Traditional IRAs, Roth IRAs, SIMPLE IRAs, SEP-IRAs, and Rollover IRAs provide investors with substantial tax benefits in exchange for putting money away until retirement. The catch is, if you raid your retirement reserves early, you can get hit with not only local, state, and federal taxes, along with an additional ten percent penalty from the IRS. The good news is that there are some exceptions to these rules when it might make sense to make early withdrawals.

In this article, we will look at the rules governing IRA withdrawals, how to avoid early withdrawal penalties, and some alternatives to IRAs to consider, depending on your needs.

IRA Withdrawal Rules

Traditional IRA Distributions

Traditional IRAs, SIMPLE IRAs, SEP-IRAs, and Rollover IRAs defer taxes until you begin to withdraw money from the account. This saves you money when you’re younger (and perhaps need it more), but you will have to pay taxes on distributions when you withdraw the funds in retirement. Unlike a Roth IRA, you also owe taxes on all of the capital gains accrued over time, which can be substantial if the account has been open for a long time.

If you’re under 59 ½, there is a ten percent penalty for making an early withdrawal, and of course, you must still pay state and federal taxes. This means that, if you’re in the 20 percent tax bracket and take out $50,000, you would lose $15,000 to taxes and penalties, and only receive $35,000 in proceeds. Even worse, the distribution may push you into a higher tax bracket for the rest of your income if you’re still employed!

If you need to make an early withdrawal anyway, you must complete IRS Form 5329, Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts, unless your Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. shows distribution code 1 in Box 7. In that case, you only need to report the additional ten percent tax on your Form 1040.

If you’re between 59 ½ and 70 ½, you have the option to begin taking money out of your traditional IRA without penalty, but you still owe state and federal taxes. You will receive a Form 1099-R from your brokerage for these distributions, which lets you know how much tax you owe on the distributions. These amounts are then included on your Form 1040 individual tax return and are subject to your regular income tax bracket rate. Most brokers allow you to withhold taxes at the time of the distribution so you don’t need to worry about a large tax bill at tax time.

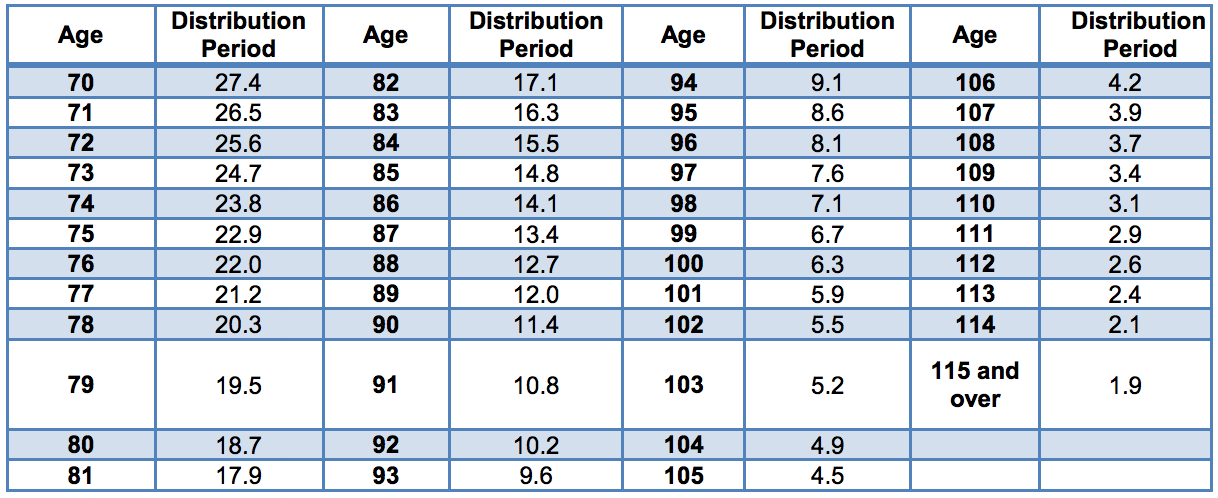

Figure 1 – IRS Required Minimum Distribution Table – Source: IRS

After 70 ½, you must begin taking required minimum distributions, or RMDs, from your traditional IRA. These are mandatory distributions and, if you fail to make an RMD, you may be subject to a 50 percent penalty on the shortfall. The penalty is reported on Form 5329 and, if you want to have the penalty waived, you can submit a request along with the form after you have taken out the missed RMD amount.

