Debt is a part of everyday life, and it can help you build wealth over time. For example, most Americans use mortgage loans to purchase a home, and nearly 40 percent of 65- to 85-year-old homeowners paid off those loans. They don’t have to worry about paying rent each month in retirement, and they have a significant asset to pass on to their heirs.

The problem is when these debts carry over into retirement and their monthly payments eat into your fixed income. According to the Employee Benefit Research Institute, more than 70 percent of retired households had debt in 2016 compared to just over half in 1992. These debts can reduce the quality of retirement—or even make it impossible.

Let’s take a look at how to get a handle on your debt and how to pay it down during retirement.

Getting a Complete Picture

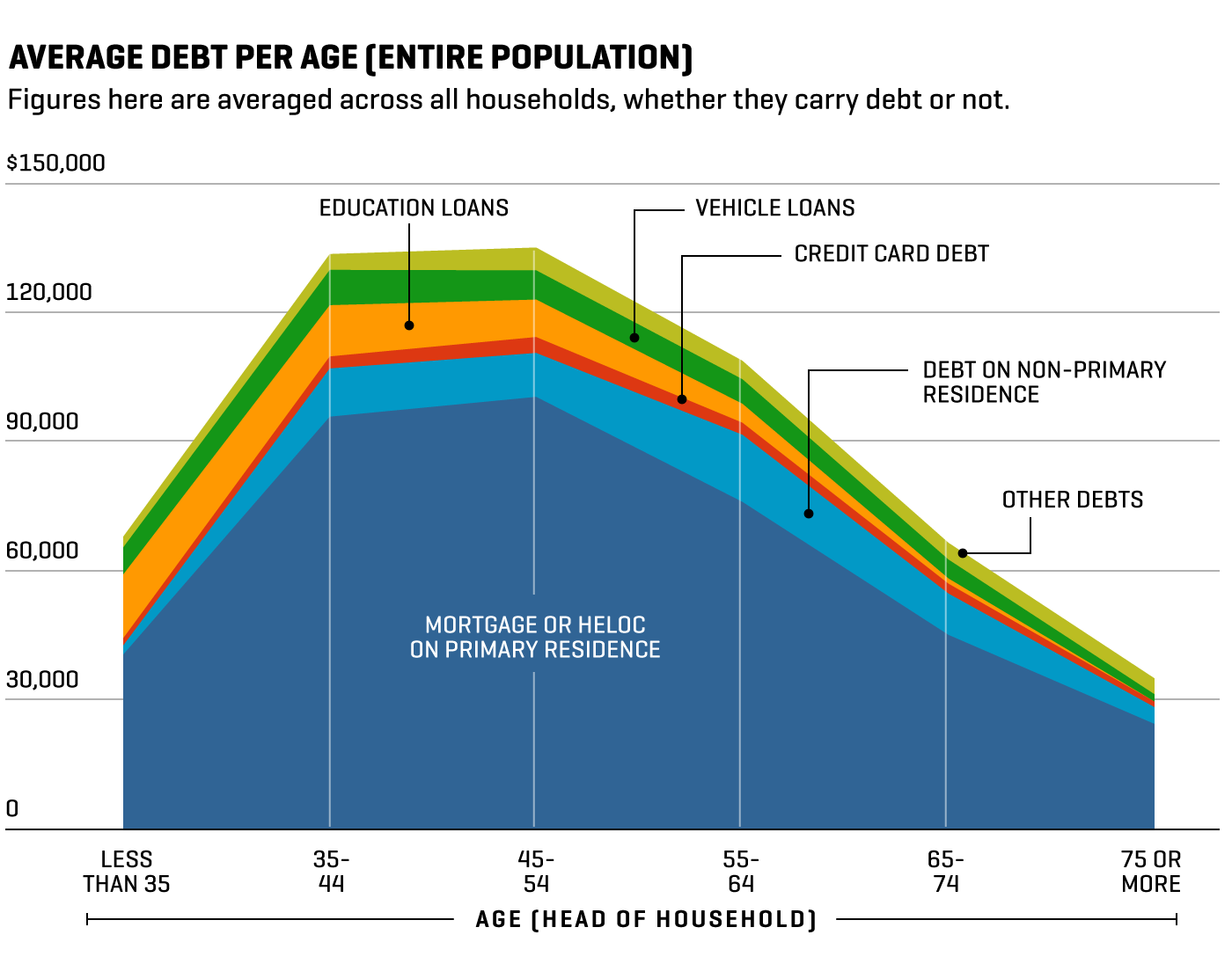

Individuals aged 65 to 74 had an average of $66,000 in debt, according to the Federal Reserve’s 2016 Survey of Consumer Finances. Aside from primary mortgages, the largest source of debt was non-primary mortgages—or vacation homes. These types of loans tend to have lower interest rates and more predictable payments. Houses (and vacation homes) also tend to be relatively stable assets.

