Most marriages involve splitting household responsibilities. For example, one spouse may handle doing the laundry every week and the other may handle household finances. But just because household responsibilities are divided doesn’t mean both parties shouldn’t be aware of the other’s job. This is especially true for finances since they affect many other parts of life, from purchasing groceries each week to being able to retire comfortably.

In this article, we will look at why it’s important to keep your spouse up to date about finances and some strategies for ensuring everyone is on the same page.

Why It’s So Important

It’s no surprise that money problems are one of the most significant factors that can lead to arguments and even divorce.

According to SunTrust Bank, more than one-third (35%) of people experiencing relationship stress indicated money was the primary cause, and those figures rose to nearly half (44%) when asking those aged 44 to 54.

A lack of budgeting skills is forgivable, but some couples lack communication when it comes to making big purchases or even opening new credit accounts.

CreditCards.com found that one-fifth of Americans have spent $500 or more and didn’t tell their spouse, while six percent maintained secret accounts or credit cards. SunTrust’s study (mentioned above) similarly found that more than one-third of couples didn’t consult their significant other before making large purchases.

These kinds of conflicts can be avoided with two basic rules:

- Financial Transparency – Both spouses should have access to at least see all of their financial accounts in a single location to make sure there are no surprises.

- Consistent Budgeting and Planning – Both spouses should agree to a household budget each month that provides for day-to-day spending and plans ahead for larger purchases.

The good news is that there are many different strategies and technologies that make it easy to remain transparent and stick to a monthly budget.

Share Data with Apps

More than three-quarters of couples share a bank account, according to TD Bank, but that leaves a full quarter of couples that don’t combine their finances. While there are many good reasons to not combine bank accounts, it’s still important for both spouses to have a clear picture of their combined finances to prepare a budget and plan for the future.

Fortunately, many personal finance and budgeting apps make it easy for couples to share financial information without sharing a login, as well as simplify the process of creating a monthly household budget and plan for retirement.

