Budgeting is one of the most important ways to contain your spending and maximize your savings and investments. While most people know that they should be budgeting, the reality is that less than a third of households actually stick to a budget, and that has contributed to chronic rising debt levels and a lack of retirement savings. The good news is that it’s easy to get started with budgeting and many different strategies to consider.

In this post, we will take a look at why budgeting is important, three popular strategies, and how you can implement them in your life.

Why Budgeting Is Important

Budgeting is the process of calculating your total income, estimating your overall expenses, and using that information to ensure that all of your expenses are covered, debts are paid off properly, and saving is maximized. While most people associate budgeting with paying off debts, it’s equally important to maximize your savings and investments. A budget can help determine how much you can save each month and project what you will have in retirement.

Many people have tried and failed to create a budget at one time or another. Without a budget in place, it’s hard to properly plan ahead for expenses to ensure that there’s enough money to go around. A single missed credit card payment can result in a late fee, higher penalty interest rate, and a lower credit score – it’s no wonder that credit card debt continues to soar!

NerdWallet estimates that American households saw their credit card debt climb seven percent to $931 billion last year. That’s an average of $15,983 per household. While household income is no longer being outpaced by the cost of living, the failure to properly maintain a budget still leads to hundreds of dollars of credit card interest each month that could be avoided by recategorizing income to prioritize debt repayment.

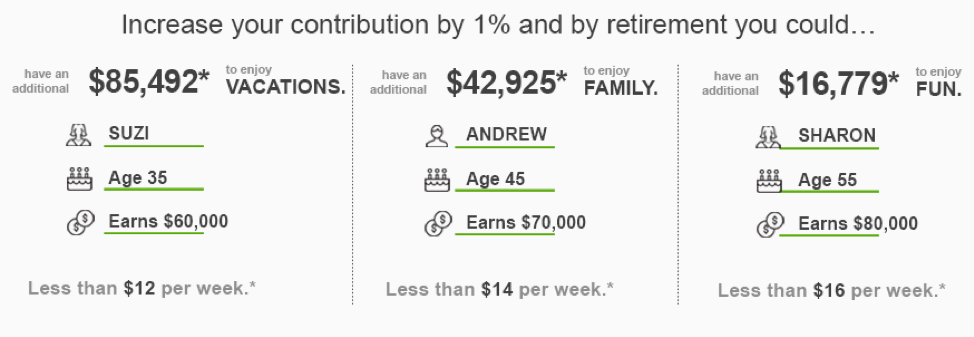

Figure 1 – Retirement Contribution Estimates – Source: Fidelity These figures assume a 5.5 percent investment return, a four percent annual salary growth (2.5 percent inflation and 1.5 percent real growth), and retirement at the age of 67.

Budgeting can also help maximize your retirement savings at any age. In Figure 1 above, Fidelity estimates the impact of a one percent increase in retirement savings at various ages and the amount that it generates come retirement age. It’s easy to save $12 or $16 per week if you have a budget setup to allocate any extra capital to savings and investments.

Top 3 Most Popular Budgeting Strategies

There are hundreds of different budgeting strategies, but a handful of them have become popular over the years. We will focus on the three most popular budgeting strategies that have been time-tested to be successful for many people.

Envelope Budgeting

Envelope budgeting is one of the fastest and most popular ways to get started with a household budget. As its name implies, you tuck cash away into different envelopes for different budget categories, such as rent, groceries, car payments, and fun money. A key benefit of the envelope budgeting system is that you don’t need to build up a savings to get started – you just have to buy a few envelopes and make a commitment to stick to your budget goals.

Here’s how it works: Suppose that you budget $1,000 per month for rent, $500 per month for groceries, and $200 per month for fun money. As soon as you receive your paycheck, take out $1,000 in cash from your bank account and put it in an envelope marked “Rent” and do the same for “Groceries” and “Fun Money”. These envelopes contain the only cash that you’re allowed to spend for the month in each category. Period.

If you run out of grocery money mid-month, it’s time to look in the fridge for leftovers or dig through the pantry and get creative. If you have leftover cash at the end of the month, you may choose to celebrate with a frivolous purchase or roll the money over to next month to have some extra spending room. At the end of the month, you should evaluate how it went and make any necessary adjustments moving into the next month.

Figure 2 – YNAB Screen – Source: YouNeedABudget

Zero Budgeting

Zero budgeting starts with your monthly income rather than your expenses. As its name implies, you take your monthly income and find places for it before it even arrives in your bank account, so that there’s zero money left over. The benefit of this approach is that you have a plan for every dollar that you earn. Some studies have shown that this approach enables people to pay off 19 percent more debt and save 18 percent more money.

Here’s how it works: Suppose that you earn $3,000 per month. You may owe $1,000 for rent, budget $500 for groceries, and have a $200 per month car payment for a total of $1,700. Instead of leaving the remaining $1,300 in your bank account, you may decide to use $1,000 to pay down debt and invest $300 in a Roth IRA, leaving a zero balance at the end of the month. You could also use extra money to build up an emergency savings fund.

Many people use digital apps for zero budgeting strategies, such as You Need a Budget and EveryDollar, which both connect to your external financial accounts and automatically categorize spending to make the process easier. But, you can also use a cash system, like envelope budgeting, or keep track of your income and expenses using a more traditional spreadsheet or free apps, like Mint, to help with the process.

50/30/20 Budgeting

The 50/30/20 budgeting system is designed for people that want to strike a balance in their budget rather than just focusing strictly on paying down debts at all costs. The strategy also works well for people that have some extra flexibility in their budget and don’t need to worry about paying down debts. The idea is to cover your basic expenses, save for the future, and still have about 30 percent of your budget for fun money. This budgeting method also gives you a framework on how much you should spend (or afford) for big expenses like housing and cars.

Here’s how it works: You spend 50 percent of your take home after-tax income on needs, such as a mortgage, credit card minimum payments, groceries, and other items that you can live without. The next 30 percent goes towards wants, such as a gym membership, dining out, entertainment, or other things that you can live without. The final 20 percent goes towards debt repayment and/or savings and investments.

The drawback of 50/30/20 budgeting is that it may not be ideal for those that have a high amount of debt. Without allocating enough to debt repayment, you can get stuck in a debt cycle that can be difficult to escape. It may be worth the sacrifice to free yourself from debt traps later in life using zero-budgeting or envelope budgeting systems.

The Bottom Line

Budgeting is one of the most important ways to contain your spending and maximize your savings and investments. Even if you’ve already retired, budgeting can help maximize your retirement income by ensuring every dollar is spent in the right place.

You may also want to consider Snider Advisors to help generate a consistent income from options during retirement. Using the Snider Investment Method, you can earn a portfolio paycheck after you retire, which helps you worry less and actually enjoy your retirement by adding a little spending flexibility into your budget.