Credit card debt, vehicle loans, and other debts (such as medical debts) accounted for a smaller portion. Despite their small size, their higher interest rates could make them more expensive to repay—especially on a fixed income. These loans are more problematic than mortgage loans since they’re typically used to pay for services (such as medical bills) or low-quality, depreciating assets like vehicles.

Average debt by age. Source: Money

It’s a good idea to get a complete picture of these debts, both “good” and “bad”, before exploring ways to pay them down.

Start by listing your debts, big and small, by the amount and interest rate. If they were used to pay for an asset, you could also record how willing you are to part with the asset. Do you need that vacation home? Could you survive with one vehicle?

Next, calculate your retirement income from your savings, Social Security, part-time jobs, and other sources. If you’re uncertain about some income, such as whether you will take early Social Security, list each separate possibility.

How to Pay Down Debt

There are a few steps to paying down any debt. While they are straightforward, these steps involve making difficult decisions that can impact your quality of life.

Control Your Spending

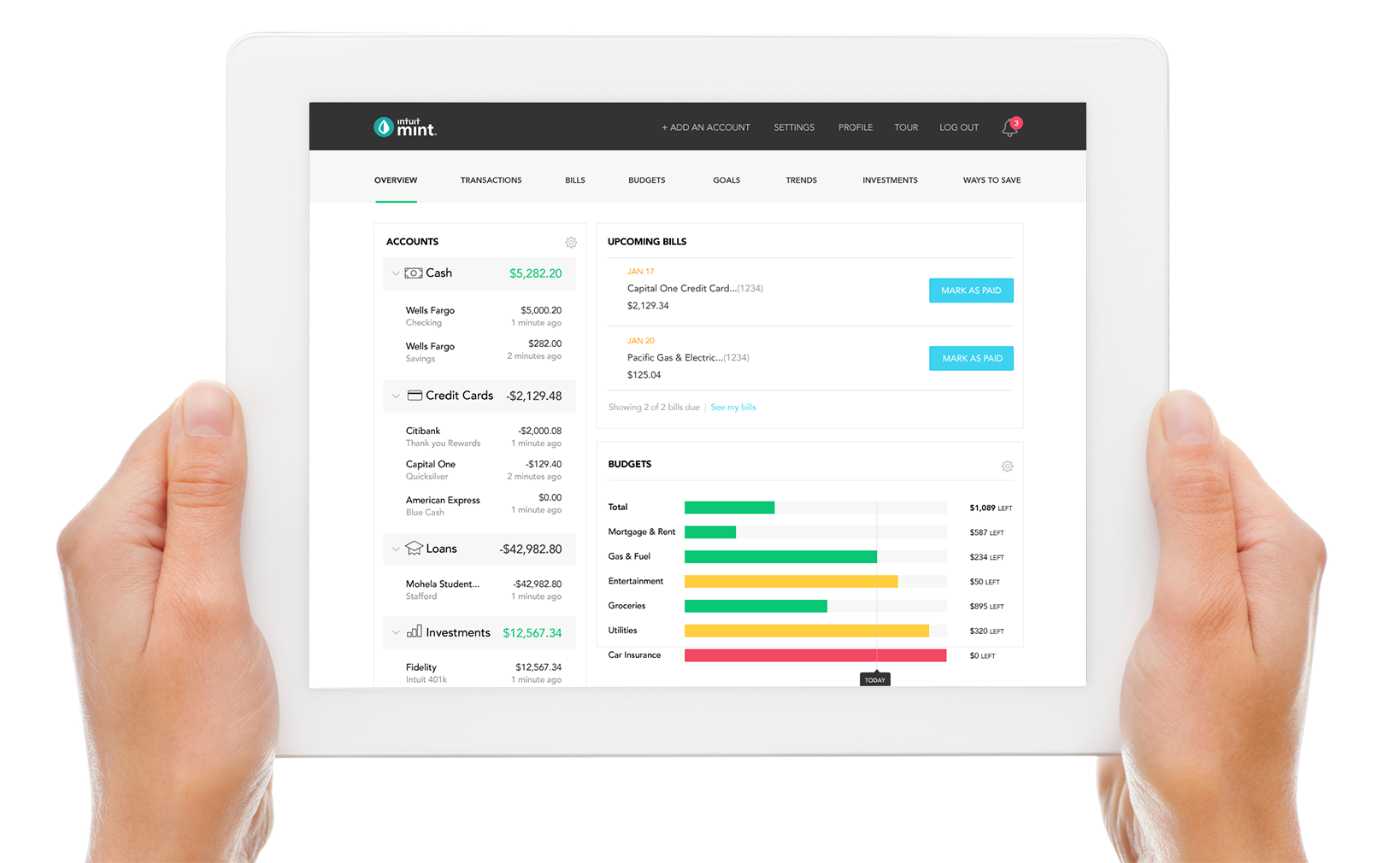

Create a monthly budget and stick to it. Tech-savvy retirees can check out Mint or YNAB, which can pull transactions directly from your bank account. However, the envelope system also works great. Just be sure to differentiate between your must-have expenses (e.g., mortgage) and your nice-to-have expenses (e.g., going out to dinner).

Budgeting app. Source: Mint

Budgeting will help you avoid any new debt and come up with a plan to pay off your existing debt while still meeting your living expenses. Moreover, these budgeting skills will help you well after you’ve paid off your debts. You can use the same techniques to build up emergency savings and acquire assets that you can eventually pass on to your heirs.

Prioritize High-Interest Debt

Debt with higher interest rates cost you the most money each month. Ten percent of $1,000 is the same as one percent of $10,000—even though $10,000 is a higher face value. The same is true for debts with high interest rates—they could be costing you more despite their lower face value. That’s why it’s important to prioritize repayment based on interest rates before trying to pay off debts based on their size or other factors.

You should generally pay off high-interest credit cards, medical debt, or auto loans before paying more than is required on your mortgage or home-equity loan. That way, you are reducing your monthly debt payments in the most efficient way. Start by paying the minimum on all balances, and then use extra funds to pay off the highest interest debt. If there’s not a big difference in interest rates, you can pay off the smaller debts first to quickly eliminate them.

