Many people are familiar with Health Savings Accounts – or HSAs – but the vast majority don’t fully understand their enormous benefits as a retirement account. The best way to think of these accounts is as an IRA-like retirement account that has added tax benefits if withdrawals are made for qualified medical expenses. With medical costs continuing to accelerate, these accounts should be considered by anyone with a high-deductible health plan.

What Are Health Savings Accounts?

High-deductible health plans have become increasingly common for those with employer-based coverage, according to the Centers for Disease Control. The percentage of adults aged 18 to 64 with employment-based coverage enrolled in high-deductible health plans increased from 26.3% in 2011 to 39.3% in 2016. Those enrolled in these plans were significantly more likely to have trouble paying medical bills (15.4%) than traditional plans (9%).

Health Savings Accounts were established by the Medicare Modernization Act of 2003 to address these problems. Under the program, individuals with high-deductible health plans have a way to save for future medical expenses in a tax-advantaged account. The idea is that healthcare expenses tend to rise as a person ages, so saving early-on in a tax-advantaged account is a great way to be able to afford these expenses as they arise.

Do You Qualify?

The only requirement to open a health savings account is to be enrolled in a high-deductible health plan. The Internal Revenue Service defines these plans as those with a minimum annual deductible of at least $1,300 for an individual and $2,600 for a family, as well as an out-of-pocket maximum of at least $6,550 for an individual and $13,100 for a family. See Publication 969 for details about the IRS’ treatment of HSAs and other tax-favored health plans.

HSAs vs. FSAs

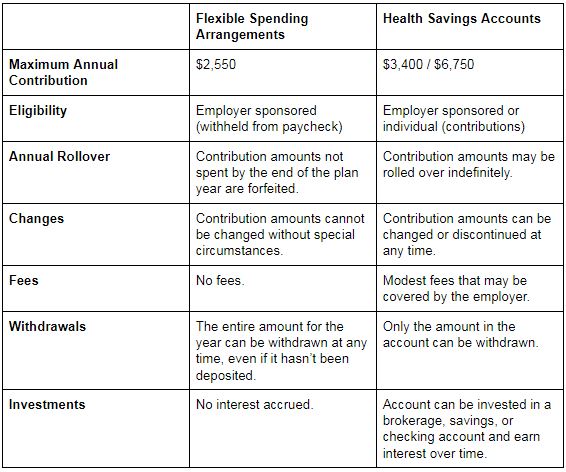

Most employers offer flexible spending arrangements (FSAs) or health savings accounts (HSAs) to employees with high-deductible health plans. Often times, employees will have a choice between these two accounts (not both), which means that it’s important to understand the differences before committing to one or the other.

There are also several other types of health spending accounts, including health reimbursement arrangements (HRAs) and medical savings accounts (MSAs). In general, these accounts tend to be employer-sponsored accounts that have limited flexibility compared to HSAs and they aren’t nearly as prominent as FSAs as an option for employees.

Contributions to HSAs Are Tax Deductible

Health savings accounts are attractive because contributions are tax-deductible or pre-tax if they’re made through a payroll deduction. In this way, they are similar to traditional individual retirement accounts (IRAs).

Individuals may contribute up to $3,400 per year and families may contribute up to $6,750 per year in 2017, according the IRS Publication 969. In addition, those over the age of 55 at the end of the tax year may contribute $1,000 more as a “catch up” contribution. This would raise the annual contribution limit to $4,350 for an individual over 55 years old. These amounts must be reduced by any contributions made to an Archer MSA, including employer contributions.

Those with an Individual Retirement Account (IRA) may also make a tax-free rollover into a health savings account once in their lifetime. The rollover is limited to the maximum allowable per year minus any amounts that were already contributed for the year. Often times, this is a great way for individuals to start contributing to an HSA without having to set aside extra money from their paycheck in the first year.

Interest Is Accrued Tax-Free in HSA Accounts

The most significant advantage of health savings accounts compared to other accounts is that interest can be accrued in them. In this way, they can become more of an investment account for the future than a way to cover current medical expenses.

Surprisingly, many people seem to be ignoring this enormous advantage. The Employee Benefits Research Institute (EBRI) found that most account holders use HSAs as a specialized checking account rather than an investment account. The organization found that 63% of account holders withdrew funds and only 4% had investments other than cash in their accounts, but financial security tended to improve over time.

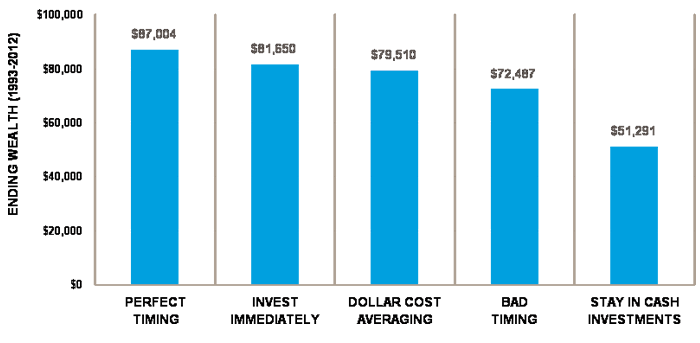

There is a significant advantage to investing HSA funds rather than keeping them in cash. For instance, Schwab found that an individual contributing $2,000 per year into an account over 20 years would have generated $81,650 by investing immediately in the S&P 500 index compared to just $51,291 by staying in cash investments (Treasuries). They also found that these same results would have occurred across 60 rolling 12-month timeframes.

Figure 1: Impact of Market Timing on Returns, Source: Schwab

Qualified Withdrawals Are Tax-Free in HSAs

The third big advantage of health savings accounts is that individuals can withdraw money from them without paying tax. In this way, they are similar to a Roth IRA for qualified medical expenses and a Traditional IRA for all other withdrawals.

The best way to use HSAs is to offset high medical costs in the future, since withdrawals for these purposes are tax-free. According to IRS Publication 502, qualified medical expenses include the costs of diagnosis, cure, mitigation, treatment, or prevention of disease, and the cost for treatments affecting any part or function of the body. These include most services provided by healthcare providers, prescriptions, and even things like acupuncture.

Those using HSAs as a tax-advantaged investment account may wonder what happens if they remain healthy and don’t require the capital they’ve accrued over the year. Individuals that make withdrawals for non-medical expenses face a 20% penalty before the age of 65, but after age 65, they are free to take penalty-free withdrawals. The catch is that they will owe income tax on these withdrawals, which makes it similar to a traditional IRA investment vehicle.

The Bottom Line

Health savings accounts provide the tax-free contribution benefits of a traditional IRA, the tax-free withdrawal benefits (for qualified medical expenses) of a Roth IRA, and the ability to earn an income over time by investing in equities and bonds. While only 4% of those with HSAs take advantage of it, these accounts make the account an attractive tax shelter for investors, especially as an alternative to traditional IRAs.

There are many different companies that provide health savings accounts and each of them has different options when it comes to investments. Before setting up an account, it’s important to consider all of your options and choose the best fit for your situation.