Roth IRA Distributions

Roth IRAs have much simpler requirements than traditional IRAs. If you have had your Roth IRA for over five years, you can make tax- and penalty-free withdrawals if you’re over age 59 ½, purchasing a home for the first time, or if you have become permanently disabled. If you fail to meet one of these criteria and still make a withdrawal, you may be subject to taxation of earnings and a ten percent additional tax that must be reported on Form 5329.

That said, unlike traditional IRAs, you are allowed to withdraw all of your past principal contributions without penalty since the account is funded with after-tax dollars. You only have to pay the ten percent penalty if you begin withdrawing capital gains, dividends, interest, and other investment income earned on the principal amount. This makes Roth IRAs a lot more flexible than the other IRAs covered above.

How to Avoid Penalties

You shouldn’t make early withdrawals from your IRAs unless it’s absolutely necessary, but if you need the money, there are several ways to avoid the ten percent penalty:

- Death or disability – You may be eligible to make penalty-free withdrawals if you become permanently disabled and are incapable of supporting yourself. If you pass away, your heirs can also avoid the early withdrawal penalty.

- First-time home purchases – You can take up to $10,000 from an IRA without penalty for the purchase of a new home, although it’s usually a better idea to save up for a down payment without raiding retirement accounts.

- Higher education expenses – You may be able to make withdrawals from an IRA to cover qualified higher education expenses as long as the amount doesn’t exceed the qualified expenses incurred by the taxpayer and is spent at a qualified institution.

- Some medical insurance premiums – You may make penalty-free early withdrawals to cover medical insurance premiums if you have been unemployed for more than twelve weeks and are unable to pay these bills to maintain coverage.

- Some unreimbursed medical expenses – You may be able to take penalty-free withdrawals from your IRA if you or your children are seriously ill or injured as long as these expenses are more than 7.5 percent of your adjusted gross income.

- Payments due to an IRS levy – The IRS may force you to make withdrawals from your IRA to cover taxes that you owe if they achieve a levy, but you will not be assessed the early withdrawal penalty for these amounts.

- Military reservists – You may make penalty-free early withdrawals if you’re a military reservist, called to active duty, and remain active for at least 180 days or for an indefinite period. Withdrawals must be made during the time of active duty.

For more information on these exceptions, see IRS Topic Number 557.

A final option is a 72(t) early distribution program, which enables you to take distributions before 59 ½ without incurring the ten percent penalty. The catch is that you must stick with the IRS’ payment schedule for five years or until you reach 59 ½. If you deviate from the schedule, you will be penalized for the entire amount withdrawn. The specifics of the calculations are beyond the scope of this article, but you can contact your financial advisors to learn more.

Alternatives to Consider

The most common reason that most people make early withdrawals from IRAs is to cover unexpected medical expenses. Fortunately, there may be another option for individuals saving up to cover these expenses that may be preferable to some IRAs.

Health Savings Accounts, or HSAs, provide many of the same advantages as a traditional IRA, including the ability to make tax-deferred investments. The difference is that you can use these funds at any time to cover qualified medical expenses without these expenses reaching 7.5 percent of your gross adjusted income. You may want to consider opening an account, if you qualify, to supplement your existing IRA accounts to meet these unforeseen expenses.

The Bottom Line

Traditional IRAs, Roth IRAs, SIMPLE IRAs, SEP-IRAs, and Rollover IRAs are great ways to save for retirement but taking early withdrawals can be very costly. By knowing the rules, you can ensure that you avoid unnecessary penalties and maximize your retirement savings. It’s important to speak with your financial advisor or tax professional and fully understand the consequences.before making early withdrawals from an IRA.

If you’re interested in generating an income to accommodate your withdrawals during retirement, Snider Advisors’ provides a call option strategy designed to provide a sustainable income over time. You can sign-up for free to learn how the system works to build sustainable cash flow to cover retirement expenses.