Part 1 – Part 2 – Part 3 – Part 4 – Part 5

Savvy Investors Stay the Course

Successful investing can be as uneventful as watching paint dry or as gut-wrenching as racing 70 mph on a wooden roller-coaster ride; depending on current market’s conditions.

Whether you’re bored and want more action or you find the ups and downs of your investment(s) too emotionally draining to stand, you must learn to be patient and stay the course if you wish to build wealth for a better retirement.

Here are the skills you should utilize to achieve long-term investment success.

Focus on the Long-Term

Savvy investors master the skill of laser-focus on their goal – and not just for hours and days, but for months and years; until they’ve achieved the goal of their investment.

Learning to focus on your long-term goals and steering clear of the downward spiral of emotional responses to market conditions will save you from making many mistakes. Costly decisions are made when you’re short-sighted by short-term setbacks and fluctuations. Granted, this habit may be one of the toughest for investors to truly adopt, but it’s imperative to your long-term success.

You see, as humans – we’re hard-wired to react to market cycles. The most basic function of the human psyche urges us to avoid pain and pursue pleasure. This powerful mental trigger has ensured the very survival of the human race for millennia; nevertheless, giving in to this trait is largely counter-productive with stock investing.

Survive Bear Markets

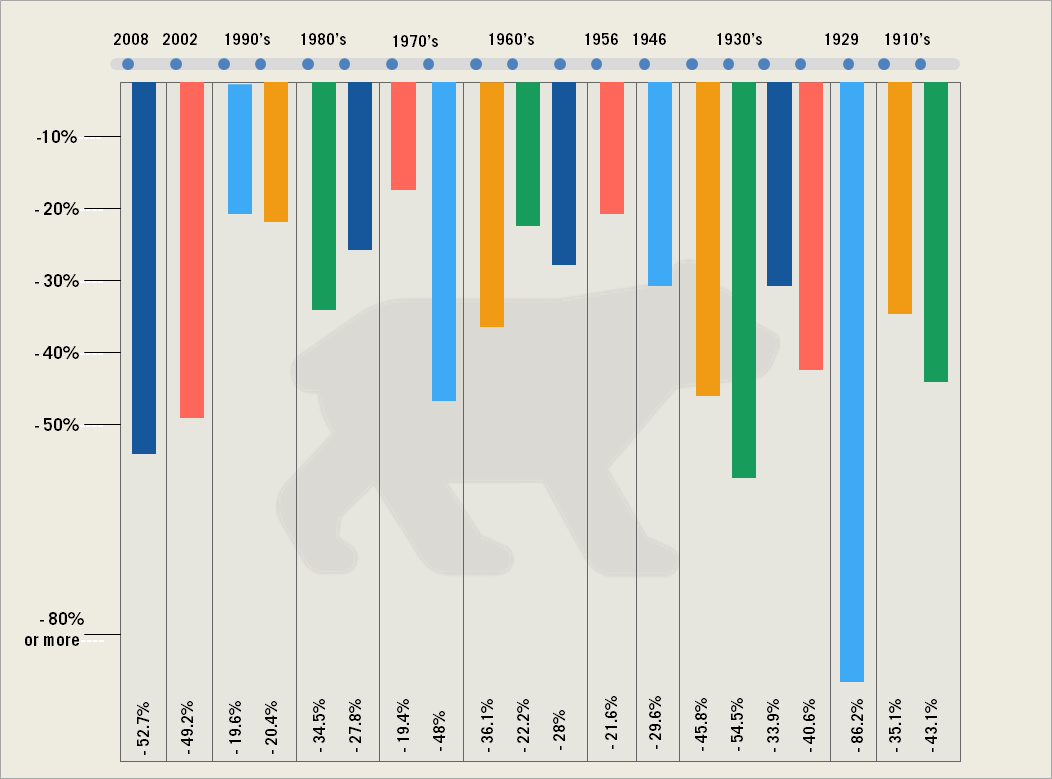

I’m often asked if I think the market will go down again. My answer’s always the same…absolutely, yes! Without a doubt, we will experience another bear market – many, many bear markets, so long as the markets exist.

This is not ‘gloom and doom’ thinking; it’s just a statistical certainty. All you need to do is look at history to know that we are always going to cycle between bull and bear markets.

In fact, we experience approximately two bear markets each decade. This chart shows each of the bear market declines since the end of World War 1 – approximately one every five years. If you want to get even more specific, it is about sixteen months out of every sixty that we spend in bear markets.

When the market declines, if you fail to plan for it, that basic instinct to flee pain and pursue pleasure will kick in strong and you’ll, likely, make a costly mistake.

On the other hand, savvy investors, who’ve accounted for the probability of bear markets before they bought their investment, will lock-in on their long-term goal and seize the opportunity that bear markets bring.

Master the Cycle of Emotions

Let’s take a look at how emotions can wreak havoc on investment outcomes.

