#5: They Prey on Social Circles

Sadly, not all financial planners hold their fiduciary responsibility in the high regard they legally and ethically should. We’ll start the third and final part of this series by warning you to watch out

for financial planners who commit ‘affinity fraud.’

Affinity fraud is an investment scam that preys upon members of identifiable groups, such as religious or ethnic communities, the elderly or professional groups. Examples include churches and veteran groups. Scammers exploit the trust and friendship that exist in tight-knit social circles and affinity groups.

Warning Signs of Affinity Fraud by Financial Planners

Financial planners who run affinity scams create something called the ‘Halo Effect’ – in which they charm individuals and are so likable that they build trust quickly. Oftentimes, they’ll even pretend to be members of the group to lower the guard of naturally skeptical prospects and build the sacred bond of trust.

The best way to achieve the Halo Effect is by engendering trust and recruiting the key leader of a given social/affinity group. Once converted, the key influencer usually does the heavy lifting of disarming the skepticism of group members by celebritizing the financial planner.

Their influence convinces the rest of the circle that the scheme is legit and worthwhile. In most cases, it’s not their fault. These leaders are also usually deceived, unwitting victims.

Because of the tight-knit structure of many groups, it can be difficult for regulators and law enforcement officials to detect an affinity scam. Oftentimes, victims fail to notify authorities or pursue legal remedies and, instead, try to work things out within the group.

This is particularly true when shady financial planners use respected community or religious leaders to convince others to join the investment.

Many, many affinity scams are nothing more than pyramid or Ponzi schemes where new investor money is used to make payments to earlier investors – so there is a false illusion that the investment is successful.

In reality, the fraudster almost always steals investor money for personal use. And once the supply of new investors dries up, the whole scheme collapses and investors discover that most or all of their money is gone.

To avoid affinity fraud you cannot be embarrassed or afraid about your natural skepticism. This is hard to do when someone you trust is urging you to invest but you may be doing everyone a greater service by holding your ground.

One quick way to nip affinity scams in the bud is to do your homework! You need to research to find whether the investment being sold is registered, find out who the salesperson is, and follow the investment’s paper trail of legitimacy.

It’s actually not at all hard to do but people just let their guard down because of the power of social influence, which these scammers count on.

The SEC cautions that you should be wary of unsolicited offers, including social media, Instagram, and other networks scams may circulate through. To learn more about Affinity Fraud or read some example you can visit : https://www.sec.gov/investor/pubs/affinity.htm

#6: They Feed the Frenzy of Emotions

People don’t make logical decisions when they’re carried away by their emotions. Shady financial planners prey on this by pouring more fuel on the flame.

If it’s a down economy and you’re afraid, they’ll feed you more fear and if the market’s going up and you’re optimistic, they convince you that they’re the best show in town and that if you invest with them you’ll become wildly rich with zero risk of failure.

Big red flag there!

You should look for an advisor who provides a realistic voice of reason, focuses on the long-term, encourages practical, rational decision-making and calms the pendulum of emotions investors experience as the market cycles up and down.

