by Anthony Obey

Learn How to Generate a Bigger Monthly Paycheck From Your Investments for Retirement!

If you’re nearing, or in, retirement (55 – 65+), then you’re starting to really think about how you’re going to generate a full-time, dependable monthly income from your investment portfolio in light of the market’s constant volatility and low-paying, fixed-income options.

You’ll learn a simple yet proven game-plan for a more financially secure retirement, with a paycheck coming from your portfolio, month after month, from your investments so you can fully retire and enjoy your golden years.

What’s YOUR Definition of ‘WEALTH’?

The goal for many investors is to build and maintain wealth. But what exactly is ‘wealth’?

Most people define wealth by the market value of their portfolio at any given point in time. In other words, the single number at the top of their account.

It may shock you to know that this definition of wealth, though widely held, is far less beneficial to you as you near retirement!

Thousands of people nearing retirement have come to realize that it’s less important to have X amount of money invested to achieve a secure retirement and it’s more important to have a monthly paycheck that covers all your living needs so you can fully retire and live indefinitely into the future.

You can live indefinitely into the future if you have a monthly paycheck that covers all your monthly living needs, right? Of course you can, which is why you must kiss the old way of defining wealth goodbye, and choose to define wealth in terms of your ability to generate a full-time monthly paycheck that lasts throughout your lifetime.

The SECRET is to adopt a winning Method that is simple and proven to helping you reach your financial goals for retirement through various market conditions.

Most Don’t Have Enough For Retirement

The single biggest need every retiree has is maximum monthly, inflation-indexed (cash value after factoring in inflation) income to pay your bills.

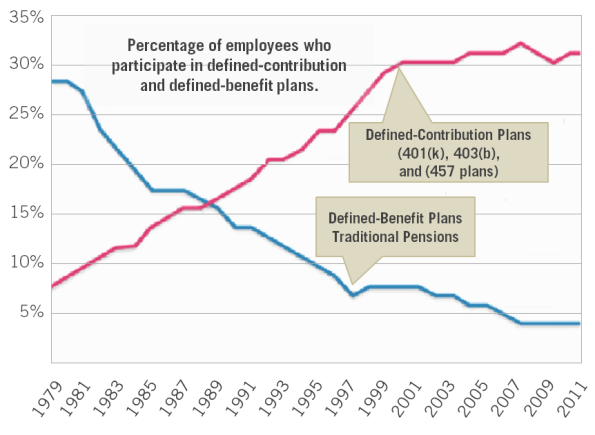

In the good ole’ days of the Industrial Age, companies took responsibility for employee retirement plans. Back then the goal was to land a job with XYZ Corp., stay there for 30 years and retire on the golf course with a guaranteed monthly check from your pension for your years of service.

Fast forward to today, most companies have long dropped defined benefit plans (Pensions), in exchange for defined contribution plans (IRAs, 401ks, 403bs, etc.) – thereby shifting the responsibility for retirement off employers and squarely onto the shoulders of employees…YOU!

Depending on Social Security or planning to live off your kids is a bad bet.

This means that now the only person responsible for your retirement nest egg is…YOU!

Inflation Eats Nest Eggs for Breakfast

At the advice of your financial planner, you decide to convert your portfolio to the best fixed-income option that’s safe and still generates a reasonable return on investment that you can withdraw monthly, in the form of a paycheck in retirement. The problem is most income-investment options, while safe, generate too little ROI, exposing you to a practically invisible foe, inflation risk (or purchasing power risk).

Inflation risk is one of the biggest problems investors face with fixed-income options most Americans have to choose from.

This means your quality of life will slowly diminish in retirement if you can’t generate more income year after year.

What’s worse, while most people think they’ll only live a few years in retirement, like their parents did, the facts show that retirees are out-living previous generations – living 30 years past retirement.

Out-living your parents should be a great thing, but for retirees who’ve run out of money, the ‘golden’ years aren’t so glorious!