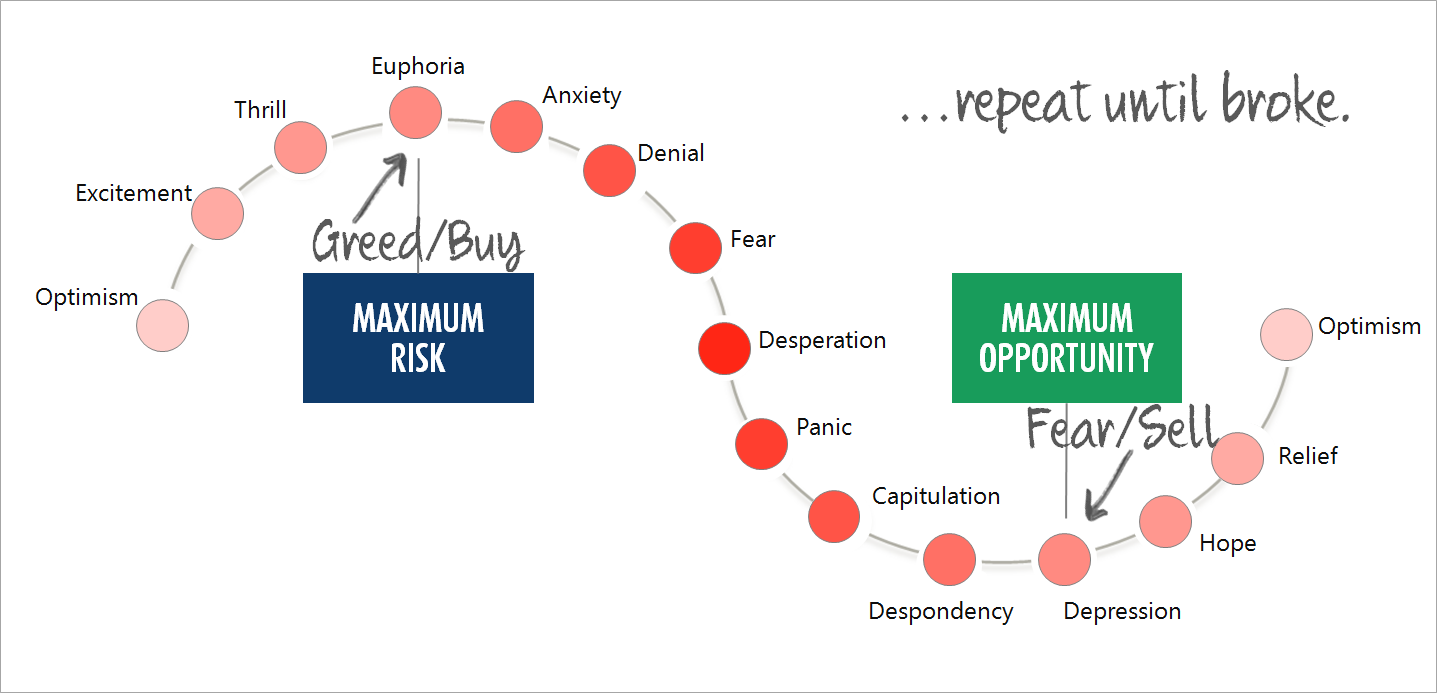

The Cycle of Investor Emotions illustrates that when the market begins an upswing, investors feel optimistic. As it rises, so do their emotions. As the market peaks, investors enter into a state of total euphoria.

Then, prices drop, just a little, and you begin to feel a little anxious, thinking this couldn’t possibly be happening again. Before you know it, your fear has grown into total despondency and depression. When the market’s rising, it’s normal to feel positive about the market and be inclined to buy stocks. But you have to remember that the more expensive an asset is, the riskier it is. So if you buy when the market’s rising, or high, you buy at the point of maximum risk.

On the flip side, when the market declines and you’re convinced only a fool would be invested in stocks, this is actually the point of maximum opportunity.

However, instead of doing the logical thing, which is to buy low and sell high, what do most naïve investors do? The exact opposite – they buy high and sell low. If you make this common mistake, you’ll likely repeat this cycle over and over again until you’re flat broke!

