President Trump signed the biggest tax reform in years at the end of 2017 and it’s sure to have an impact on millions of Americans. While the 2018 tax season is a little less than a year away, many businesses have already started making quarterly tax payments and it’s never too early for individuals to start planning ahead. These tax cuts have also already had a significant impact on publicly-traded companies in terms of their future earnings projections.

In this article, we will look at the new tax law, how it impacts you, and the potential impact on your investment portfolio.

What Is the Tax Cuts and Jobs Act?

The Tax Cuts and Jobs Act reforms both individual and corporate income taxes. According to the Congressional Budget Office (CBO), individuals and pass-through entities will receive about $1.125 trillion in net benefits and corporations will realize about $320 billion in benefits over the next ten years. The individual and pass-through tax cuts will fade over time and become net tax increases starting in 2027 while corporate tax cuts will be permanent.

The CBO estimates that the tax bill will add about $1.456 trillion to the national debt over the next ten years and about $1 trillion after accounting for macroeconomic feedback effects. These costs are in addition to the $10 trillion increase that’s already forecast under the current baseline policy and the existing $20 trillion in national debt. Partisan think tanks dispute these numbers, saying that economic growth will compensate for the decline in tax revenue.

The new law will also impact the healthcare market via the repeal of the Affordable Care Act’s (ACA) individual mandate. According to the CBO, repealing the mandate will reduce federal deficits by about $338 billion between 2018 and 2027, but increase the number of uninsured individuals by four million in 2019 to 13 million in 2027. Those remaining on the ACA exchanges could also see higher healthcare costs as a result of healthier individuals opting out.

How the Tax Law Will Impact You

The Tax Cuts and Jobs Act introduces several important changes to the tax code for individuals, married couples, and families, while leaving several other benefits in place. The biggest beneficiaries of the new tax law are individuals with pass-through entities, while those that had itemized their deductions in the past but don’t meet the new standard deduction threshold could see a higher bill. That said, almost everyone will see some changes come next tax season.

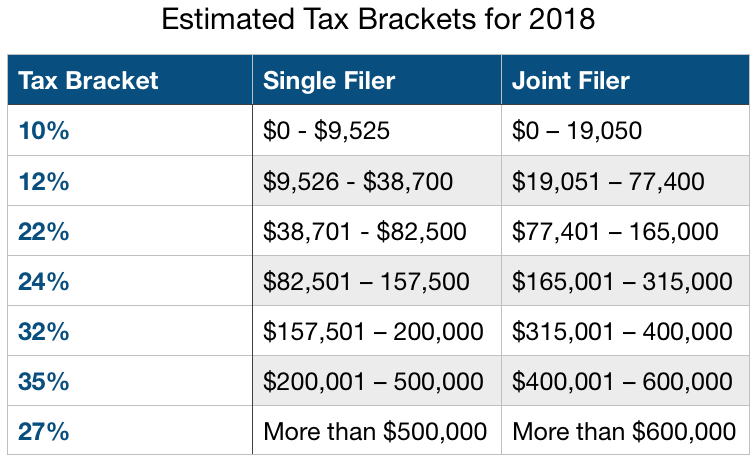

The most visible changes are the new tax brackets:

It’s important to note that these tax brackets are simply estimates based on the new tax law; the final tax brackets will be announced by the IRS in or around October.

Other big changes, aside from the tax brackets, include:

- Alternative Minimum Tax – The AMT threshold has been increased from $54,300 to $70,300 for single filers and from $84,500 to $109,400 for joint filers.

- Standard Deduction – The standard deduction has nearly doubled from $6,350 to $12,000 for single filers and from $12,700 to $24,000 for joint filers.

- Child Tax Credit – The child tax credit has doubled from $1,000 to $2,000 per child. For those that can’t take advantage of the entire credit, the refundable amount increased from $1,100 to $1,400. The income threshold for these benefits also increased from $110,000 to $400,000 for married couples.

- Personal Exemptions – Personal and dependent exemptions have been eliminated through 2025.

- State Tax Deductions – The amount of state and local property, income, and sales tax that can be deducted has been limited to $10,000.

- Individual Mandate – The tax penalty for not having health insurance has been eliminated after December 31, 2018, but the floor for out-of-pocket medical expenses was lowered from 10 percent to 7.5 percent of income in 2017 and 2018.

Finally, there were a few important changes for investors:

- Deductibility of Investment Expenses – In the past, investment expenses like trading commissions and investment management fees were deductible as a “miscellaneous itemized deduction” if they exceed two percent of your adjusted gross income (AGI). This deduction was eliminated in the law. Now might be a good time to consider a Do-It-Yourself approach.

- 529 Plans – 529 plans have been expanded from covering college expenses to covering primary and secondary education up to $10,000 per year per student. These changes make 529 plans a better alternative to other account types, such as Coverdell Education Accounts that were used for these purposes.

- IRA Recharacterizations – IRA recharacterizations of conversions are being eliminated, which means that investors can no longer reverse their decision to convert a traditional to a Roth IRA.

- Estate Taxes – Estate and gift tax exemptions have been doubled to $11.2 million for 2018, which will benefit wealthier investors passing on capital to future generations.

Importantly, many savings and investment incentives have been preserved in the new tax law. For example, contribution limits on 401(k) and Roth IRAs have been preserved and private activity bonds have retained their exemptions for interest paid. The tax cost of securities was also left in place, despite efforts to change it in the Senate, which means that fund investors can specifically identify fund shares to be sold based on their price.

How Will It Impact Your Portfolio?

The new tax law has benefited many corporations with high effective tax rates, which has translated to higher earnings power for public companies. According to many strategists, the corporate tax cuts could provide an extra earnings boost of between 7 percent to more than ten percent in 2018, while the recurring benefit could be closer to eight percent. Paybacks from repatriations account for much of the difference between the initial and ongoing effects.

The banking industry experienced some of the largest benefits. In addition to the lower corporate tax rate, many smaller banks benefited from the more preferable tax treatment for pass-through entities. Larger banks were forced to write-down tax-deferred assets that had to be revalued based on the lower corporate tax rate, but these banks are poised to benefit down the road given an effective tax rate of less than 21 percent.

What does that mean for investors?

Improved earnings growth factors into price-earnings ratios, discounted cash flow projections, and other valuation metrics used by investors to set share prices. That said, there are many other factors that are coming into play at the same time, including higher interest rates and the potential dissolution of various trade agreements. This convolution of factors has led to higher volatility for the stock market over the first quarter of the year.

The Bottom Line

The Tax Cuts and Jobs Act will have a significant impact on both individuals and businesses moving into next year. Individuals will generally see lower tax rates, but the benefits vary based on itemized deductions and other factors. Corporations will see a much more certain reduction in taxes, which could help improve earnings on an ongoing basis. These trends are good for investors but these gains could come at a cost in terms of the national debt.

If you’re looking for ways to capitalize on equity upside, but hedge against some of these risks, you may want to consider covered call option strategies. The Snider Investment Method provides a simple and easy retirement education so you can earn a portfolio paycheck after you retire without worrying as much about market volatility.

Finally, it is important to note that we are not tax professionals. Always consult your CPA for specific tax advice before you decide whether it is appropriate for your specific situation.