Investing can be intimidating, but throw in taxes and it can be an even more overwhelming if you don’t know what you’re doing.

You not only have to pay taxes on investment income like dividends, interest, or real estate rent, but also on your capital gains, should you sell any assets during the year.

That’s why the best thing you can do is to start planning for taxes before you even have to pay them. Tax-efficient investing is the key to maximizing your returns and getting the most for your money.

Here’s what you need to know…

Paying Taxes on Income and Capital Gains

Anytime you sell an investment at a profit, you will most likely be taxed. This is true of capital gains in addition to any other income from your portfolio.

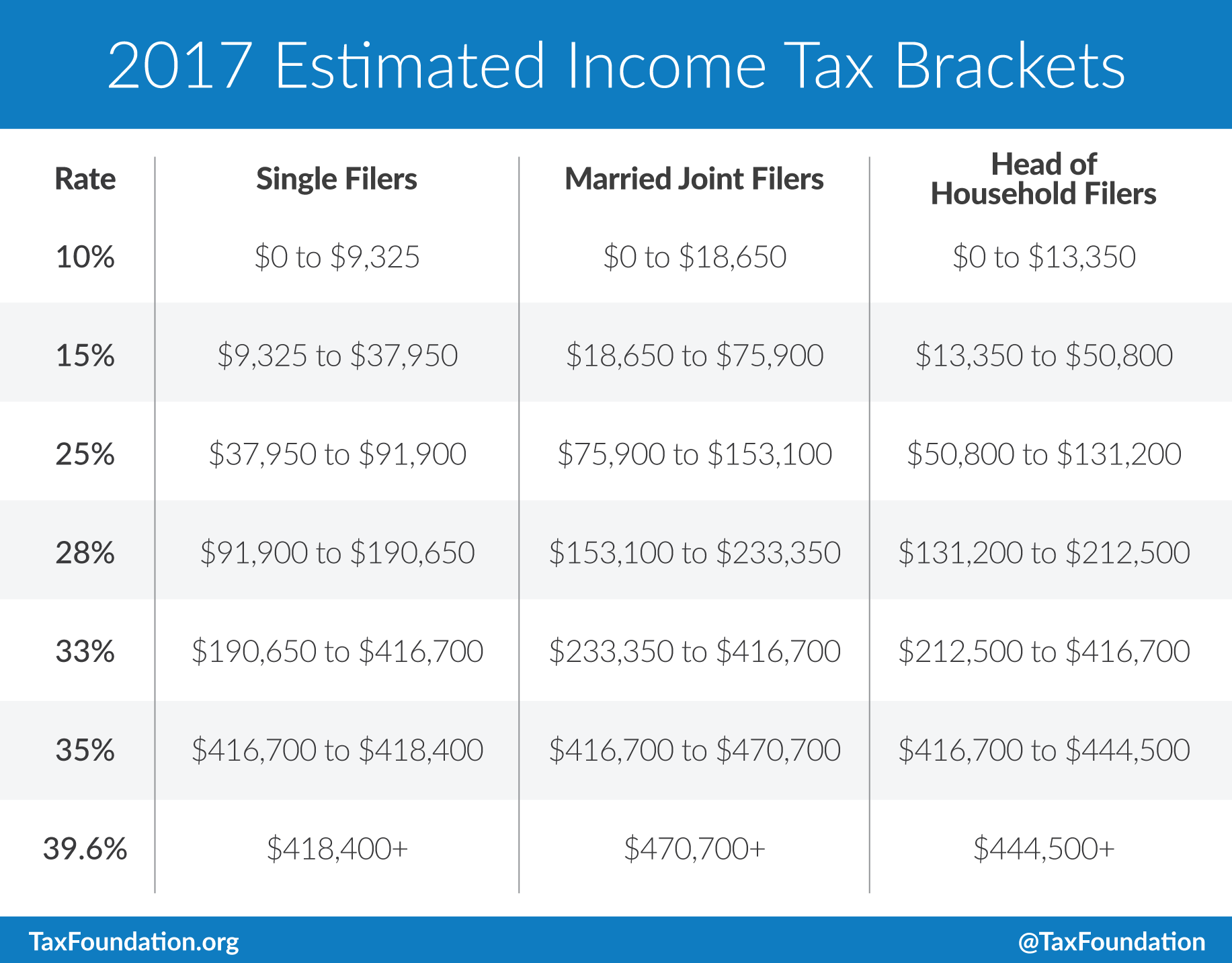

If you sell within the first year you own the investment, you could pay tax rates as high as 35%, but the longer you wait to sell, the more tax breaks you will receive. Capital gains sold after a year or more are usually taxed around 15%.

This tax encourages investors to take a long-term approach to investing, so consider timing when it comes to selling your assets, especially if you’re near retirement.

You will also pay taxes on any interest, dividends, and rental or other income you receive from your investments. Some investments will receive a bigger tax break than others.

Qualified dividends on stocks, for example, will qualify for a lower rate of 15%, while interest on stocks and income from rental property will be taxed at higher rates closer to 35%.

Make sure that you report your dividends correctly, however. Only qualified dividends are eligible for the favorable 15% tax rate. Be sure to review your 1099s to see how they break down taxable distributions as long-term capital gains, short-term capital gains, or interest.