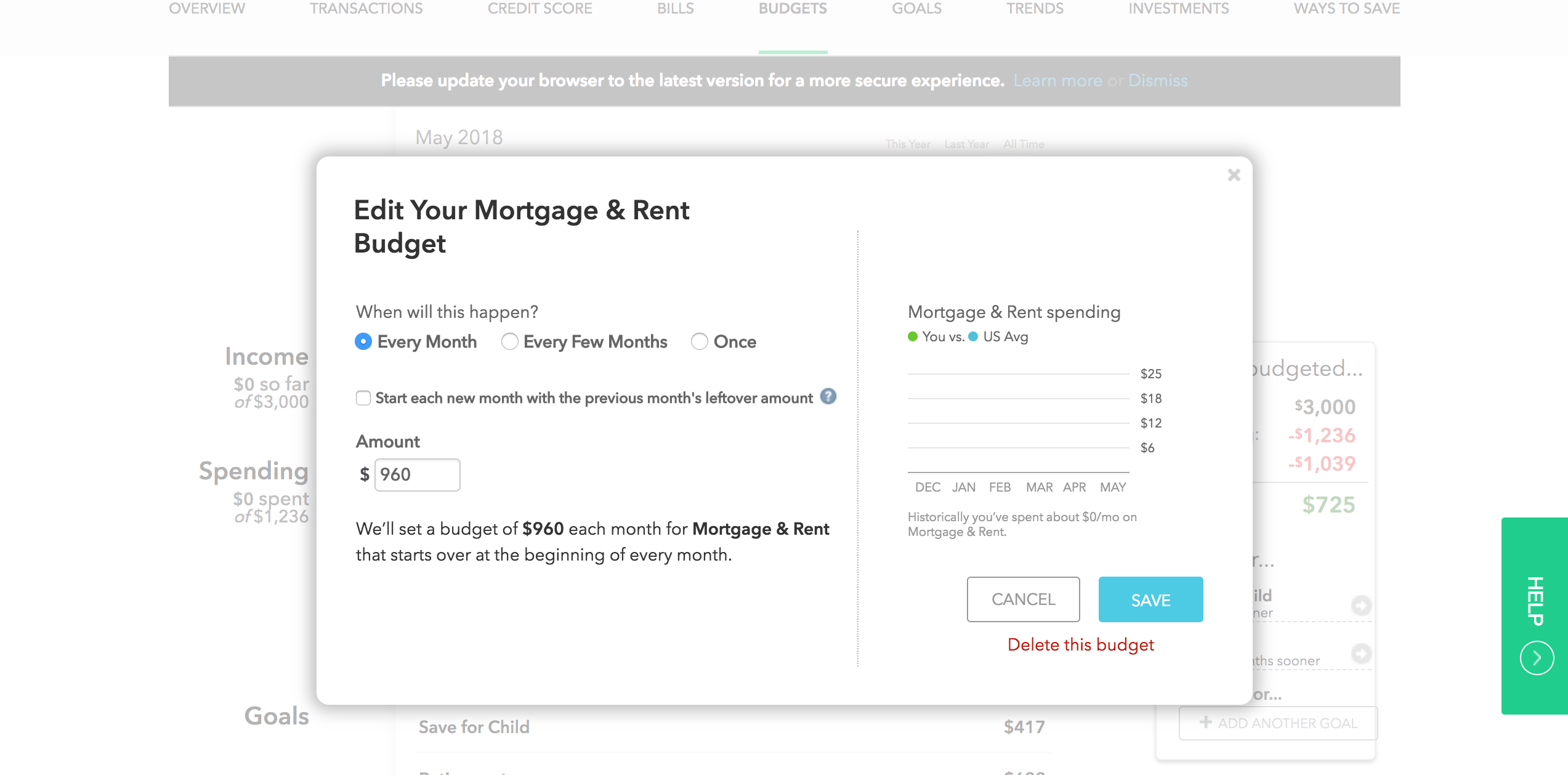

For example, Mint is a free app that lets you set up a budget based on your past spending behavior and see how your actual spending compares to your targets. You can also see the balances in all of your financial accounts – including banks and brokerages – at a glance.

There are also premium budgeting applications, such as You Need a Budget and Every Dollar that help you create a monthly budget, pay off debts, and save for the future. These apps take a different approach than Mint to budgeting by allocating income rather than planning expenses.

Use a Financial Advisor

Many couples have different ideas about how much to spend, how much to save, and what financial goals are important for the future.

Financial advisors are great intermediaries that can help reconcile these differences. In addition to creating a long-term investment plan, advisors can help you develop a budgeting strategy and send monthly statements to keep both spouses informed.

There are two types of financial advisors:

- Commission-based Advisors – These advisors often work for brokerage firms and earn a commission on investments that they recommend. Oftentimes, funds with higher fees pay greater commissions, so there’s a potential conflict of interest.

- Fee-only Advisors – These advisors charge a fee, which can be either a set fee or a percentage of assets, rather than earning a commission on investments. As a result, their interests tend to be more aligned with your financial goals.

The best way to find a financial advisor is through a referral from a trusted professional, such as an accountant, or a friend. It’s a good idea to ensure that the advisor has reputable credentials, such as a CFP® or CFA® designation, and use BrokerCheck to see if they’ve had any complaints or other troubles in the past. Check out our team.

After selecting an advisor, both spouses should try to attend the meetings – or at least the initial meetings – to make sure they’re both comfortable working with them and make their voices heard when it comes to developing long-term plans.

The Bottom Line

Money can be a contentious issue for married couples, but most problems can be avoided through transparency and planning ahead. Many personal finance apps have simplified this process by aggregating financial accounts and providing easy-to-use tools, but in some cases, a financial advisor can be a helpful intermediary to get everyone on the same page.

If you’re budgeting for retirement, Snider Advisors’ simple and easy retirement education makes it easy to earn a portfolio paycheck without using up your retirement funds. The Snider Method uses proprietary algorithms to identify covered call option strategies and guides you through the trading process each month. That way, you can avoid the emotions and common mistakes that average investors make when taking over their portfolios.

For more information, take a free three-part online investment course that will show you the basics of the strategy before delving in deeper.