home equity loan is generally higher than that of a traditional mortgage — consisting of the LIBOR and lender’s margin. However, it might be lower than the interest rate on a personal loan or credit card.

- Loss of Equity – The home equity loan reduces the amount of equity left in the home, which translates to fewer assets to pass along to heirs down the road. Heirs may also be required to pay off the loan in order to keep the house when the original borrower passes away.

- Existing Costs – Reverse mortgages still require that you pay property taxes, insurance, and maintenance costs. If you fall behind on these payments, then you may be required to repay the loan or forfeit the home. This means that you can lose your home as a result of a reverse mortgage.

When the homeowner dies or moves (e.g. to assisted living), the house is usually sold and the proceeds go to covering the loan along with the fees and interest accrued. If there’s any money left over, it goes to the homeowner or their heirs. If the house sells for less than is owed, the lender’s insurer (the federal government) covers the costs.

Example of a Reverse Mortgage

Let’s take a look at an example of a reverse mortgage to better understand how they work and the costs involved.

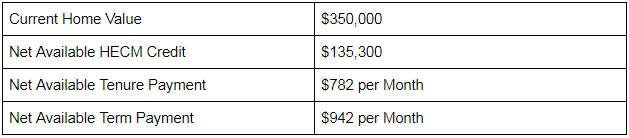

Suppose that John, aged 70, is a homeowner that’s looking to boost his monthly income to cover living expenses. The first step is having his house appraised by an FHA appraiser, who determines that the home value is $350,000. John has $25,000 remaining on his existing mortgage loan.

* Assumes loan origination fee of $5,000, initial mortgage insurance of $7,000, and other closing costs of $2,500 (appraisal, title, etc.) for total upfront costs of $14,500, as well as a 2.96% LIBOR Swap rate and 2.25% lender’s margin. Payout rate is 6.94% for tenure payments. Time horizon is 20 years for term payment. Estimates from RetirementResearcher.

The home equity loan eliminates John’s monthly mortgage payment and either provides $782.00 per month in perpetuity or $942.00 per month over the next 20 years. But, if John can no longer afford HOA payments or property taxes, he may be forced to repay the loan immediately or sell the house to cover the costs.

Let’s assume that John took the term loan option and passes away at age 90. The HUD’s rules state that John’s heirs can buy back the house for the lesser of the total loan amount or 95 percent of the home’s current market value. Or, the house will be sold and the heirs will receive anything left over.

Weighing the Pros & Cons

Reverse mortgages receive a lot of criticism because they tend to have high costs and target a vulnerable population. In fact, there is such a high potential for abuse that homeowners interested in taking out a reverse mortgage are required to receive mandatory (free) counseling by an independent third party, such as the AARP.

That said, there are some cases where it might make sense to consider a reverse mortgage. A couple may want to remain in their home and decide to take out a reverse mortgage to pay off high-interest debt and delay Social Security to obtain a higher payout from the government program in the future. The cost of the high-interest debt and income from delayed Social Security could more than offset the high cost of a reverse mortgage.

When to Consider a Reverse Mortgage

Reverse mortgages may be worth considering for homeowners that can afford the cost of home ownership and don’t plan on moving, as a way to supplement their retirement income or eliminate high-interest debts. For example, a homeowner that has substantial credit card debt can pay off that debt and increase their monthly cash flow using a reverse mortgage. Of course, this should be balanced with other alternatives.

The pros of a reverse mortgage include:

- You can turn your home into an income generating investment.

- You can use the money to pay off high-interest debt.

- You can pay off your mortgage to eliminate a monthly payment.

When to Avoid a Reverse Mortgage

Reverse mortgages are a not a good option for homeowners with little equity in their home or if it could be a struggle now or in the future to keep up with homeowner expenses. In these cases, it may be a better financial decision to sell the home, invest the proceeds in a different investment vehicle designed to generate a monthly income at a much lower cost, and downgrade their home size or rent until they can afford another home. Finally, I don’t recommend a reverse mortgage to homeowners that want their home to be part of their legacy or have heirs interested in owning the home after their death.

The cons of a reverse mortgage include:

- You pay a lot more interest and fees than a typical mortgage loan or other types of loans.

- You must still pay property taxes and homeowners insurance, as well as keep the house in good condition.

- Reverse mortgages can make it harder for heirs to hold on to the house if you pass away.

What Do the Experts Say?

Historically, reverse mortgages have received very bad publicity because of unreputable sales tactics used to advantage of seniors. Many financial advisors argue against reverse mortgages given their high costs, since there are often better solutions out there. For example, homeowners can use a traditional home equity loan or take out a second mortgage on the house to raise money to cover expenses or pay off high-interest debts.

Alternatives to a Reverse Mortgage

What alternatives should cash-strapped homeowners consider?

There are two popular options:

- Most financial advisors recommend that homeowners sell their house and consider downsizing rather than obtaining a reverse mortgage. That way, you can receive a lump sum of cash that can help you pay off debts while still owning a home or condo with no mortgage.

- If that’s not a possibility, many advisors recommend taking out a new mortgage or home equity line of credit. The proceeds from the mortgage or HELOC can be put into an investment fund that generates monthly payments. When that money is gone, it’s time to sell the house.

These options may be less appealing to some people because they involve either selling the home or taking on additional debt. But, the total cost of these decisions can be lower than a reverse mortgage.

The Bottom Line

Reverse mortgages enable homeowners to eliminate their monthly payments and receive a monthly income. For the homeowner focused on staying in their existing home, they can be a good solution. While that sounds good on the surface, these are home equity loans in disguise tend to have high costs and consumers have other alternatives that they could explore before going down this irreversible path.

If you want to generate a monthly income, you may want to consider the Snider Investment Method as an alternative to more drastic measures, like reverse mortgages. Our stock and option strategy enables you to generate a higher monthly income in retirement.

For more information, take our free course or get in touch to learn more.