You should also determine your marginal income tax bracket to see if it’s subject to the alternative minimum tax.

Leveraging Capital Losses

Even though the IRS taxes capital gains, you can reduce this by selling non-performing stocks in the same tax year and using the loss to offset the capital gains tax.

If you have more losses than gains, you can usually take $3,000 in losses against ordinary income in the future. This can come in handy for investors later on in the year as final gains and losses are tallied, but remember that if you’re still holding the losing stock into the new tax year (after Dec. 31) then you won’t receive a tax deduction.

To deduct your stock market losses, you have to fill out Form 8949 and Schedule D. Just be careful of the wash sale rules, however, which can take away your deduction if you try to buy back what you’ve sold within 30 days.

Using Your Retirement Account for Tax Breaks

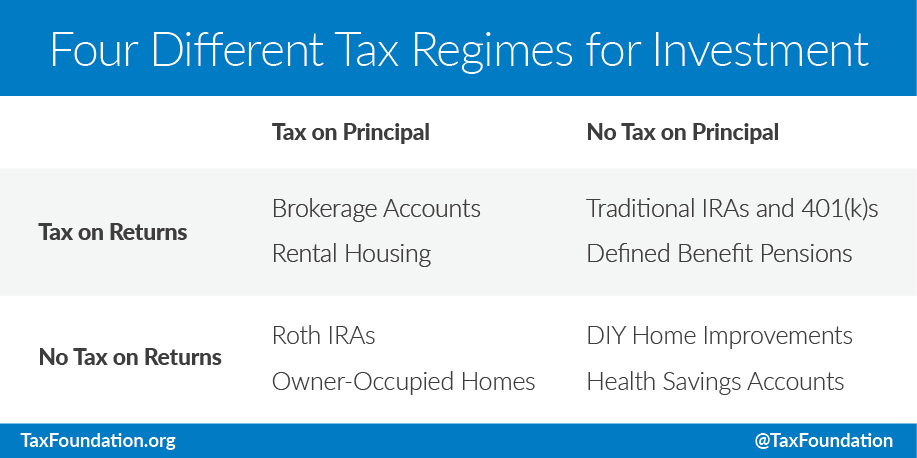

There are four investment accounts that are considered “tax-favored”:

- Company-Sponsored Retirement Plans – Ex. 401(k), 403(b), 457 plans

- IRA

- Health Savings

- 529 Saving Plans

You can take advantage of these special accounts to get additional tax breaks. If you’re saving for retirement, you may want to consider taking full advantage of your IRA in the coming year as well.

In addition to saving in your 401(k), you can also defer income tax on IRA contributions up to $5,500. Those age 50 or older can also defer an additional $1,000. Keep in mind that the investment earnings in your IRA account aren’t taxed, and withdrawals after age 59.5 are tax-free.

If your adjusted gross income is less than $30,750 for individuals, $46,125 for heads of household and $61,500 for married couples, you might be eligible to claim the saver’s credit. Contributions of up to $2,000 ($4,000 for couples) could earn you a tax credit worth between 10 and 50 percent of your retirement account deposit.

Maximizing contributions to a retirement savings plan makes tax-reducing and wealth-accumulating easier after retirement as well, so it’s best to max out your 401(k) too.

Focusing on Income

You should also continue to focus on a distribution strategy that allows you to withdraw money from your tax-deferred accounts after retirement to help cover your known expenses.

If you worked for someone else or had net profits from self-employment before retirement, you are most likely eligible to receive Social Security benefits during retirement. These benefits may be taxable depending on how much income you have from other sources, however.

Between 50-80% of your annual benefit is taxable if the sum total of your retirement income (half of your Social Security income plus income from your investment portfolio or other sources) is more than $25,000 ($32,000 for married or joint filers).

To reduce the risk of paying tax on your Social Security, you would need to limit your income from other retirement plans to ensure you stay within that income limit. If that’s not a desirable option, you will need to compensate for tax fees with additional income.

To maximize your income, pull from both taxable and non-taxable sources. Keep in mind that by April of the year you turn 70 ½, you will need to take an annual Required Minimum Distribution. If you don’t, the IRS will place a 50% excise tax on the amount you should have withdrawn. (If you have questions about RMD, check out our post about it here).

You should also cash your taxable investments first (you will only owe annual taxes on the earnings), and reserve your tax-deferred investments (capital gains) for as long as possible so they can accrue value.

Cash flow investment strategies like the Snider Investment Method can also help you create sustainable income during retirement.

Final Thoughts

Pay attention to any assets sold close to or during retirement, as they may have some serious tax implications, and take advantage of any tax-deferred accounts you already are using.

Remember that you may be taxed on Social Security income above a certain level, so you may need alternative solutions to create additional income to cover these, like cash flow investing.

It’s important to remember that tax laws can and do change on a regular basis. It’s always wise to consult a tax advisor who can evaluate your taxes in association with your retirement assets. They will have the most accurate and up-to-date information related to tax law for investors.

If you have questions about your portfolio and related taxes, get in touch with a Snider Advisor’s expert today.