In some cases, you may be able to refinance high-interest debt to reduce your monthly payments and save money. Home-equity loans, or HELOCs, can be a smart way to accomplish these goals. But it’s important to be cognizant of the lending fees and interest rate structures involved to make sure it’s a financially-sound decision. Variable rates can make these loans more expensive in rising interest rate environments.

Consider Other Sources of Income

The more income you can generate to repay debt, the faster you’ll be able to escape from under it. There are three ways to generate this income: You could sell assets to produce a one-off profit, reduce your expenses to free up more money each month, or earn a regular income with a part-time job. The right decision depends on your circumstances, but it’s important to consider all of your options before making a decision.

It’s usually a good idea to use cash to pay down debt before selling retirement assets. When you sell stocks or bonds, you will trigger capital gains taxes that could impact your tax rates and benefits. That also applies to retirement investment accounts. Raiding these accounts to pay down debt will have a long-term impact on your wealth. Income investment strategies are a great alternative to generating a regular income without selling assets. For example, The Snider Method is designed to create recurring income from your existing portfolio using stock options, and cash, along with specific techniques applied in a specific sequence, to maximize your portfolio’s income potential.

If you’re not eligible for Medicare, you could consider part-time employment that provides health care benefits. That way, you can reduce your health care expenditures and earn an income to repay the debt at the same time. Just make sure that your income doesn’t exceed the Social Security’s limits if you’re already taking benefits.

The Bottom Line

Debt isn’t necessarily a bad thing. When properly used, it can provide the necessary leverage to build wealth. The problem with debt during retirement is that the monthly payments can eat into your fixed income. It’s always a good idea to pay down debt as you approach retirement for this reason.

If you are already retiring with debt, building a complete picture and following the three steps covered in this article can get you back on track. The sooner you get started, the sooner you can get out of debt and enjoy retirement.

You can learn more about The Snider Method and how it can generate an income from your portfolio by taking our free three-part online income investing course. For those looking for a more hands-off approach, we also offer full-service asset management services.