Do you pay any fees for your 401(k) plan? What are the expense ratios of the mutual funds in your portfolio? Are these funds charging you other fees? Is your financial advisor fee-based or commission-based?

Don’t worry, you’re not alone if you can’t answer those questions.

The AARP recently surveyed over 800 401(k) plan participants and found that the vast majority have no idea if they’re paying any fees and could be in for a nasty surprise if they didn’t account for fees when calculating how much they needed to save for retirement.

In this post, we will take a closer look at investment fees, how they can impact returns, and how to avoid some of these fees to maximize your returns.

What Are Investment Fees?

There are many different fees associated with saving for retirement, including administrative fees, transactional fees, financial advisor fees, expense ratios, sales commissions, and numerous others. While many fees appear on account statements, they may be expressed as small percentages that have little meaning without running the numbers. There are also indirect fees that don’t appear on any account statements and can be difficult to track down.

Let’s break down the fees based on the financial product or service:

- Broker & Account Fees – Most brokerage accounts charge fees of $5.00 to $30.00 per trade and may charge annual account fees, trading platform fees, and certain fees if you do not meet minimum account balances or trading activity. You may minimize fees by choosing a low-cost discount broker and avoid paying for unnecessary services, such as advanced platforms or premium research. Our recommended broker for individual investors is Ally Invest. With special discounted commissions for our clients and excellent customer service, they are a great choice for implementing the Snider Investment Method.

- Mutual Funds & ETFs – Mutual funds and ETFs both charge an annual fee that’s expressed as a percentage of your investment in the fund. Mutual funds may also charge various other fees, including sales loads, redemption fees, or purchase fees. You may minimize these fees by selecting funds with low expense ratios – typically index funds – and being cognizant of extraneous mutual fund fees.

- Retirement Plans – Administrative fees apply to 401(k)s and other retirement plans provided by employers. Often times, these fees are passed on to the plan participants and can be found in annual account statements. You may carefully consider whether employer matching offsets the higher cost of 401(k) plans and consider opening other retirement accounts to supplement your 401(k).

- Advisory Fees – Financial advisors, including robo-advisors, charge an advisory fee that’s typically expressed as a percentage of assets under management. However, some advisors charge a flat fee for advice, similar to a lawyer or tax professional. You may minimize fees by working with fee-only financial advisors and comparing costs to ensure that you’re getting the service that’s right for you.

Most of these fees can be found on brokerage websites, fund prospectuses, and account statements, but it takes time to aggregate these documents and calculate true costs.

How Fees Can Add Up

One way to think about fees is using the Rule of 72: You can quickly determine how many years it will take to double your savings by dividing 72 by your expected rate of return. If you’re expecting a six percent rate of return, it will take roughly 12 years to double your retirement savings. A one percent fee taken out of that six percent expected rate of return means that it will take more than two additional years to double your retirement savings.

The U.S. Department of Labor put it another way in its A Look at 401(k) Plan Fees report published in August of 2013:

Assume that you are an employee with 35 years until retirement and a current 401(k) account balance of $25,000. If returns on investments in your account over the next 35 years average 7 percent and fees and expenses reduce your average returns by 0.5 percent, your account balance will grow to $227,000 at retirement, even if there are no further contributions to your account. If fees and expenses are 1.5 percent, however, your account balance will grow to only $163,000. The 1 percent difference in fees and expenses would reduce your account balance at retirement by 28 percent.