The truth is, while most financial planners will help you set up a fixed-income option that usually produces no more than 4%, we know that 4% is not a good enough withdrawal rate

(the amount you can withdraw from your investment account per year) for most people – certainly not our clients. Today, annuities, bonds and other income-producing investments just don’t pay enough for you to live well on in retirement.

A Simple, Proven Solution Trusted by Thousands

But the Good News is that generating a full-time monthly paycheck you can depend on when you reach retirement IS possible!

As a matter of fact, a growing number of people are using one simple and proven Method to generate paychecks from their investment portfolio for retirement. These aren’t a bunch of seasoned investors. Beginners and experienced investors alike are successfully applying a time-tested Method to generate monthly income.

You see, as you near retirement, your investment objective shifts from capital appreciation to investing for income. The problem is the investment instruments commonly used to generate income simply don’t pay enough.

If you’ve worked and sacrificed for decades to set money aside, take responsibility and build a nest egg to provide for yourself in retirement then you deserve the best possible withdrawal rate (annual amount you can withdraw from your investments to live on in retirement) available.

You need the most money you can get to pay your bills and enjoy the Golden Years of life.

So what’s the best solution for you nearing retirement to generate a full-time paycheck from your portfolio, month-after-month, regardless of crazy market conditions?

Introducing the Snider Investment Method

The cornerstone of our business and our primary tool for achieving wealth is the Snider Investment Method®. The Snider Method is a long-term investment strategy that uses a uniquely powerful combination of stocks, options, and cash management techniques to achieve two fundamental objectives:

Cash Flow – The goal is an average monthly yield of 1% from your investments. Think of it as exchanging the long term return of the U.S. Stock Market for a more immediate and tangible cash-on-cash return. Ultimately, we want you to be able to generate income replacement for the day when you can’t or don’t want to work.

Most traditional investments are based on the concept of capital appreciation. You buy assets, such as shares of stock, and hope they appreciate in value so you can sell them later for a profit. Cash-flow investing works differently.

With cash flow, you buy an asset not for its future value, but for its potential to generate income. When you use the Snider Method, your goal is to put your assets to work to produce a monthly yield (income).

No Permanent Loss of Capital – With the Snider Method, you buy stocks from fundamentally sound companies you would be willing to own for long periods of time, even if the price declines. The Snider Method helps reduce the chance of selling stocks at a loss by diligently screening stocks and following a systematic set of rules to help you control emotional reactions to market changes.

The Truth About OPTIONS…Revealed

When I say the word Options, there’s one of two things that come to mind.

1. You may think “This already sounds difficult and I don’t even know where to start!”

2. Or, you may think “Options are complex and risky and I don’t want to get into all of that!”

Using options is no different than using a sharp knife. If used properly by a skilled person, a knife is used to cut things safely. When used wrongly by an unskilled person, knives are extremely dangerous, and perhaps, deadly.

We start with a covered call position, which reduces the risk of stock ownership and can be used for generating monthly income from your underlying investment portfolio, in various market conditions. Complete investment novices learn the Snider Investment Method in our 6-month Snider Investment Method Online Course and begin investing right after completing the initial modules.

The Snider Method is simple, proven and repeatable. Users take a few hours on just one day each month to invest and place trades, so we’re not watching screens everyday looking at the markets.

Build Your Game-Plan for a Dream Retirement

The Snider Method offers the opportunity for higher income than the traditional Capital Appreciation method, also known as ‘buy low, sell high’ and ‘buy and hold’. With the Snider Investment Method, we maximize the potential ROI while reducing risk in various market conditions, which has worked very well for our clients over the past 13 years.

This is the single most successful, proven and sustainable model of income investing we’ve seen that’s passive and easy-to-use.

Thousands of real people, just like you have been successful with using the Snider Investment Method to invest for retirement and sell options for additional income.

If you want to learn how to generate a higher monthly income from your investment portfolio than the low 4% a year withdrawal rate most investment advisors expect you to live on then you need a Game-Plan!