Health care costs are the single largest financial burden for every age group except those under 24 years of age. Employees have seen their deductibles and out-of-pocket expenses rise at a faster pace than wages over the past decade, according to the Kaiser Family Foundation, while retirement is becoming increasingly expensive. The Affordable Care Act addressed some of these issues, but health care cost inflation continues to be a major concern.

In this article, we will look at how much health care costs are expected to rise, how much you should save for retirement health care costs, and some ways to save and reduce costs.

How Much Will Costs Rise?

A 65-year-old couple retiring this year will need an average of $275,000 (in today’s dollars) to cover medical expenses through retirement, according to Fidelity Benefits Consulting. The figure is up six percent from 2016 ($260,000) and could be much higher for some individuals since it assumes traditional Medicare insurance coverage and does not include any costs associated with nursing home or other long-term care.

How much will these costs rise in the future?

You can expect to see a 5.5% annual inflation rate for medical care, according to HealthView Services’ 2017 Retirement Health Care Costs Data Report, which includes a 7.2% increase in supplemental Medicare insurance and an 8% increase for Medicare Part D. By 2027, the organization expects that 30% of cost will come from hospitalization and doctors, 29% will come from supplemental insurance, and 27% will come from prescription drugs.

Unfortunately, the Social Security Administration only offers a 2.6% average annual cost of living increase when it comes to retirement benefits. This means that there will be a growing gap between Social Security income and health care costs that will need to be bridged through additional retirement saving during working years. The upshot is that there are many attractive ways to save money to help cover health care costs during retirement.

How Much Do You Need to Save?

The amount of money that you need to retire depends on a variety of factors, including your planned retirement age and overall health condition.