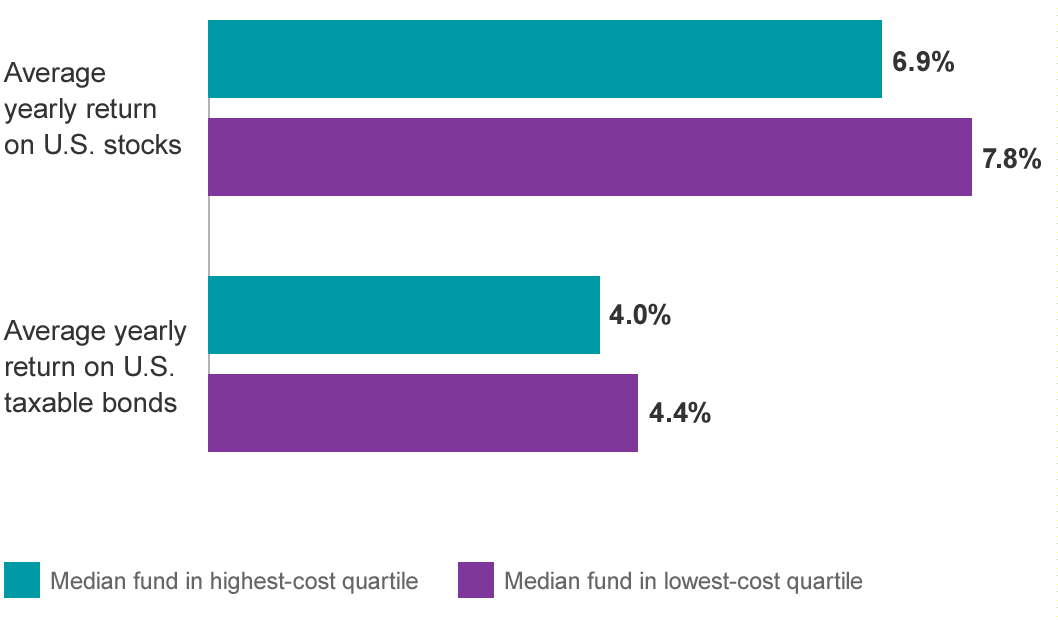

Funds with lower costs also tend to outperform more expensive funds, according to a Vanguard study that looked at annualized returns for the ten years ending December 31, 2014:

When considering these fees, it’s important to remember that you’re paying for a service. The 0.15 percent that you pay for an expense ratio covers the cost of keeping an entire portfolio of stocks rebalanced and optimized over time. At the same time, the one percent that you might pay for a financial advisor includes the cost of managing portfolios, tax planning, estate planning, and various other services that you may need over time.

That said, the outsized impact of small fees is extremely important to consider when planning for retirement and deciding how to manage your retirement savings.

DIY vs. Using Funds

Most investors choose to manage their own portfolio of individual equities, bonds, and options, invest in a mutual fund or ETF (e.g. target date retirement funds), or work with a financial advisor that can handle everything for them. They may also choose a combination of these strategies when managing their retirement savings. For example, you may invest a 401(k) in mutual funds and manage your own Roth IRA portfolio of stocks, bonds, and options.

There’s no doubt that the most cost-effective way to build a portfolio is taking a do-it-yourself approach. That way, you avoid paying a financial advisor, and potentially, the expense ratios associated with various funds. The drawback is that managing your own portfolio takes a combination of knowledge, time, and effort and there’s a potentially high cost if you make a mistake. You must carefully balance these benefits and drawbacks when making a decision.

To see these fee differences, let’s assume that you’re investing $35,000 in one of three ways:

| Traditional Advisor | Mutual Funds | DIY | |

| Advisory Fee | 1% | 0% | 0% |

| Fund Expense Ratio | 0.75% | 0.75% | 0% |

| Annual Fee | $0.00 | $0.00 | $0.00 |

| Commissions | $0.00 | $45.00* | $100.00** |

| Total Cost | $612.50 | $307.50 | $100.00 |

*Assumes three mutual fund trades at $15.00 each.

** Assumes 10 stock trades at $10.00 each.

These costs become even more significant as a portfolio grows larger since the financial advisor and mutual fund fees are expressed as percentages. Worse, the amount paid in fees during a given year does not compound over the remaining time until retirement, resulting in an opportunity cost. For example, the $612.50 spent on financial advisor fees would be worth $4,662 in 30 years assuming a seven percent annual return!

To see these changes, let’s look at the same table for a $100,000 portfolio:

| Traditional Advisor | Mutual Funds | DIY | |

| Advisory Fee | 1% | 0% | 0% |

| Fund Expense Ratio | 0.75% | 0.75% | 0% |

| Annual Fee | $0.00 | $0.00 | $0.00 |

| Commissions | $0.00 | $90.00* | $250.00** |

| Total Cost | $1,750.00 | $840.00 | $250.00 |

* Assumes six mutual fund trades at $15.00 each.

* Assumes 25 stock trades at $10.00 each.

The Bottom Line

Most people aren’t aware of the fees that they’re paying when it comes to retirement savings, but these fees can have a tremendous impact on long-term returns. One way to reduce fees is to manage your own portfolio, which eliminates advisor fees and some expense ratios. You should carefully weigh the benefits and costs of managing your own portfolio.

Snider Advisors provides a simple and easy retirement education that enables you to earn a portfolio paycheck after you retire if you self-manage a portfolio of stocks, bonds, and options. Using covered call options, the Snider Advisors Method enables you to generate an income from a portfolio of stocks above and beyond dividends.

For more information, try our free investment courses as an introduction.

Full Disclosure: Snider Advisors has an economic incentive for recommending that clients open an account with Ally. Specifically, Snider Advisors receives a flat referral payment for each new account it refers to Ally. More detailed information about the relationship and our fiduciary responsibility can be found in our ADV Part 2A. Clients may contact Snider Advisors with any questions about the terms of the agreement with Ally.