Cycle of Investor Emotions

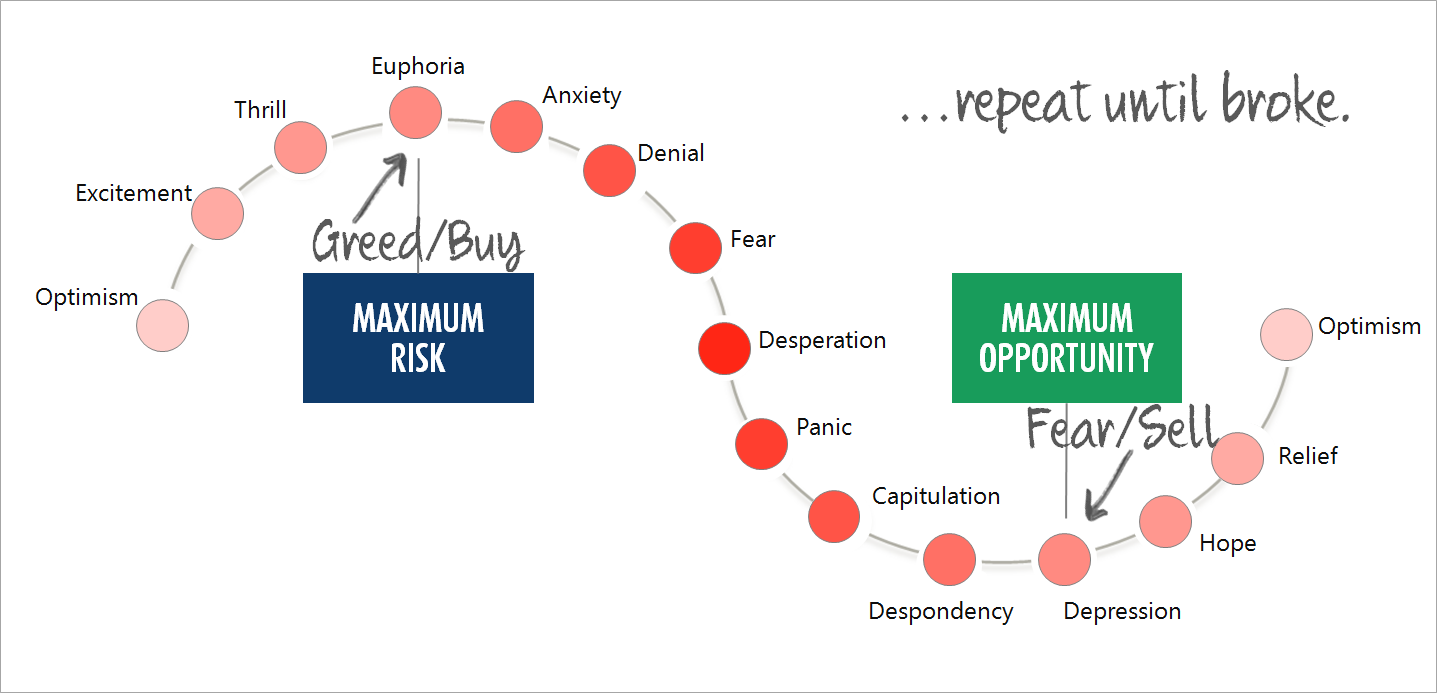

The Cycle of Investor Emotions illustrates that when the market begins an upswing, you feel optimistic as it rises. As the market peaks, you reach emotional euphoria. Then, when prices start to drop, even just a little, you begin to feel a little anxious, thinking this couldn’t possibly be happening again. Before you know it, your fear grows into total despondency and depression.

When the market’s going up, the natural response is to buy and when it’s going down, the natural response is to jump ship and sell. But when it comes to investing, this natural inclination is wrong, wrong, wrong.

You see, the more expensive an investment is, the riskier it is. Likewise, the more price drops on your investment, the more you lose by selling. Feels right, but it’s wrong. Savvy investors know that market declines present prime opportunities to buy great stocks at a discount while uneducated investors sell off all their stock in these times – thus, realizing a net loss in the investment.

While it’s quite natural to feel good when the market is up and anxious when it’s down, you must apply a rules-based approach to investing or you’ll make all the wrong moves and end up broke. Then you’ll regrettably demand, “How did this happen when it felt like I was doing the right thing?”

Whether shady financial planners scam you or you have no one to blame but yourself, emotional investing always leads to investment failure.

Good financial planners coach you through the emotional side of investing to save you from yourself. They help you to understand that when it comes to investing, you must have an emotional disconnect.

You must develop the habit of putting your emotions aside, like professional money managers, so they don’t dictate your actions and hurt performance.

A few good questions to ask the financial planner you’re considering include:

- What are your thoughts on behavioral finances?

- What’s your plan for handling market volatility and declining prices?

- What criteria do you use to determine when to buy and sell?

#7: They Fail to Connect & Communicate with You

Financial planners work for you, not the other way around. Good financial planners have a heart to enlighten, educate and empower you. They provide regular reports and give you access to your account so you know what’s going on at all times – which is transparency.

They educate you with articles, webinars, reports, blog posts and other tools so that you learn and grow financially literate. They’re available by email and have at least one annual meeting to rebalance your portfolio and to discuss life changes. These meetings are usually done either face-to-face or by phone. A lack of communication, connection and transparency with a financial planner is a bright-red flag.

This series is intended to give you insight into the things you should consider to avoid scammy financial planners. Review all seven of these red flags before you make a decision on a financial planner or investment advisor so that you have a logical reason to be excited about the decision you make.

Your hard-earned money is your livelihood, so don’t blindly trust a so-called professional money manager or investment advisor until you do your homework – regardless of who may be experiencing extraordinary results. As you’ve learned, that’s all the more reason to perform careful due-diligence, not less.