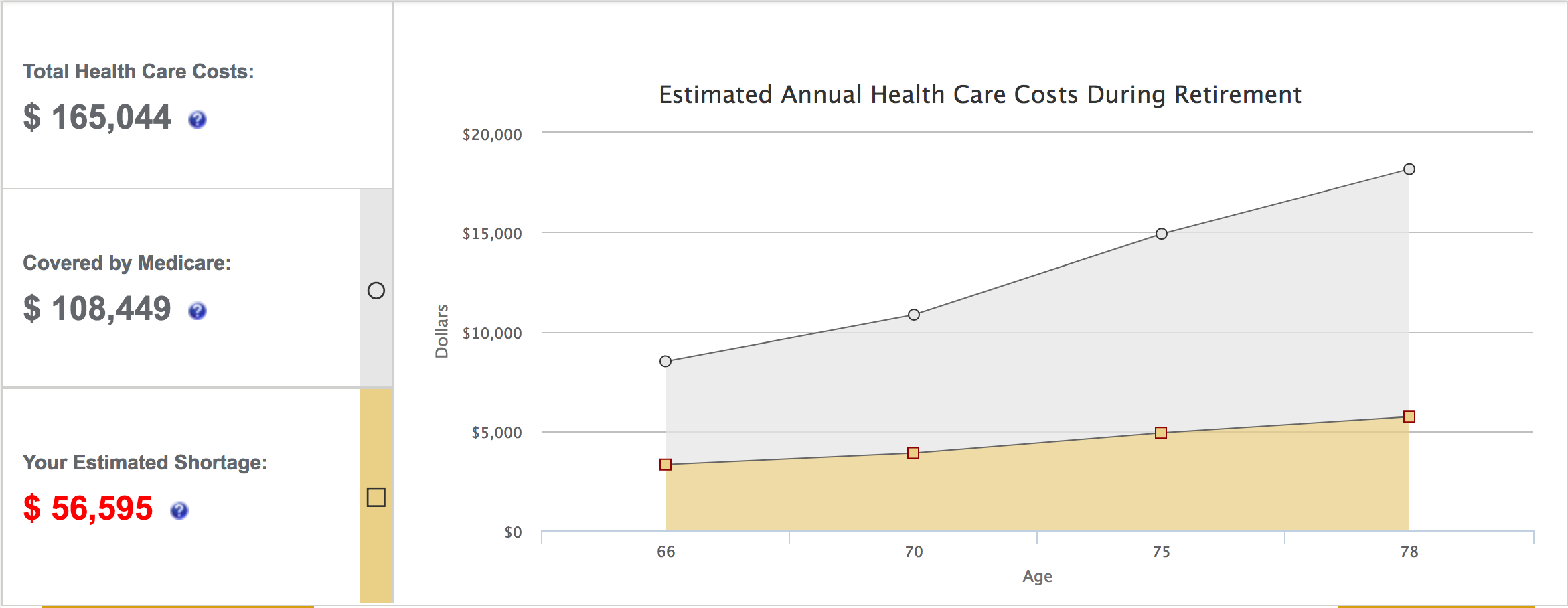

A good place to start estimating these costs is AARP’s Health Care Cost Calculator, which estimates your retirement health care costs based on retirement age, life expectancy, and your health conditions. The estimate includes how much Medicare will cover and how much you may need to pay out-of-pocket from retirement savings. You can even add and remove health conditions to see how they affect your long-term health care costs.

AARP Health Care Cost Calculator – Source: AARP

Medicare insurance – Part B and Part D – accounts for about 35% of Fidelity’s cost estimates with the other 65% coming from cost-sharing both in and out of Medicare, including copayments, deductibles, and out-of-pocket expenses. Many people use supplemental insurance policies – known as Medigap – to cover these other costs. HealthView Services estimates that these Medigap policies will account for ~30% of retirement health care costs.

Dental, hearing, vision, and long-term care aren’t usually included in these estimates and may involve even greater out-of-pocket expense. When determining how much to save for retirement, it’s important to account for all of these costs to ensure that you have the health coverage that you need over the long-term. There are supplemental insurance policies that can be used to even out these costs, but the cost of insurance should be included in any estimates.

The Best Options for Saving

Many employers are moving away from full health care coverage to high-deductible health plans that have lower premiums and more out-of-pocket expenses for employees. According to the Kaiser Family Foundation, individuals on these plans pay an average of $2,295 before insurance kicks in and families are spending an average of $4,364. This can be a heavier burden during working years, but there are some benefits when it comes to retirement savings.

High-deductible plans are eligible for HSAs, which are triple tax-advantaged investment accounts to build up health care savings. Individuals can save up to $3,400 per year and families can save up to $6,750 per year in these accounts. These accounts are similar to traditional IRAs in that you get a tax deduction for any contributions and the money grows tax-deferred, but unlike a traditional IRA, withdrawals are tax-free when used for qualified medical expenses.

Another key benefit is that you can invest this money to benefit from compounding interest, which makes it a lot more attractive than other health care account types. Surprisingly, only 4% of HSAs are invested in something other than cash despite the benefits. A Schwab study found that contributing $2,000 per year over 20 years would have generated $81,650 by investing immediately in the S&P 500 versus just $51,291 when staying in cash account.

For more information on the benefits of HSAs, see Understanding Health Savings Accounts.

Reducing Health Care Costs

The single best way to reduce retirement health care costs is to maintain a healthier lifestyle. The AARP’s Health Care Cost Calculator demonstrates how these changes can lead to significantly lower health care expenditures during retirement. Start by taking advantage of employer benefits, such as gym memberships or nutrition counseling, to help lower the risk factors for common diseases that can be much costlier down the road.

Some other tips to save on health care costs include:

- Preventative Care – Many routine health care services are free of charge and designed to catch problems early on, including colonoscopies, mammograms, and vaccinations. Despite the guaranteed free coverage, most people avoid these beneficial procedures because they think the procedures cost money.

- Compare Prices – Most people do not comparison shop when it comes to medical procedures or prescription drugs despite a wide range in pricing. GoodRx can help you compare prices across 70,000 U.S. pharmacies, while many health insurance companies provide cost comparison tools on their websites.

- Track Your Spending – It pays to track how much you’re spending relative to your deductible each year. If you need an expensive procedure done, you may want to wait until the following calendar year to reduce your deductible for an entire year instead of getting a procedure done late in the year.

The Bottom Line

There’s little question that health care costs will rise over the coming years. By understanding these costs, you can plan ahead for retirement and ensure that you have enough to cover your needs. There are also many steps that you can take before retirement to help reduce health care costs and risk factors for costly diseases.