“Risk comes from not knowing what you’re doing.”

– Warren Buffett

There are two approaches to risk. One is to ignore it completely and hope everything turns out okay. The second is to manage risk and reward as two interrelated pieces of an equation. But you must understand risk before you can effectively manage it.

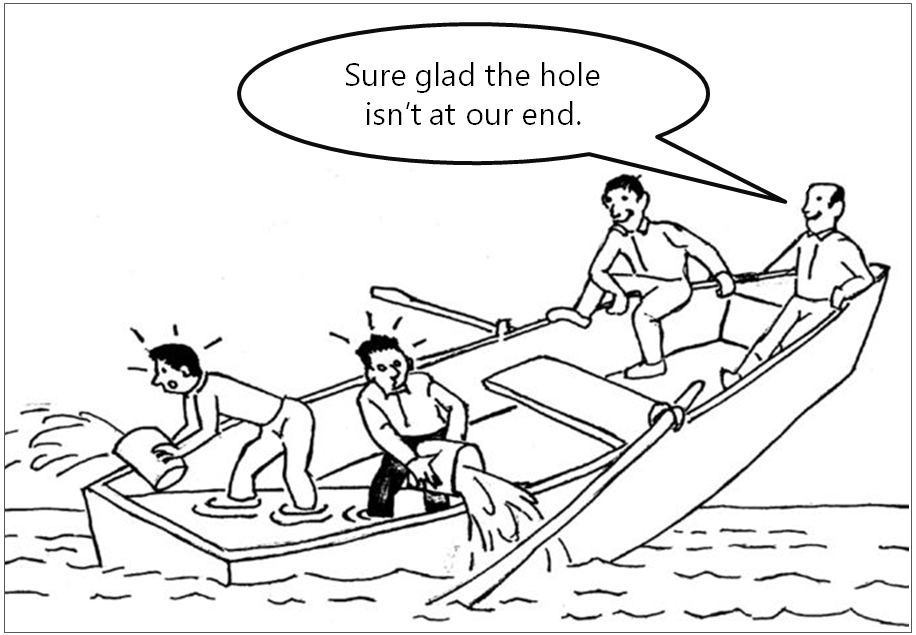

The problem is that investors tend to be myopic when it comes to risk. It reminds me of this old cartoon:

Investors worry so fervently about the inherent volatility of the stock market and the potential loss of money that they fail to see the equally significant risk of the loss of purchasing power.

Maybe it’s because the loss of money creates a visceral reaction. Just the thought of a big market drop, corporate scandal, or missed earnings sends a panic through most people. But before you give into the temptation to hide your money under the mattress or move it to a seemingly safe investment like bonds or CDs, consider the chart below that illustrates the negative real, after-tax return that cash earned from 1926-2012.

Sure, cash may feel safe to you in the short-run, but over the long-term, inflation and taxes can have a devastating impact on your purchasing power.

And as you can see, bond portfolios also fall woefully short. Unless you’re a billionaire with a reasonably modest standard of living (think Warren Buffett), you’re going to have to generate something dramatically higher than bond market returns to sustain a reasonable standard of living.

One of the reasons many investors get so stressed out by their investments is we have been taught to focus on capital appreciation instead of cash flow investments. Capital appreciation focuses on a number to gauge success – either account value, return percentage, or both. Income investing is focused on outcomes. It strives to answer the question, “Can you live comfortably without fear of running out of money?” (Keep in mind, there is no law that says you have to spend portfolio income. When you don’t need the income, because you have a W-2 paycheck coming in, you re-invest the income to create growth.)

While we would all like to stop worrying about the market’s ups and downs and retreat to the so-called safe havens offered by lower-return investments, reality requires you to do two things:

- Construct your portfolio so that the returns are high enough to sustain both growth and a reasonable standard of living

- Avoid the mistakes that cause investor returns to be lower than investment returns – because if you hope to live off of the proceeds of your portfolio, your success depends largely on your ability to tolerate the short-term fluctuations that come with higher-return investments.

We think the Snider Investment Method can help you do both of the above. Does that mean it’s right for you? We think there’s a good chance it is, but you have to see for yourself. Our next Snider Investment Workshop is scheduled for September 20th in Irving, TX. Click here to sign up.

When you register, use the promo code FALL250 to save $250 off of the course price*. We know trying something new can be nerve-wracking. But don’t worry – we offer a 90-day test drive on our course. If you decide for any reason that the Snider Method isn’t right for you, you have 90 days after the course to receive a hassle-free 100% refund of your course fees.

If you want to get the same performance you’ve always gotten – if you want to be worried about what the market is going to do next, then by all means, keep doing what you’re doing. But if you want to change your outcomes, sign up to learn the Snider Investment Method.