Dalbar Tells the Story

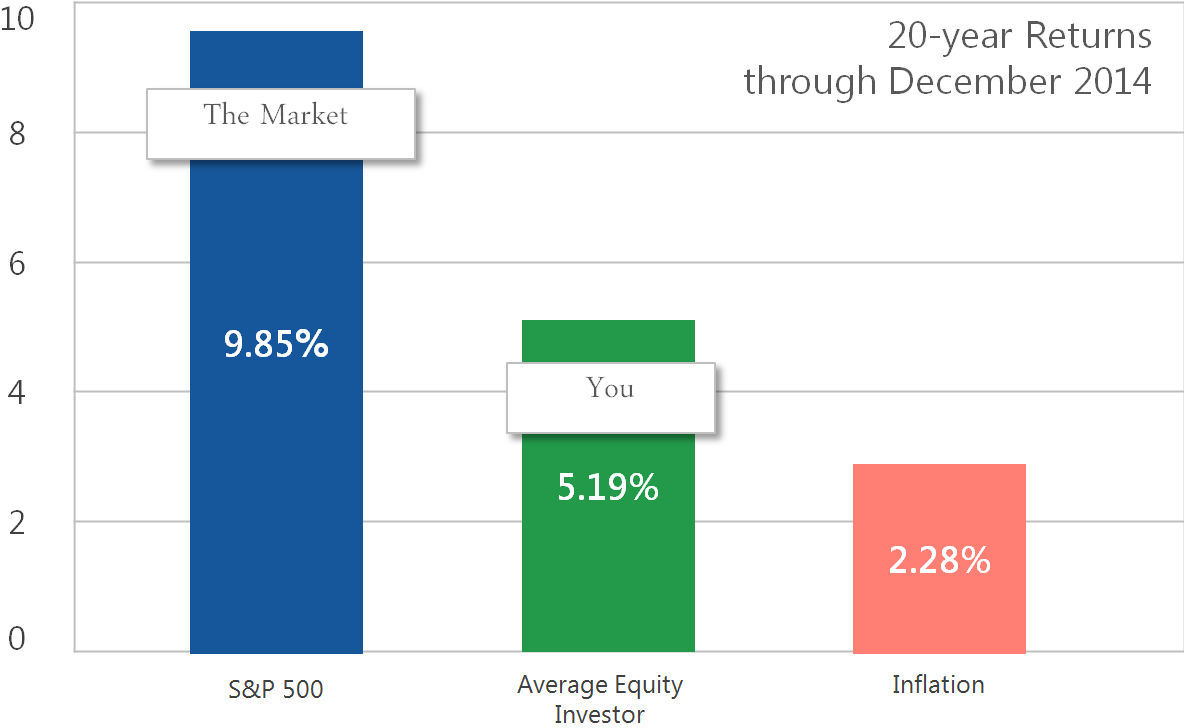

Nothing quantifies this better than the Quantitative Analysis of Investor Behavior, a study done by DALBAR, which is a well-respected research firm based in Boston. Each year, DALBAR releases a rolling 20 year study that compares relevant benchmark returns to investor returns.

Here you have the returns for the 20-year period that ends in December 2015. What we see with this chart is that in this period of time, the S&P 500 had an average return of 9.85%, while the average equity investor – in other words the person invested in the S&P 500 only made 5.19%.

So why does that gap exist between what the market gets and what the average investor gets? Just to be fair – some of it is fees, right? Especially if you think about mutual funds, which can have pretty hefty fees. But the vast majority of the gap is created by what DALBAR calls, ‘psychological factors.’

In other words, it is caused by our irrational behavior. This proves what I shared earlier; which is that investors who are controlled by their natural, irrational responses to flee from pain and pursue pleasure, sabotage their own success while experienced, knowledgeable investors control their emotions and execute their predetermined strategy.

We shared the importance of determining the point at which you sell an investment before you buy it in Part 2 of this article series. You learned how you must stick to the rules of your method, rather than fall victim to the whims of the volatile market; in order to achieve your end-goal.

Don’t Believe the Hype

Savvy investors are anchored by their well thought-out strategy – not tossed around by trends, fads, shiny objects and the lure of so-called gurus.

For example, in the 90s, everyone was told to ‘buy the dips’ – which was a slang phrase for the strategy of buying stocks following a price decline. After all, at the time, people believed that stocks would always go up, so they thought success was inevitable by simply ‘buying the dips.’

Fast-forward a few years to the dot-com bubble, a time where the rule of thumb that suggests “what goes up must come down,” performing due diligence, and the use of valuations were all safety measures that were thrown out the window.

Today, stock picking, or market timing, is the hot trend. This is the belief that there is someone or something somewhere that can predict the market like a crystal ball, and all you have to do is follow the pied-piper to success.

The truth is that an occasional market call is easy, but doing this consistently is categorically impossible. But, just like a surfer cannot control the tide or the waves, you cannot control the market, but you can control when and how you ride it!

So don’t believe the hype.

There has always been, and there will always be, ‘noise’ that makes grand promises and/or poses great threats but, in reality, is nothing more than a fleeting distraction. As a savvy investor, you must learn to train your eye on your goal; focus on executing your well-conceived game-plan and you’ll be operating like the icons of the investment world towards success.

Nothing in the world can take the place of persistence. Talent will not; nothing is more common than unsuccessful men with talent. Genius will not; unrewarded genius is almost a proverb. Education will not; the world is full of educated derelicts. Persistence and determination alone are omnipotent. The slogan, ‘press on’ has solved, and always will solve, the problems of the human race. – Calvin Coolidge